How much do you need in an ISA to target £1,799 in monthly passive income?

Building an ISA portfolio that can generate £1,799 in monthly passive income might sound like a tall order, but itâs more achievable than many think.

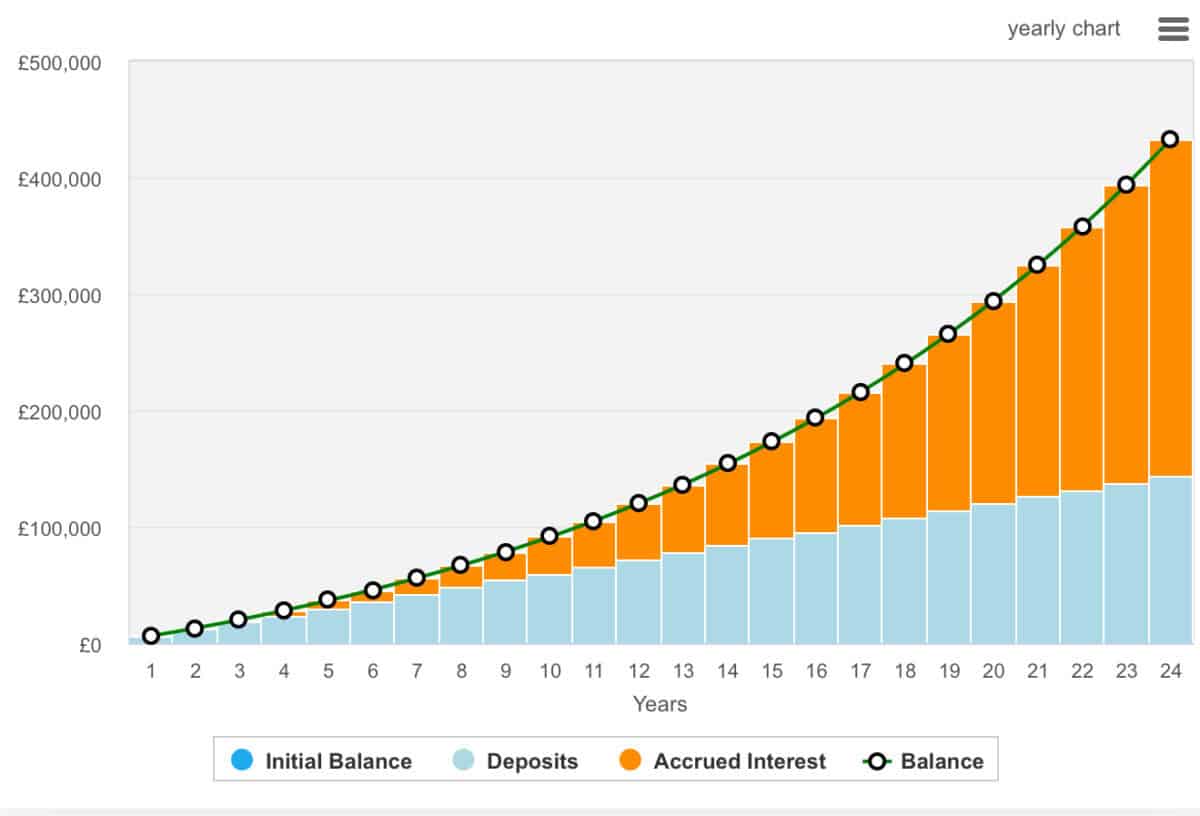

The secret lies in time, consistency, and the power of compounding. By steadily contributing to a Stocks and Shares ISA and reinvesting dividends, investors can turn modest savings into a meaningful income stream over time.

Whatâs more, even those who are late to investing can build significant wealth just by following a tried and tested formula.

To generate £1,799 a month in passive income, an investor would need a portfolio worth roughly £431,760 â assuming a 5% annual return.

Building that portfolio

Every pound invested today has the potential to multiply over time. And by regularly adding to a Stocks and Shares ISA, reinvesting returns, and letting compound growth work its magic can turn modest monthly contributions into serious capital.

The earlier the start, the greater the impact â but even late starters can make real progress by staying disciplined. Itâs something that can really help with retirement.

Beyond the contributions and the compounding, the key to investing is finding businesses trading below intrinsic value. These are the kind of companies the market’s mispriced.

By steadily buying quality assets when others are fearful and holding through market noise, investors give themselves the best chance to grow that £431,760 nest egg. And, eventually, they can enjoy that steady £1,799 a month in passive income.

Investing smart

As alluded to above, investors can lose money if they invest poorly. However, a data-driven approach can help them beat the market and deliver strong long-term returns.

One stock I believe could help investors achieve this is often-overlooked Hikma Pharmaceuticals (LSE:HIK). The company’s one of the smallest on the FTSE 100, but is potentially one of the most undervalued.

In fact, according to the 11 analysts covering the stock, itâs undervalued by around 41%. There are currently 10 Buy ratings and just one Hold.

The shares trade on a 2025 forward price-to-earnings (P/E) ratio of roughly 12.2, with an adjusted price-to-earnings-to-growth (PEG) ratio of around 0.85, once net debt and dividends are factored in. That suggests the market’s undervaluing Hikmaâs earnings trajectory.

The company continues to generate strong cash flows, supported by its diversified mix of injectables, branded products, and generics. Management’s focus on margin discipline and gradual debt reduction’s also positive.

While US tariffs and structural issues in the US generic market are a concern, thereâs also a lot to be positive about. Hikma has a strong product pipeline and may be able to capitalise on expiring weight-loss patents in the coming years.

For long-term investors, the current valuation may offer an appealing entry point. This includes a 3.4% dividend yield, expected to rise to 4.3% by 2027.

In short, I certainly believe Hikma’s worth considering.

The post How much do you need in an ISA to target £1,799 in monthly passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Hikma Pharmaceuticals PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hikma Pharmaceuticals PLC made the list?

More reading

- Late to investing? Here are Dr James Foxâs favourite FTSE 100 stocks right now

- 2 overlooked UK shares to consider for dividend income

- These undervalued FTSE 100 shares could rise more than 50% over the next year, according to brokers

- After crashing 50%+, is this a bargain-basement growth stock?

James Fox has no position in any of the shares mentioned. The Motley Fool UK has recommended Hikma Pharmaceuticals Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.