3 reasons why Greggs shares could be set to bounce back in October

So far, 2025’s been a pretty terrible year for Greggs‘ (LSE:GRG) shares. The FTSE 250 stock’s down 45% since the start of January.

There are however, three reasons for thinking this might be set to change in October. There are no guarantees, but investors might well want to take a closer look.

Reason 1: growth

The main reason Greggs shares have been falling is revenue growth. The firm reported a 7% sales increase in July, but this was largely due to opening new stores during the first half of the year.

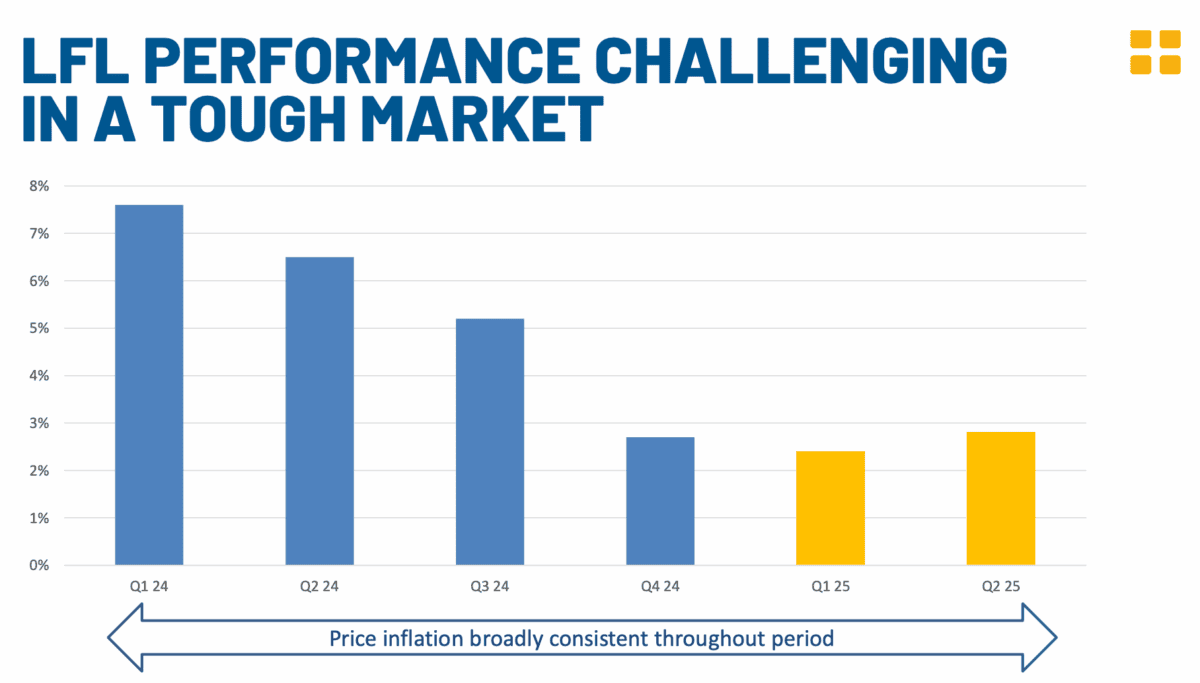

Adjusting for this, revenues were up less than 3% and like-for-like sales have been consistently disappointing since the start of 2024. But things are starting to show signs of recovery.

Source: Greggs Interim Results Presentation 2025

Management’s been citing unusual weather conditions for recent weak demand. With this out of the way however, thereâs a chance like-for-like growth could start to pick up.

In this situation, the market might start to take a more positive view of the stock than it currently is. And the current multiple the stock’s trading at might well amplify the effect of this.

Reason 2: valuation

As a result of the recent declines, Greggs’ shares currently trade at a price-to-earnings (P/E) ratio of less than 11. And to some extent, I think that makes a lot of sense.

Right now though, the stock’s trading at one of its lowest multiples in the last five years. So if things start to pick up with the underlying business, I expect this to expand.

Source: Trading View

The shares trading at a P/E ratio of 12 would cause the price to jump 15%, even before the effect of any growth. Furthermore, earnings have also been held back by one-off expansion costs.Â

At their current level, I think even a modest surprise could cause Greggs shares to trade at a significantly higher multiple. And that could mean a lot in terms of the share price.

Reason 3: imminent update

Dramatic share price moves often come in response to company reports. This is because updates from businesses give investors the best chance to review their expectations.

Given this, itâs probably significant that Greggs is set to issue its trading update for the third quarter of 2025 at the start of October. And I suspect investors will be watching carefully.

Cost inflation’s probably the biggest issue facing the company at the moment. Itâs the single largest reason operating income fell during the first half of the year and looks set to continue.

For the stock to move higher, investors will want to see Greggs being able to offset this through higher like-for-like sales growth. And weâll get an update on this very soon.

Long-term view

Sales growth across the takeaway and fast food sector in the UK has been weak. While Greggs has faltered, the industry as a whole has seen declines.

From a long-term perspective, this is a very positive sign for Greggs. It means the company’s relatively resilient, even when the sector as a whole is under pressure.

Given this, I think long-term investors might want to take a look. At the current multiple, it might not take much from the business to get the share price moving.

The post 3 reasons why Greggs shares could be set to bounce back in October appeared first on The Motley Fool UK.

Should you invest £1,000 in Greggs plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greggs plc made the list?

More reading

- Greggs’ shares have turned £1,000 into £500. Hereâs what hedge funds expect to happen next

- Prediction: here’s where the Greggs share price could go by 2027

- By 2026, the Greggs share price could turn £5,000 intoâ¦

- Down 51%, here are the latest Greggs share price forecasts for 2026

- With a spare £500, hereâs how a stock market novice could start buying shares

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Greggs Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.