At £11.90, the Rolls-Royce share price isn’t cheap. But here’s why I’m not selling

The Rolls-Royce Holdings (LSE:RR.) share price is currently (1 October) at a level that values the group at just under £100bn.

Itâs now the FTSE 100âs fifth-most valuable company. Five years ago, I donât think many people would have predicted that. Since October 2020, the aerospace and defence groupâs share price has risen close to 3,000%.

During this period, questions have been repeatedly asked (including by me) about whether the stock is overvalued. But after the company kept upgrading its earnings forecasts, I eventually took a position in the fourth quarter of 2024. Iâm now sitting on a gain of around 90%. Okay, I could have done a lot better if Iâd invested sooner after the pandemic. But Iâm happy enough.

However, looking at three common valuation measures, I think itâs hard to deny that the shares are borderline expensive or — expressed another way — not cheap.

Crunching the numbers

For example, with a current share price of £11.90 and underlying earnings per share (EPS) of 20.3p in 2024, the groupâs valued at 58.6 times historic earnings.

Looking ahead — based on analystsâ forecasts through until 2028 — its price-to-earnings (P/E) ratio drops to a more palatable 31.7.

| Year | Forecast EPS (pence) | P/E ratio |

|---|---|---|

| 2025 | 24.8 | 48.0 |

| 2026 | 29.5 | 40.3 |

| 2027 | 33.3 | 35.7 |

| 2028 | 37.6 | 31.7 |

But the trouble with the P/E ratio is that it doesnât consider the growth rate of earnings. Thatâs why the P/E-to-growth (PEG) ratio was invented. Itâs calculated by dividing a stockâs P/E ratio by its earnings growth rate. If the analysts are correct, Rolls-Royce will see its EPS grow by 22% in 2025. This gives a PEG ratio of 2.67. Generally speaking, a figure above one implies that a stockâs overvalued.

It’s a similar story when it comes to the groupâs balance sheet. At 30 June, its accounting value (assets less liabilities) was £2.4bn. This is well below its current stock market valuation of £98bn.

Looking at these figures, Iâm tempted to sell up. After all, Iâm a cautious investor. However, Iâm also a long-term investor. And I think there are some significant opportunities that aren’t yet reflected in the groupâs share price.

