After a tough 2025, FTSE 100 miners are seeing unusually high trading volume. Time to buy?

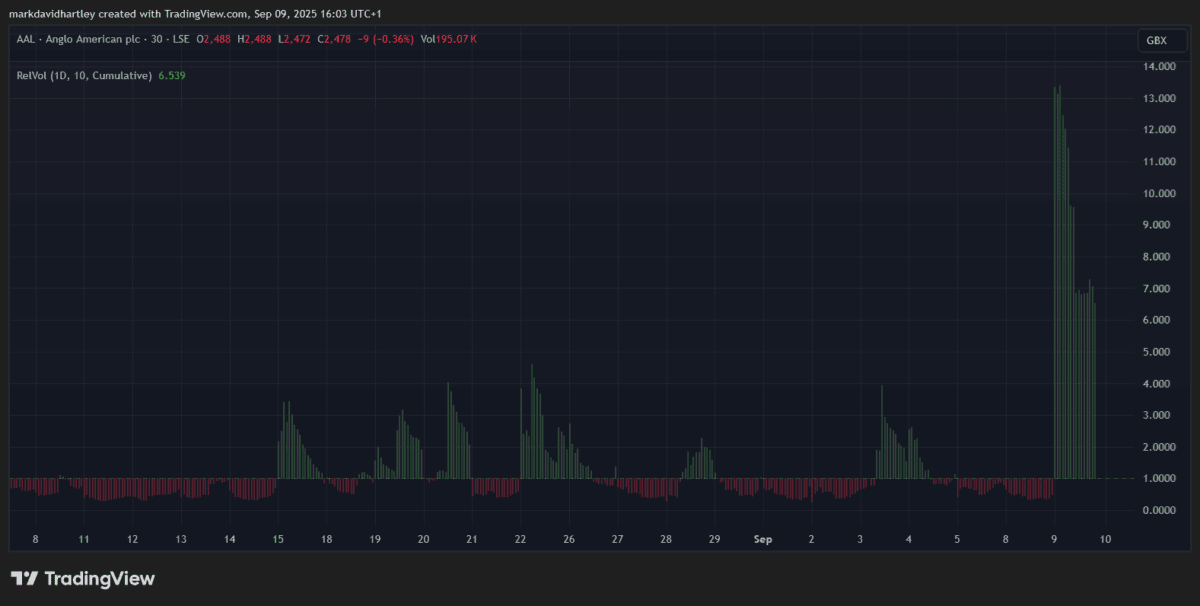

Itâs been an interesting week for FTSE 100 miners. Shares in Glencore (LSE: GLEN) and Anglo-American (LSE: AAL) have seen unusually high trading volumes, despite both companies reporting sharp earnings losses in recent months.Â

Others, including gold miner Fresnillo, enjoyed growth this year due to jitters in the US economy. The combination of trade tariff uncertainty and a possible interest rate cut have fuelled demand for safe-haven assets like gold and other metals.

But Glencore and Anglo havenât had the easiest ride in 2025 — both stocks remain in the red, with Glencore down 14.6% year to date and Anglo off 7%. But with volumes climbing and dealmaking heating up, recovery might finally be on the cards.

So are these mining giants worth considering at todayâs prices?

Glencore: stretched balance sheet

Glencore’s been particularly hard hit. Earnings per share (EPS) collapsed 285% year on year, pushing the company into a £1.28bn loss for 2024. Thatâs despite revenues of more than £180bn. Margins have shown signs of stabilising in H1 2025, but itâs hardly been enough to restore confidence.

For the current year, analysts expect full-year EPS of just 10p per share — less than half the 24p delivered in 2024. The balance sheet doesnât inspire much faith either. Debt now outweighs equity, leaving the company heavily exposed if commodity prices fall further.

I can see why some investors might be tempted, given Glencoreâs enormous revenue base and global reach. But personally, itâs not a stock Iâd consider right now. The numbers remain weak and the leverage problem feels too big to ignore.

Anglo-American: a merger boost

Anglo-American however, looks more promising. The stock jumped 10% this week after announcing a $53bn merger with Canadian copper miner Teck Resources. Together theyâll control two strategically-positioned Chilean mines — Quebrada Blanca and Collahuasi — which should create cost savings and synergies.

The timing’s important. Copper demand’s projected to soar in the coming decades as electric vehicles (EVs), solar panels and wind farms drive the global transition to clean energy. By combining resources in Chile, Anglo and Teck should be well-placed to capitalise on this megatrend.

Of course, Anglo isnât immune to challenges. It posted a £2.4bn loss last year on £21.41bn of revenue, highlighting just how expensive mining operations can be. But unlike Glencore, Angloâs debt remains well covered by equity, giving it more breathing space.

A bright future

The Teck merger, while promising, isn’t risk free. Political shifts in the US have recently slowed solar development, threatening demand growth for copper. Integrating two large mining operations may help mitigate this but isn’t straightforward either, with cost overruns and operational hiccups a possibility.

But risks aside, I think it makes Anglo a highly appealing option. The balance sheet is stronger, the merger could unlock real value and long-term copper demand is hard to ignore. Itâs certainly a stock investors may want to consider for long-term growth â and one I plan to add to my portfolio as soon as I’ve some free capital.

For me, the takeaway’s clear. FTSE 100 miners may still be under pressure, but not all are created equal. Glencore looks stuck in neutral, while Anglo-Americanâs merger could mark the start of a new chapter.

The post After a tough 2025, FTSE 100 miners are seeing unusually high trading volume. Time to buy? appeared first on The Motley Fool UK.

Should you invest £1,000 in Anglo American plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Anglo American plc made the list?

More reading

- Up 9% after a mega-merger announcement, is the Anglo American share price set to go gangbusters?

- Prediction: experts forecast the Glencore share price could now smash Rolls-Royce

- Has Taylor Swiftâs engagement just given a boost to this flailing FTSE stock?

- Down 29%, can the Glencore share price get its mojo back?

- 33% down from its 7 October high, is Glencoreâs share price set to soar on stunning earnings growth forecasts?

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has recommended Fresnillo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.