Could the BT share price take off?

The BT (LSE:BT.A) share price has been a steady performer since the pandemic. In October 2020, its shares were changing hands for just over 100p. Today (9 October), they sell for around 185p. This five-year performance just about puts it in the top third of those currently on the FTSE 100.

Then and now

The sale of BT shares to the public in 1984 was the first major privatisation of the Thatcher government. The idea was to free the telecoms group from state control and let it compete internationally without being held back by bureaucracy and union power.

But a look at the 1984 sales prospectus suggests that the groupâs made little progress since. At the time, it was valued at £7.8bn — or £25.6bn in todayâs terms. Now, its market cap is ‘only’ £18.2bn.

During the year ended 31 March 1984 (FY84), it made a profit after tax of £990m (£3.25bn in current money). Forty years later, in FY25, it reported adjusted post-tax earnings of £1.83bn.

So in real terms, itâs now worth less and isnât as profitable as it was over four decades ago. Also, its dividend is less generous. In 1984, the stock was yielding 7.1%. Based on amounts paid over the past 12 months, itâs now offering a return of 4.4%. This is a reminder that payouts are never guaranteed.

Sectoral challenges

This disappointing performance is symptomatic of the telecoms industry, where the infrastructure is expensive and the returns are poor.

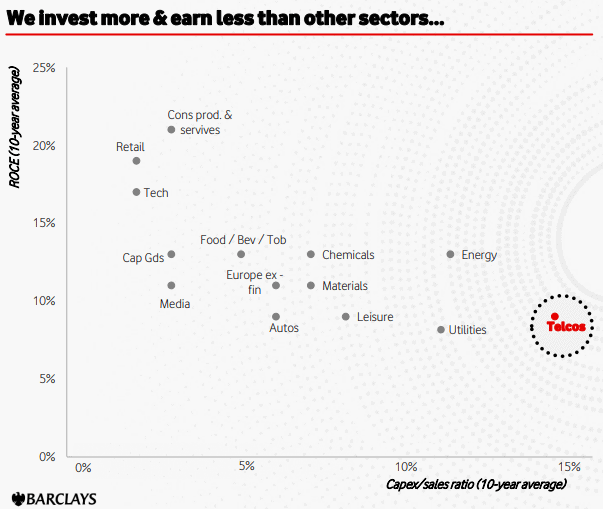

In 2023, Vodafone published research from Barclays that showed the ratio of capital expenditure to sales was the highest of any industry. The sector also had one of the lowest returns on capital employed (ROCE).

This is also evident from BTâs accounts. At the end of FY84, it had fixed assets of £8.8bn and debt (including leases) of £3.9bn. By the end of FY25, these had increased to £42.6bn and £23.3bn, respectively. Over the same period, its ROCE has fallen. And it’s remained largely unchanged over the past five financial years (FY21-FY25) fluctuating between 8.3% and 8.7%.

Pros and cons

One bright spot has been its adjusted EBITDA (earnings before interest, tax, depreciation and amortisation). Itâs increased from £7.42bn in FY21 to £8.21bn in FY25. Although this is the groupâs preferred measure of profitability, it can be controversial. Warren Buffett has described it as a âvery misleading statisticâ that âcan be used in pernicious waysâ. Pithily, he once asked: âDoes management think the tooth fairy pays for capital expenditures?â This seems to be a highly relevant question in an industry where, as we’ve seen, the infrastructure isn’t cheap.

Adjusted earnings per share is probably a more reliable indicator. But in FY21, this was 18.9p. In FY25, it was slightly lower at 18.8p. The business appears stuck to me.

But brokers are optimistic. They have a 12-month share price target thatâs 15% higher than its current value. And BT has some impressive names on its share register. The largest chunk of stock (24.5%) is held by Bharti Overseas. In my opinion, the group also retains a strong brand.

However, this isn’t sufficient to make me want to invest. BT looks like too much of a plodder in an industry that demands deep pockets. I think there are better opportunities for me elsewhere.

The post Could the BT share price take off? appeared first on The Motley Fool UK.

Should you invest £1,000 in BT Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT Group made the list?

More reading

- Forecast: in 2026, the BT share price could turn £20,000 into…

- Trading just under £2 now, BTâs share price looks a bargain to me anywhere below £6.13

- When will the BT share price hit £3 again?

- After the latest stumble, is the BT share price rally going into reverse?

- Prediction: in 12 months the dirt cheap BT share price could turn £10,000 intoâ¦

James Beard has positions in Vodafone Group Public. The Motley Fool UK has recommended Barclays Plc and Vodafone Group Public. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.