Is a 15% stock market correction coming? If so, I’m ready

Recently, analysts from several banks have voiced concerns about a short-term stock market correction, including Deutsche Bank, Morgan Stanley and Societe Generale. While expectations vary, some suggest a fall of as much as 15% â or more.

Nobody really knows what could happen but it pays to be prepared. And looking at the market, I can understand their caution.

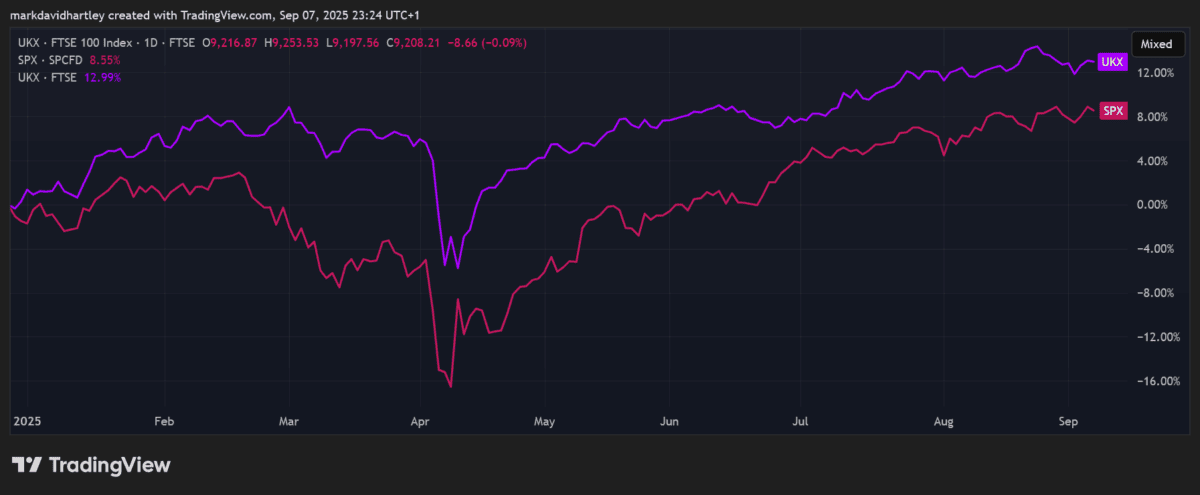

The S&P 500 hasnât had the strongest year, yet valuations still look stretched following last yearâs rally. The index is trading on a price-to-earnings (P/E) ratio of 27, far higher than its long-term historical average of 16.

The FTSE 100‘s in a similar position. It’s up 12.99% year to date, compared with 6.7% at this point last year. The P/E ratio sits at 19.7, higher than its three-year average of 15.7.

Why are experts worried?

Concerns range from trade tariffs to economic weakness and stretched valuations. With tariff costs likely to be passed onto consumers, the fear is that household spending will slow. That could drag down earnings across several industries, putting pressure on equity markets that already appear expensive.

When a market correction looks possible, some investors choose to hold a cash pile. The idea’s simple — wait for the fall and then buy at cheaper levels. I like this strategy but I also think it’s worth remembering that not all stocks decline during downturns.

Some defensive companies, particularly in retail, pharmaceuticals and utilities, tend to hold up better. Tesco and National Grid are two classic examples. Done correctly, a well-balanced defensive portfolio of shares could even deliver stronger returns than the average Cash ISA.

One stock I like

For my own portfolio, AstraZeneca‘s (LSE: AZN) a core defensive holding. It’s the largest company on the FTSE 100 and has built a reputation for dependable revenue and earnings. Over the past decade, it’s delivered annualised returns of 11.24% — impressive consistency for a business of its size.

Recent performance has been clouded by weaker vaccine sales once pandemic demand fell away. Revenues dipped in late 2022 and through 2023 as a result. However, stripping out Covid-19 products, the business has continued to grow strongly. Core revenue rose 17% in 2022 and 15% in 2023, showing its underlying strength.

Of course, there are still risks. Trade tariffs could impact global operations and supply chain disruptions are always a concern for a company with such wide reach. Management’s already announced plans to invest $50bn in US manufacturing by 2030 to help reduce exposure, though this will be costly and there’s no guarantee it will deliver the desired benefits.

But from a defensive viewpoint, its valuation looks reasonable, with a forward P/E ratio of 17.8. Similarly, profitability and margins are decent for the industry, with a return on equity (ROE) of 20%.

Final thoughts

A potential 15% stock market correction may sound alarming but history shows they’re fairly common. My approach is to keep some cash on hand while also ensuring my portfolio has sufficient defensive coverage.Â

With a solid balance sheet supported by healthy cash flow and manageable debt, AstraZeneca remains one of my favourites. For investors looking to reduce risk during a downturn, I think itâs a stock well worth considering.

The post Is a 15% stock market correction coming? If so, I’m ready appeared first on The Motley Fool UK.

Should you invest £1,000 in AstraZeneca PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if AstraZeneca PLC made the list?

More reading

- At 217%, the ‘Warren Buffett indicator’ is higher than during the dotcom bubble! Is a crash coming?

- The FTSE 100âs largest company could surpass a £200bn market valuation this year

- Just over £119 now, AstraZenecaâs share price looks cheap to me anywhere under £220.91

- After this weekend’s news, is it time to look again at the AstraZeneca share price?

Mark Hartley has positions in AstraZeneca Plc, National Grid Plc, and Tesco Plc. The Motley Fool UK has recommended AstraZeneca Plc, National Grid Plc, and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.