Have investors left it too late to buy gold stocks and ETFs?

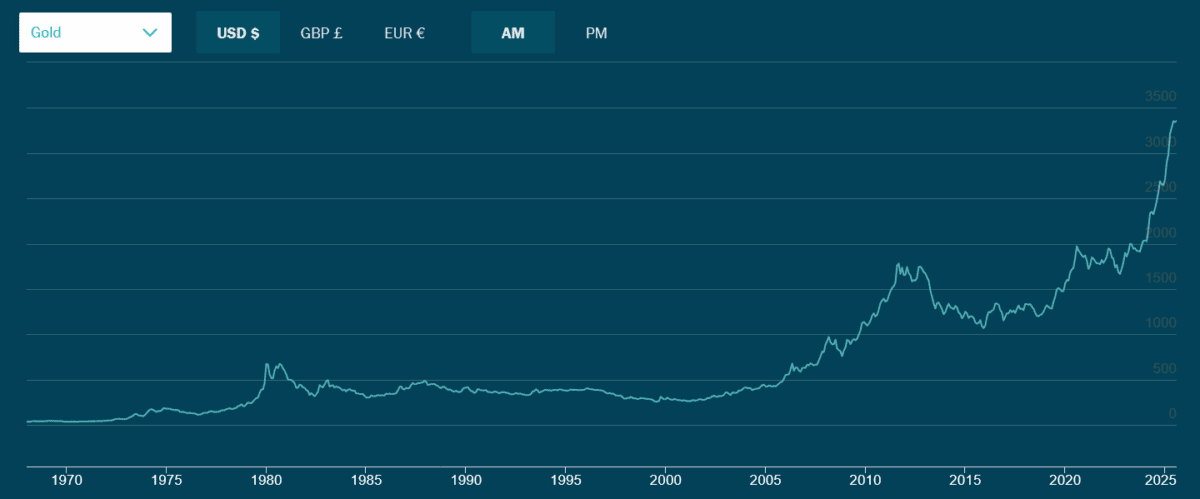

Fuelled by a range of economic and political factors, gold prices have surged almost 90% in value in just three years. But they’ve fallen back since hitting April’s record highs above $3,500 per ounce, and were last stable around $3,340.

Have investors today missed the chance to make big profits with gold stocks and funds? My view is ‘no.’ I myself hold shares in the L&G Gold Mining ETF, an exchange-traded fund (ETF) that holds a basket of bullion producers. I’m confident it will continue rising in value given:

- The threat of a prolonged and severe global trade war.

- Rising concerns over geopolitical stability.

- Signs of rising inflation.

- Mounting worries over Western governments’ debt levels.

- The strong possibility of sustained US dollar weakness (a cheaper greenback makes it more cost-effective to buy dollar-denominated assets).

- Increasing gold investment among global central banks.

Of course, any reversal of the above trends could put gold prices under pressure. But on balance, I believe owning gold stocks remains an attractive option. My view is that gold is consolidating before attempting a new move higher.

Keeping it simple

ETFs like the Xtrackers Physical Gold are a simple and low-risk way to target a rising gold price. They simply move in relation to the bullion price, which means that — unlike holding shares in a gold stock — investors aren’t exposed to the unpredictabilities of metals mining.

That’s not to say they’re not without danger, of course. They can still fall in value if bullion prices retreat. But their lack of complexity makes them hugely popular — World Gold Council data shows total holdings in global gold ETFs at record peaks of $386.4bn.

The diversified option

Another option for investors is to purchase a fund that tracks a basket of precious metals. The WisdomTree Physical Precious Metals ETF is backed by physical gold, silver, platinum, and palladium.

Each of these metals has safe-haven qualities that can help them rise like bullion. But that’s not all: their widescale industrial applications also mean they can rise in price when economic growth improves.

Be mindful, though, that the fund’s exposure to cyclical metals means it could disappoint if macroeconomic worries last.

A cheap gold share

The final choice investors have is to buy gold stocks themselves. They can do it using an ETF that holds a basket of shares, like the L&G Gold Mining fund I described earlier. Or they can take the riskier, albeit potentially more lucrative option of choosing individual stocks.

Serabi Gold (LSE:SRB) is one such gold producer to consider. Upgrades to its Brazilian assets mean production is tipped to rise steadily through the next few years, providing it with the chance to capitalise on a sustained gold price rise.

By 2028, it’s hoping to produce 100,000 ounces of the yellow metal a year. That’s more that double the 44,000-47,000 it’s on course for this year.

I like Serabi because of the cheapness of its shares, too. A forward price-to-earnings (P/E) ratio of 3.5 times leaves considerable scope for price gains if bullion prices continue marching higher.

The post Have investors left it too late to buy gold stocks and ETFs? appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- Winter is coming! Here’s a top stock to consider in an ISA for the rest of 2025

- Here’s one of the best shares to consider buying as Trump’s trade war escalates!

- Looking to capitalise on gold prices? Here’s a soaring UK share to consider

Royston Wild has positions in Legal & General Ucits ETF Plc – L&g Gold Mining Ucits ETF. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.