As Tesco shares hit a 5-year high, what would a £5,000 investment look like now?

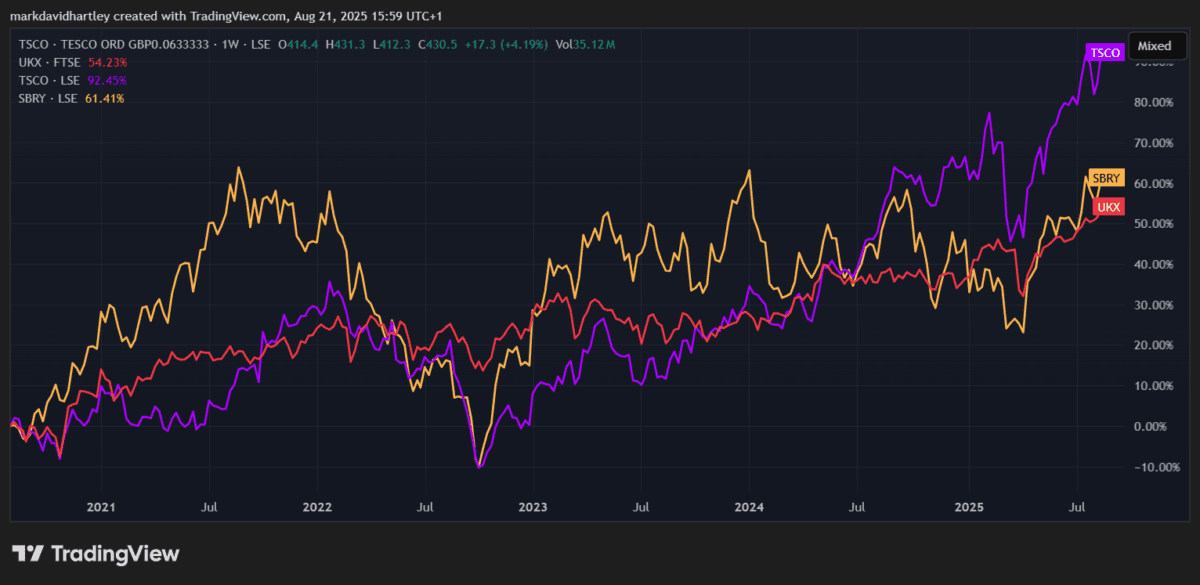

Tesco (LSE: TSCO) shares are up over 90% in the past five years, with the vast majority of those gains coming in just the past two.

After post-Covid inflation began tapering off in 2023, the UKâs largest supermarket chain has gone from strength to strength.

An investor who sank £5,000 into the stock in August 2020 would be sitting on a £2,500 gain from capital appreciation alone. Reinvesting dividends along the way, that figure climbs to around £11,200 in total value â a tasty £6,200 profit.

By comparison, the FTSE 100 has only managed a 54% rise in the same period.

Main rival Sainsburyâs has also delivered a more modest return over the same five-year stretch, with the shares up around 61%. Admittedly, it does have a slightly more meatier dividend though. But even with the benefit of its Argos business and a stronger push into convenience stores, it seems it simply doesnât have the same scale or buying power as Tesco.

Clearly, things have been going well lately. But will the growth continue or is it now overvalued?

An optimistic market

Last month, Tesco confirmed it will continue with its existing £1.45bn share buyback programme, a signal that management believes the stock is still attractive at current levels. Not long after, Deutsche Bank reiterated its Buy rating, setting a target price of 470p.

Interestingly, thatâs exactly where a discounted cash flow analysis would place the stock, suggesting it remains around 10% undervalued today. Citi is also bullish, setting a slightly lower target of 460p. Either way, the analysts are in agreement: the market is still pricing Tesco below fair value.

Cost-of-living crisis

Of course, itâs not all smooth sailing. Britainâs cost-of-living crisis continues to put retailers under pressure. Earlier this month, Tesco joined forces with rivals including Sainsburyâs, Asda, Aldi, Lidl, John Lewis, JD Sports and Boots in writing to finance minister Rachel Reeves. The letter warned that further tax hikes in the Autumn Budget could undermine the governmentâs pledge to improve living standards.

Meanwhile, itâs quietly nudging prices higher, with its popular meal deal set to rise by another 25p. That might not sound like much, but such moves can irritate customers in an ultra-competitive market.

Some rivals are going in the opposite direction. Lidl, for example, has lifted hourly pay for its 28,000 workers for the fifth time in two years. And from September, Aldi will pay store assistants at least £13 an hour — a fair bit above the £12.21 minimum wage.

Wage pressure like this has the potential to squeeze Tescoâs margins over time.

My verdict

At the end of the day, whether Tesco shares dip in the short term is largely irrelevant to me. I see this as a long-term play that offers a mix of reliable income, defensive qualities and consistent growth.

Yes, it faces challenges in a tight consumer environment, but Tescoâs scale and efficiency give it a moat that few rivals can match.

For me, itâs still a stock worth considering for any well-diversified UK investment portfolio.

The post As Tesco shares hit a 5-year high, what would a £5,000 investment look like now? appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- I sleep easier at night because of these FTSE 100 defensive stocks

- Worried about inflation? Here are 3 dividend shares to consider buying

- Still trading near a 14-year high, how close to âfair valueâ is Tescoâs share price?

- Prediction: in 12 months Aviva and Tesco shares could turn £10,000 intoâ¦

- Here’s what analysts expect for the Tesco share price in the coming year

Citigroup is an advertising partner of Motley Fool Money. Mark Hartley has positions in JD Sports Fashion and Tesco Plc. The Motley Fool UK has recommended J Sainsbury Plc and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.