2 UK shares with outstanding dividend growth records

I think the UK stock market is a great place for dividend investors looking for shares to consider buying. And there are a few names that have very impressive track records.

Decades of consistent dividend growth doesnât guarantee higher returns in future. But it also doesnât come about by accident and itâs something investors might want to pay attention to.

Croda International

Croda International (LSE:CRDA) has increased its dividend per share each year for over 34 consecutive years. Thatâs an outstanding record and itâs fair to say the company has seen it all.

The last three decades have included the dot-com bubble, the subprime mortgage crisis, and Covid-19. And through all of this, the firm has kept its dividend growing.Â

This is impressive for any business, but arguably even more more so for a cyclical operation. But Croda makes specialty chemicals, where demand can wax and wane depending on end markets.

Investors, though, seem to think this impressive record is under threat. The dividend yield has reached almost 4.5%, which is its highest level for the last 10 years by some margin.

The concern might well be that the firmâs free cash flow in the last 12 months hasnât covered its dividend. Croda can bridge the gap in the short term, but this isnât sustainable indefinitely.

Part of this was the result of higher working capital requirements, though, which I expect to stabilise over time. So, as it’s at an unusual cheap price, I think itâs worth a look.Â

FW Thorpe

FW Thorpe (LSE:TFW) is a much smaller company. It focuses on industrial lighting for things like airports, tunnels, and hospitals, where lighting is critical and often has to meet specific requirements.

That means operating in this sector requires high levels of technical expertise, which creates a barrier to entry for potential competitors. And this gives the company a degree of pricing power.

FW Thorpe has managed to increase its dividend per share for 22 consecutive years. While the yield is only 2.2%, the £11m distribution is more than covered by free cash flows of £38m.

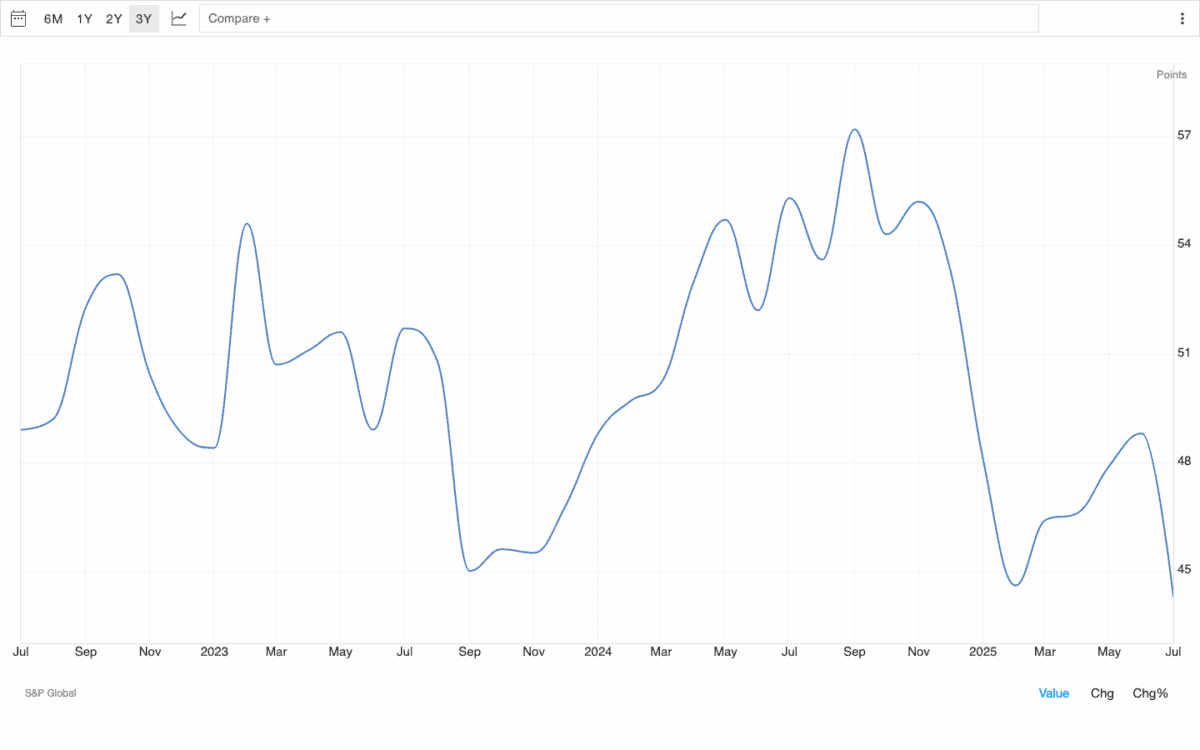

Investors looking at the stock should think about the outlook for UK construction. And one of the best forward indicators for this is the UK Construction Purchasing Managers Index (PMI).

UK Construction PMI June 2023 – July 2025

Source: Trading Economics

The latest reading (from July) came in at 44.3. Thatâs a concern because (a) a number below 50 indicates contraction in the sector and (b) itâs the lowest the index has been in the last three years.

Thatâs a risk investors should pay attention to. But for those with a long-term perspective, it might mean FW Thorpe represents an under-the-radar opportunity to be greedy where others are fearful.

Track records

Around 66% of businesses fail within their first 10 years. But at the other end of the scale, there are those that can generate higher and higher returns for shareholders each year for decades.

Croda International and FW Thorpe both have outstanding records of dividend growth. And this is the result of each having an extremely strong competitive position.

Despite the possibility of temporary disruptions, I expect both companies to do well over the long term. And I think dividend investors looking for opportunities should take note.

The post 2 UK shares with outstanding dividend growth records appeared first on The Motley Fool UK.

Should you invest £1,000 in Croda International plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Croda International plc made the list?

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Croda International Plc and FW Thorpe. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.