Not over yet

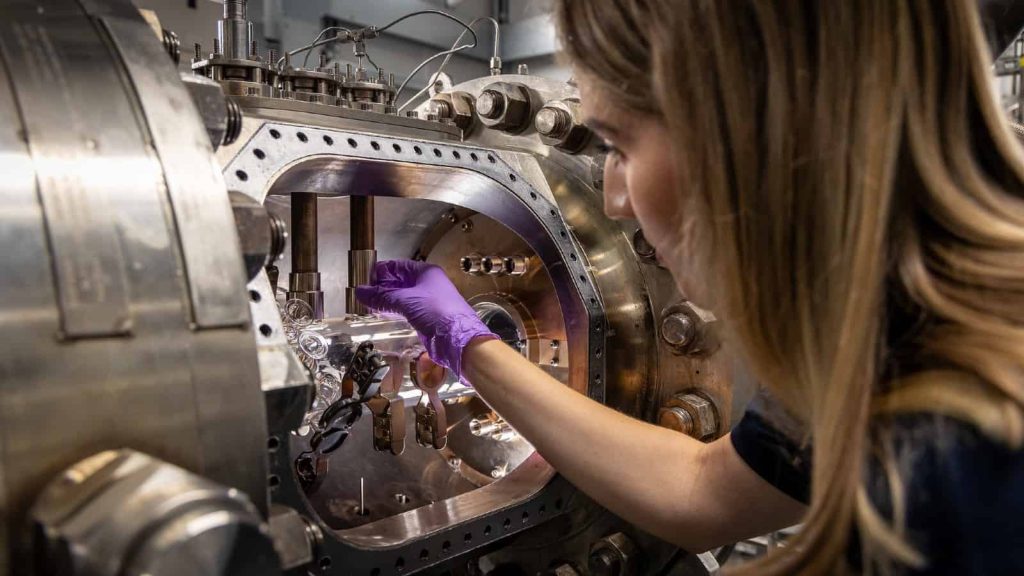

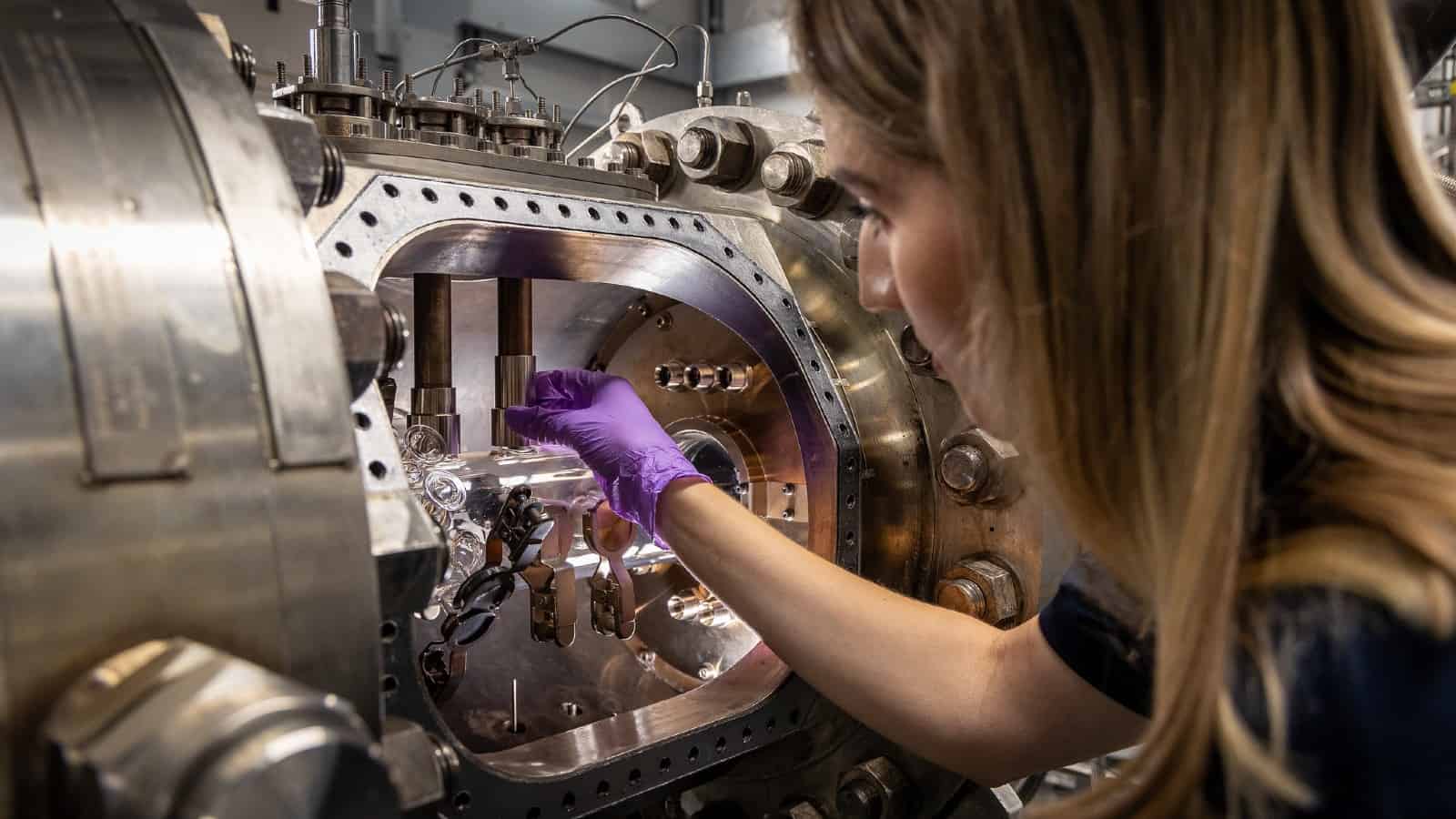

For example, itâs leading the UKâs development of small modular reactors (SMRs). These are factory-built nuclear power stations that are designed to be assembled on site. Significant revenues aren’t expected until 2030 at the earliest. But Citi Group reckons SMRs could add 11p-40p to the share price.

The groupâs boss has also said that he wants to re-enter the narrowbody aircraft market. Rolls-Royce stopped fitting its engines to single-aisle aeroplanes in 2011. If it can find a suitable joint venture partner, sales could commence by the middle of the next decade.

These opportunities complement its existing three business units — civil aviation (predominantly larger aircraft), defence, and power systems — which are growing strongly.

But there are challenges. SMRs are commercially unproven and the pandemic demonstrated how vulnerable the group can be to a downturn in the aviation industry. Its dividend is also modest, although this can be forgiven if the groupâs share price continues its current rally.

Due to its lofty valuation, any sign of a weakness in the groupâs earnings and its share price is likely to suffer. But I believe the long-term fundamentals of the business are solid which is why I’m going to hold on to my shares and why I still think Rolls-Royce is a stock for others to consider.

The post At £11.90, the Rolls-Royce share price isn’t cheap. But here’s why I’m not selling appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Up 2,954%, the Rolls-Royce share price has never been higher! Time to buy?

- £2k invested in Rolls-Royce stock in January would currently be worth…

- Are Babcock, BAE Systems and Rolls-Royce shares no-brainer buys in October?

- As Rolls-Royce shares hit another all-time high, am I missing out for the wrong reason?

- Should I buy more Rolls-Royce shares at a 52-week high?

James Beard has positions in Rolls-Royce Plc. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.