Here’s a 5-stock S&P 500 portfolio to consider to target a £1k monthly passive income

The S&P 500 has been an excellent hunting ground for investors chasing long-term returns. Since 2015, this collection of blue-chip US shares has delivered an average annual return of 14%.

Yet, its ability to generate passive income is poor, in all due to respect. This reflects unfavourable tax rules that see companies prioritise share buybacks over dividends. The S&P 500’s high composition of growth shares, where reinvesting to build earnings takes precedence over handing spare cash back to investors, is another reason for its underperformance.

However, I wouldn’t say investors should ignore US shares when building a passive income portfolio. Here I’ll show you how individuals could target a £1,000 second income each month with a portfolio of S&P 500 dividend shares.

Top REITs

The index is home to almost 30 real estate investment trusts (REITs) today. So, we’ll start by looking at two of them: Realty Income (NYSE:O) and UDR. The dividend yields on these property stocks are a meaty 5.5% and 4.7%, respectively.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

REITs can be an excellent way to target passive income, though investors must be mindful of interest rate pressures that can depress asset values. Under sector rules, a minimum of 90% of trust profits from rental activities must be distributed by way of dividends.

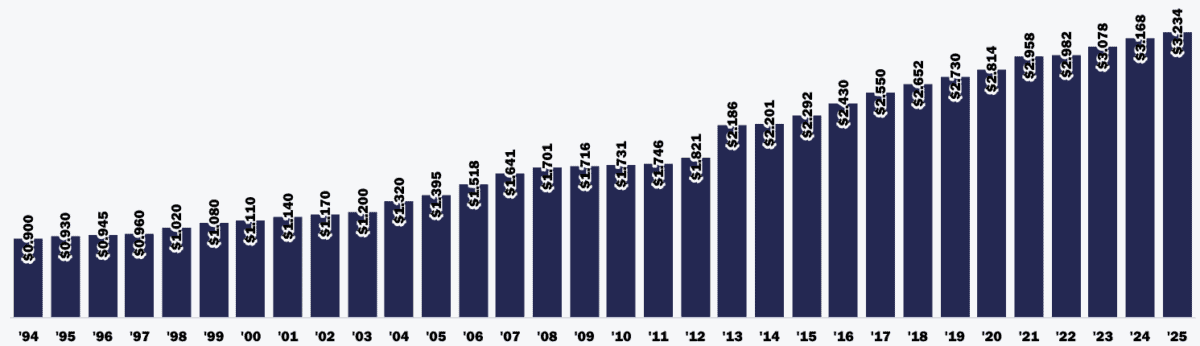

Realty Income is one of the most reliable S&P 500 income stocks out there, in my view. Shareholder payouts haven risen every year since the mid-1990s:

What’s more, dividends have grown at an average yearly pace of 4.2% since then, outpacing the rate of inflation.

Realty Income’s focus on retail and industrial clients leaves it vulnerable to weakening economic conditions. However, its demand that tenants have “a service, non-discretionary and/or low-price-point component to their business” helps it to weather tough times and maintain strong occupancy levels and stable rent collection.

Furthermore, with some 1,600 clients tied down on long-term contracts, its portfolio can cushion client-specific setbacks to deliver solid returns.

More dividend heroes

There are plenty of other non-REIT income stocks to consider as well. Ford, for instance, carries a 5.3% forward dividend yield. I’m confident in its investment prospects as truck, electric, and commercial vehicle sales soar. However, it may face higher trade tariff costs in future.

Telecoms giant Verizon, meanwhile, is in a prime position to grow profits as the digital economy grows. I think that could help offset the challenges it faces in the form of high capex spending requirements. The prospective dividend yield here is 6.2%.

The final stock that I think is worth considering in this mini portfolio is Kraft Heinz, which also has a 6.2% yield for 2025. Competitive threats are mounting, but I think beloved brands like Heinz Ketchup and Philadelphia should help it maintain excellent earnings stability.

Targeting a £1k passive income

Dividends are never guaranteed. But a diversified portfolio like this can protect investors from shocks and provide a smooth return over time.

Based on this stock portfolio’s average yield of 5.6%, a £215,000 investment spread equally among its constituents would generate a monthly passive income of £1,000.

Sure, that £215,000 is a decent chunk of change. But it’s a realistic target for investors with a disciplined approach to investing. Someone investing £500 a month could achieve that in 17 years, assuming an average annual return of 8%.

The post Hereâs a 5-stock S&P 500 portfolio to consider to target a £1k monthly passive income appeared first on The Motley Fool UK.

Should you invest £1,000 in Realty Income right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Realty Income made the list?

More reading

- A surging US stock to consider for an ISA in October

- No savings at 30? Putting aside £100 a month could create a £16,937 by retirement

- 2 dirt-cheap growth shares to consider for Q4!

- Hereâs a 5-stock FTSE 250 portfolio to consider to target a £1k monthly passive income

- 3 things that put me off Diageo shares

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.