How much do you need in a Stocks and Shares ISA to aim for a £2.5k monthly retirement income?

Retirement planning often leans heavily on pensions, but many a Briton also eyes a Stocks and Shares ISA as a powerful tool. It lets investors benefit from tax-free dividends and capital gains and, unlike many pensions, withdrawals are typically free of tax.

Over time, that tax shelter can help a portfolio grow more efficiently, making it an appealing way to build passive income for later life.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Calculating the target

An ISA retirement income of £2,500 a month works out at £30,000 a year. It’s common practice to use the ‘safe withdrawal’ guideline of 4%, so as to limit capital depletion by only taking 4% annually.

To support £30,000 from 4%, the required portfolio is £750,000 (£750,000 à 0.04 = £30,000). That is a sizeable sum, but not beyond reach with disciplined saving and sensible returns.

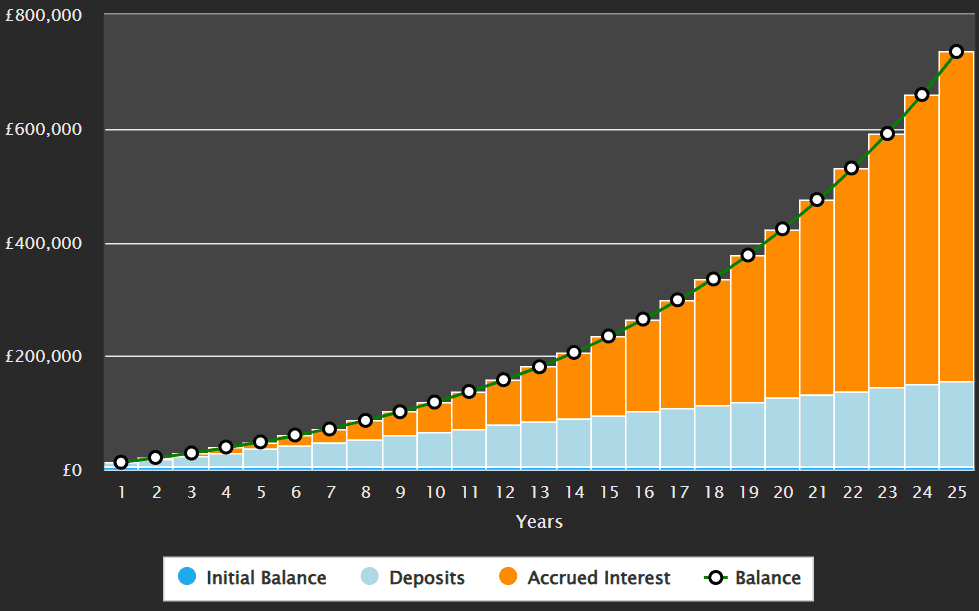

For instance, suppose an investor puts away £500 every month into a diversified portfolio of shares that delivers an average growth (including reinvested dividends) of 10% a year. Over roughly 25 years, that could grow to about £735,700, just shy of the £750,000 target.

Of course, with smaller monthly contributions and lower annual returns, the horizon would stretch somewhat. Naturally, returns will vary and market corrections will occur, so it wonât be a straight line. But the illustration is an example of what could happen.

Is a 10% annual return realistic?

For some, the answer is no. But many long-term investors have achieved average returns close to 10% via stocks or diversified funds. Recent data shows the average UK Stocks and Shares ISA fund delivered growth of 11.86% between February 2024 and February 2025.

Over the last decade, some sources cite a typical ISA return of around 9.64% annually.

Rather than picking individual stocks, many lean on investment funds or ETFs to spread risk. It’s also common practice for investors to opt for stocks or funds in an industry they understand.

For example, gaming enthusiasts may want to consider the VanEck Video Gaming and eSports ETF (LSE: ESGB).

It manages about £770m in assets and charges 0.55% annually with a net asset value (NAV) total return over one year of 58.9%. The share price is up up 101% over the past five years, equating to annualised returns of around 15% a year.

The fund’s top holdings include Tencent, Nintendo, Roblox, NetEase and Electronic Arts.

Because it focuses heavily on Asian tech and gaming firms (62%), it’s exposed to sector concentration. If Asian technology stocks tumble or regulation tightens, the ETF could suffer steeper losses than broader funds.

Also, currency movements matter as returns may fluctuate if foreign exchange rates shift. Lastly, the relatively high volatility of gaming and tech sectors means returns could swing wildly. An investor should weigh up these risks before committing large sums.

Patience and dedication

To aim for a £2,500 monthly retirement income via a Stocks and Shares ISA, a sizeable portfolio is required.

That calls for steady investing and a long time horizon. While 10% average returns arenât guaranteed, theyâve been attained in certain strategies and markets. Using diversified funds or ETFs can help spread risk, though sector or currency exposures bring their own uncertainties.

An investor should always think about balance, costs and the risk sensitivity of any fund or stock when building towards such a goal.

The post How much do you need in a Stocks and Shares ISA to aim for a £2.5k monthly retirement income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Vaneck Vectors Ucits Etfs Public Limited Company – Vaneck Vectors(TM) Video Gaming And Esports Ucits right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vaneck Vectors Ucits Etfs Public Limited Company – Vaneck Vectors(TM) Video Gaming And Esports Ucits made the list?

More reading

- 3 UK shares to consider this month as major brokers raise their price targets

- This FTSE 250 firm continues to outshine its rivals

- Could the BT share price take off?

- My highest-conviction FTSE 100 investment right now isâ¦

- 3 cheap shares with P/Es under 8 â but 1 of them worries me

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has recommended Electronic Arts, Nintendo, and Roblox. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.