Should I hedge my portfolio now to prepare for a stock market crash?

In my view, the Bank of America Fund Manager Survey is an incredibly useful resource. It provides a lot of information about how investors are seeing the stock market.

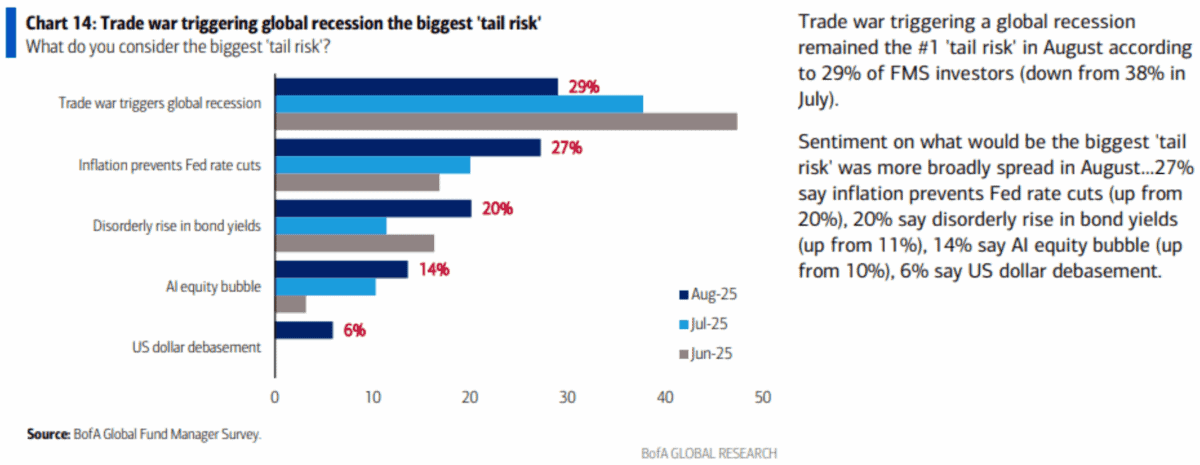

One of the most interesting questions concerns the biggest âtail riskâ â what could cause things to go dramatically wrong. And a new threat has emerged this month.

Tail risks

Over the last few months, fund managers have seen the possibility of a trade war leading to a global recession as the biggest risk. And that’s still the case in August.

Things, however, are changing. Over the last few months, investors have been shifting their focus from an economic slowdown to a different threat â inflation.

Source: Hedge Fund Tips

The prospect of rising prices in the US leading to higher interest rates is now seen as almost as much of a threat as a recession. And this is worth paying attention to.

In general, higher interest rates aren’t good for the stock market. But is there anything investors can or should do to get themselves ready for a potential correction?

Hedging

One strategy for protecting an investment portfolio from a stock market crash is hedging. This involves buying an asset that will go up if share prices fall suddenly.

An obvious hedge would be a put option on the S&P 500. This gives the owner the right to sell shares at a certain price, providing protection if the asset falls below that level.

If the index doesn’t fall, the option expires worthless. That entails a loss, but a hedge is supposed to be like insurance â it’s better to not need it but good to have if something happens.

In principle, I don’t mind this strategy. But the reason I’m not buying options to protect myself from a potential stock market crash is that I don’t think I need to.

Buying and holding

My investing plan is based on a long-term approach. That means looking for companies that can persist through inflationary periods and emerge stronger on the other side.

Berkshire Hathaway (NYSE:BRK.B) is one example that I own. Inflation is a risk for the firm’s insurance operations as higher prices are likely to make claims more expensive.

Warren Buffettâs firm, however, has seen it all before. It has a terrific record of using difficult situations to find investment opportunities that set it apart from other companies.

Berkshire has more than enough cash on hand to cope with rising prices pushing insurance claims higher. And that’s why I don’t feel the need to hedge my investment.

A stock for all seasons

In some ways, Berkshire is essentially like a put option on the stock market â it does tend to do well when share prices in general falter. But I think it’s more than this.

I expect the firm’s competitive position to allow it to do well in good times and tough ones. Whether it’s acquisitions or existing businesses, Iâm optimistic about future growth.

Iâm still looking for opportunities to add to my investment. And inflation rising and leading to higher interest rates could mean my chance is coming.

The post Should I hedge my portfolio now to prepare for a stock market crash? appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- How can we plan for a US stock market crash?

- No savings? Hereâs how Warren Buffettâs teachings could help you build wealth

- How Warren Buffett avoids losing money

- Could this be Warren Buffett’s last big investment?

- As the Warren Buffett premium fades, what next for Berkshire Hathaway shares?

Stephen Wright has positions in Berkshire Hathaway. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.