How much money do you need in a SIPP for a £38k passive income at 65?

I don’t know about you, but I have no plans to leave my financial fate in retirement up to outside forces. With the future of the State Pension coming under increased scrutiny, I plan to build enough wealth for a healthy passive income to supplement any state benefits I’ll receive.

Given enough time, investing regularly in a Self-Invested Personal Pension (SIPP) could be one of the best ways for individuals to generate enough money for retirement. Generous tax breaks and government top-ups can supercharge long-term compounding, helping your savings to grow faster.

They mean that even those late to the investing party can build a large passive income for later on.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building income

According to Shepherds Friendly, the average Briton has £514 at the end of each month to invest. Thanks to tax relief, those who use a SIPP to buy shares, funds and trusts have even more money to use to grow their wealth.

Tax relief on these products ranges from 20% for basic-rate taxpayers. That rises to 40% and 45% for those on the higher-rate and additional-rate tax bands respectively. For those investing around half a grand each month, that’s a tidy little bonus can make an enormous difference.

Let’s say we have a higher-rate taxpayer with that £514 to put in the stock market each month. Thanks to tax relief, the amount they actually have to invest is bumped up to £857.

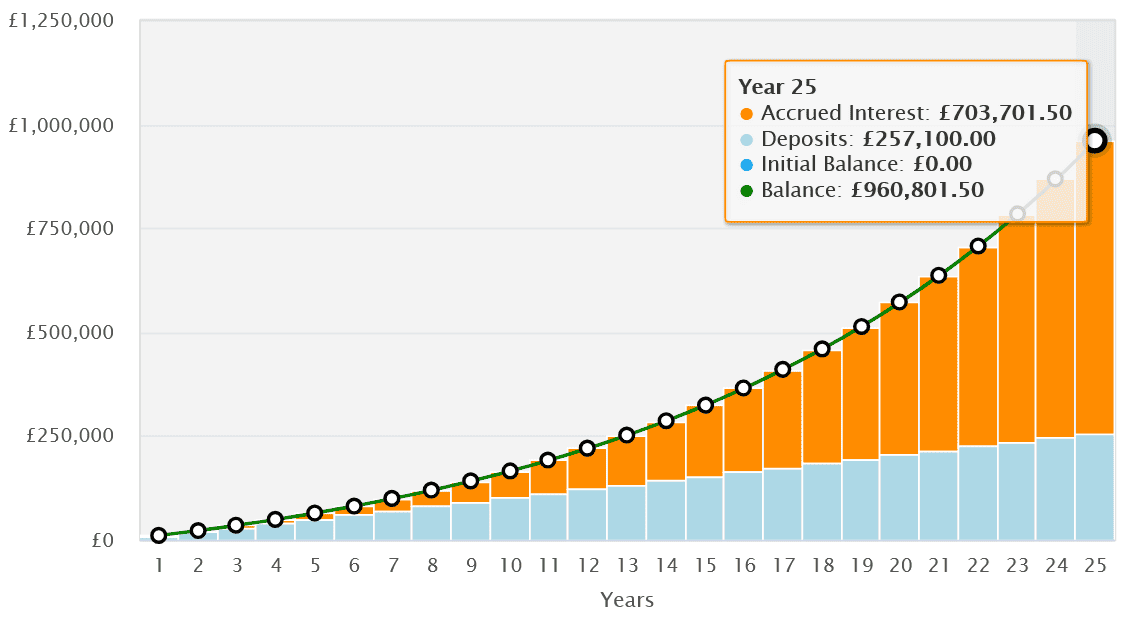

If they started investing this at the age of 40, they could have £960,802 sitting in their SIPP by the time they reach 65. That’s based on an average annual return of 9%.

Such a sum would produce a passive income of just over £38,000 if our investor drew down 4% of their fund each year (£38,432, to be precise).

What would their SIPP look like without tax relief? After 25 years, they’d have a portfolio worth £576,257, which would produce a lower income of roughly £20,000 a year, based on the same withdrawal rate.

Targeting retirement wealth

But just how realistic is it for the average investor to achieve that 9% annual return and build a nest egg like this? History shows that patience and a balanced portfolio spread across the stock market can deliver solid long-term growth, though past performance isn’t a guarantee of future results.

I’ve increased my own holdings in diversified products like exchange-traded funds (ETFs) to grow my retirement fund. The iShares Digital Security ETF (LSE:LOCK) is one I’ve added to my SIPP in recent weeks.

During the past five years, it’s delivered an 11.7% average annual return, ahead of our target 9%.

A focus on cyclical tech shares means the fund could underperform during economic downturns. But I’m convinced it will continue delivering knockout returns over the long term as the cyber security market grows.

What’s more, with holdings in 110 different companies, this iShares ETF can harness this opportunity without overreliance on individual companies to drive growth.

For any SIPP investor targeting a large passive income, I think it’s worth serious consideration.

The post How much money do you need in a SIPP for a £38k passive income at 65? appeared first on The Motley Fool UK.

Should you invest £1,000 in iShares IV Public Limited Company – iShares Digital Security UCITS ETF right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if iShares IV Public Limited Company – iShares Digital Security UCITS ETF made the list?

More reading

- 2 ETFS and a FTSE 250 trust to consider from the London Stock Exchange

- Here are 2 UK shares and ETFs I’ve just bought for my SIPP!

Royston Wild has positions in iShares IV Public – iShares Digital Security Ucits ETF. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.