Why the stock market often falls in September

Both in the UK and the US, the stock market hasnât made a great start to the month. The FTSE 100 and the S&P 500 are both down since Monday (1 September).

This, however, isnât that unusual. Historically, September has been a bad month for share prices and there are some important reasons why this is the case.

The ‘September Effect’

The decline in the stock market a this time of year is well-known enough to have a name. Itâs called the September Effect and there are several potential explanations associated with it.

One is higher trading volumes. The idea is that, as professional investors get back to work after their summer vacations, increased activity leads to bigger movements â in either direction.

The reason this results in share prices falling â rather than rising â is often attributed to tax-loss harvesting. This involves selling stocks that are down to offset tax liabilities on ones that are up.

Whether or not either of these is the right explanation of the well-documented September Effect is open to question. But I donât think itâs the main reason share prices have been falling this week.

Market movements

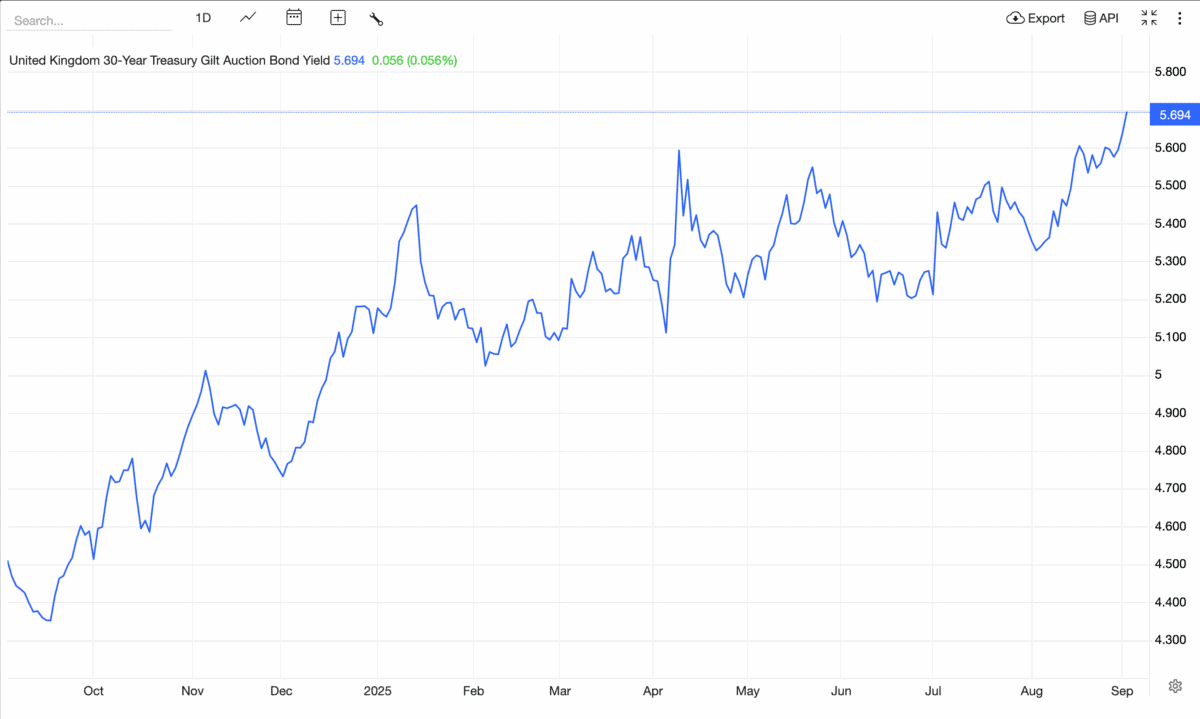

Concerns over the UK economy have sent 30-year government bond yields to 27-year highs. Right now, thereâs a return of almost 6% on offer from an asset where the risk is extremely low.

Source: Trading Economics

That naturally creates downward pressure on share prices as investors look for better returns from stocks as a result. And this is an important part of why the FTSE 100 is down this week.

At the same time, the US Court of Appeals has ruled a number of President Trump’s latest tariffs illegal. The case is likely to proceed to the Supreme Court, but the verdict creates further uncertainty.

Investor positioning might well be amplifying the effects of these developments. But I think itâs these specific features â rather than seasonal trends â that are weighing on share prices right now.

Buying opportunities

Iâm looking to use the heightened volatility as a buying opportunity. And a stock on my radar is 3i (LSE:III) â the FTSE 100âs top-performing stock of the last 10 years.

Unlike other private equity companies, the firm focuses on deploying its own capital. That means itâs able to be selective about when to buy, rather than being constrained by external investors.

Despite falling 6% in the last week, 3i shares trade above the value of its portfolio. That means the needs to find future growth opportunities to justify its current price, which is a risk.

As I see it, though, a 55% premium to the firm’s book value is more than justifed by a 22% return on equity. That’s why it’s on my buy list at today’s prices.

Wake me up when September starts?

Given the September Effect, investors might wonder whether waiting until the end of the summer to buy shares is a good plan. But that isnât always the case.

With 3i, the stock is still 7% higher than it was at the start of the year. So waiting nine months for a potential sell-off would have been a mistake â and Iâm glad I didnât.

The post Why the stock market often falls in September appeared first on The Motley Fool UK.

Should you invest £1,000 in 3i Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if 3i Group plc made the list?

More reading

- Meet the monster stock that continues to crush the FTSE 100 index

- The overlooked ways a Stocks and Shares ISA saves investors money — and a £3m example

Stephen Wright has positions in 3i Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.