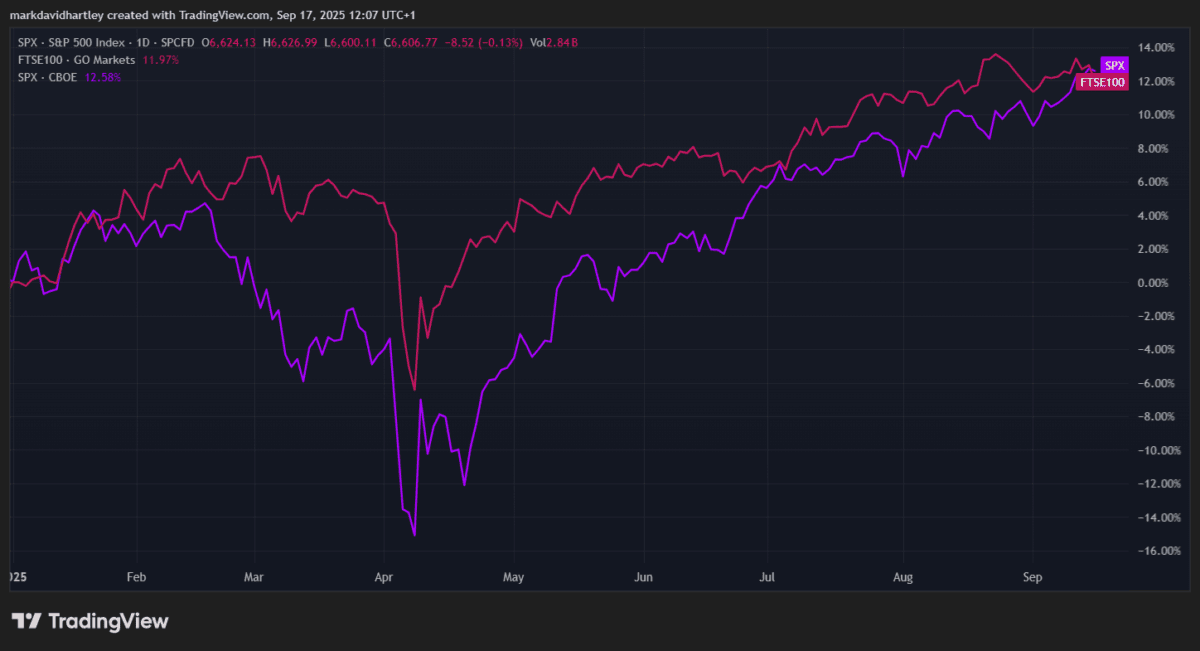

The S&P 500 hit a new high this week, overtaking the FTSE 100 for the first time this year

After lagging for much of the year, the S&P 500 is now up about 12.6% year to date, while the FTSE 100 is up roughly 11.97% as of mid-September 2025. The S&P 500 touched a fresh high of 6,624 points on Tuesday 16 September. Meanwhile, the FTSE 100 has flatlined a bit, with growth under 1% over the past 30 days.

This shift suggests global investor sentiment may be changing. The FTSE has been bolstered this year by its high exposure to energy, financials, industrials, and defence â sectors that benefit from higher interest rates, commodity strength, and geopolitical concern. Meanwhile, the S&P 500 has been more exposed to growth and technology names, many of which have come under pressure on valuation concerns, regulatory risk, and weak macro signals in the US.

I wouldnât say that means the FTSE is in any trouble â rather that the US market is catching up after an unusual period of underperformance.

With the US Federal Reserve expected to cut interest rates this week, the mood has changed. If borrowing costs ease, it often helps companies with heavy debt burdens or those whose growth depends on accessible credit.

All signs point toward a 25-basis point rate cut. This is driven by weak labour data and inflation pressures that are easing but still present. For an investor, this could mark the start of a looser monetary policy environment. However, much depends on how persistent inflation proves, and how clearly the Fed conveys its trajectory for future rate moves.

S&P 500 firms in the real estate investment trust (REIT) sector, financials, and consumer discretionary are among those likely to gain from this shift in policy.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

An S&P 500 stock that could benefit

One S&P 500 stock that could benefit is VICI Properties (NYSE: VICI), a REIT focused on gaming, hospitality, entertainment. and leisure properties. I think itâs a good stock for investors to consider when thinking about rate cuts.

VICI currently offers a dividend yield of 5.5% with a payout ratio of around 66%. This suggests it has sufficient earnings to continue covering payments. This is reflected in its profitability, with a net margin estimated to be above 70% in recent reporting.

The balance sheet also seems manageable, with a low debt-to-equity ratio and steady revenue growth. Notably, with $46bn in assets, it’s one of the largest REITs in the US.

Naturally, it faces some REIT-related risks. The business depends on its tenants (casinos, hotels, entertainment) maintaining strong operations. Economic shocks, weak tourism, or regulatory changes could hurt cash flow, leading to disappointing results and a share price dip.

Final thoughts

The S&P 500âs recent nudge past the FTSE 100 reflects changing investor preferences. There’s a move away from purely defensive or value plays toward growth and rate-sensitive names now that the Fed is loosening.

In that environment, REITs like VICI Properties look interesting. While not without risk, I think VICI is one stock thatâs well positioned to benefit if rates continue falling.

For someone building global exposure, combining FTSE-based value/defensive names with a few well-chosen S&P 500 REITs could help balance growth and income in a shifting macro backdrop.

The post The S&P 500 hit a new high this week, overtaking the FTSE 100 for the first time this year appeared first on The Motley Fool UK.

Should you invest £1,000 in Vici Properties right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vici Properties made the list?

More reading

- Down 21%, this FTSE 100 income stock offers a 7.4% dividend yield for investors!

- The Moonpig share price flies higher after the group issues its latest trading update!

- 2 investment trusts with high dividend yields to consider buying right now

- £10,000 invested in Tesla stock at its 2025 low is now worth…

- Today’s results give a small boost to the Barratt Redrow share price

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.