Here’s what I’d consider doing if ISA allowances plunge!

The Cash ISA is a good product to build wealth. The tax protections it offers can over time significantly boost the returns savers make on their contributions.

It’s unfortunate, then, that annual allowances — that is, contribution limits — on these tax wrappers look like they might be slashed. Rumours have been swirling of rule changes as the government seeks to encourage Britons to invest rather than save. Current talk is that Cash ISA allowances will be halved to £10,000.

But as the saying goes, when life gives you lemons, make lemonade. My hope is — as a Stocks and Shares ISA investor — these changes will mean more people investing in the stock market where they can target better returns.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Wealth gap

Don’t get me wrong. I use a Cash ISA myself, and I’m not especially keen on those rumoured allowance cuts. I think a carrot rather than a stick approach is the best way to encourage people to pursue better returns.

However, the vast majority of my extra money each month is used to buy shares, investment trusts and exchange-traded funds (ETFs). Given the superior returns on offer, it’s a no-brainer decision for me.

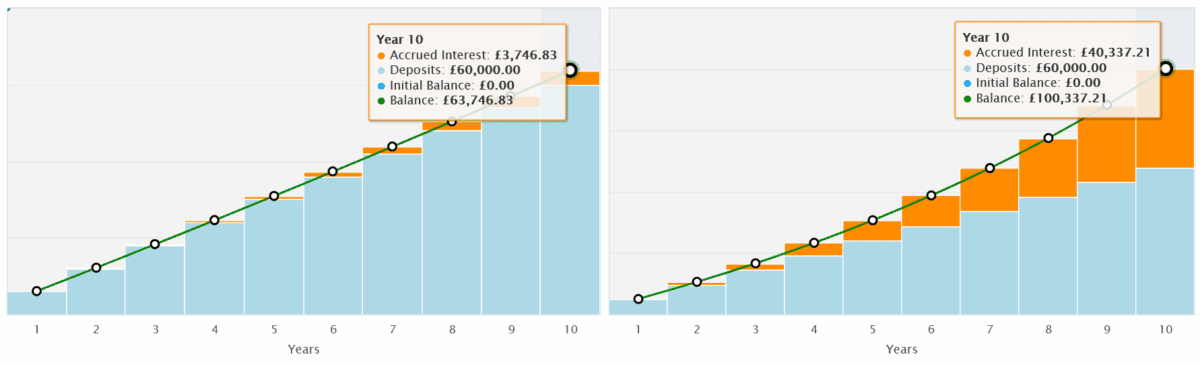

Moneyfacts data shows that the average Stocks and Shares ISA user made an average annual return of 9.64% over the last decade. Cash ISA savers, meanwhile, made a paltry 1.21%.

Based on these numbers, someone who put £500 every month in the latter would have roughly £63,700 to show for it today. The return on the investing ISA would have blown that out of the water, at around £100,300.

Stretched over a number of decades, the difference would be even starker, given the compounding effect where returns generate further returns over time.

A balanced approach

I love the advantages that a Cash ISA offers. It’s simple, and provides a guaranteed return. By comparison, stock ISAs are higher-risk and can go up and down.

But over a longer time horizon, the bumps that share investors experience tendsto be ironed out, allowing the full power of the stock market to shine through. What’s more, with a wide range of assets to choose from, Stocks and Shares ISA investors can significantly reduce the risks to their cash now and in the future.

I myself own a range of investment trusts and ETFs including the HSBC S&P 500 (LSE:HSPX) fund. This particular one diversifies across hundreds of US shares with footprints in different sectors and regions.

It’s an approach that’s paid off handsomely. Over the last decade, it’s delivered an average annual return of 15%.

These huge returns largely reflect the fund’s large contingent of high-growth tech shares. This tilt towards technology can result in volatility during economic downturns. However, it can also deliver blockbuster returns as digital trends like artificial intelligence (AI) and robotics take off.

Holdings here include Nvidia, which became the world’s first $4trn company this year.

I think a diversified portfolio of stocks, trusts and funds like this — balanced with some money held in savings — could be an effective way to target long-term wealth. It’s the path I’d consider taking if I was a Cash ISA saver today.

The post Here’s what I’d consider doing if ISA allowances plunge! appeared first on The Motley Fool UK.

Should you invest £1,000 in HSBC ETFs Public Limited Company – HSBC S&P 500 UCITS ETF right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC ETFs Public Limited Company – HSBC S&P 500 UCITS ETF made the list?

More reading

Royston Wild has positions in Hsbc ETFs Public – Hsbc S&P 500 Ucits ETF. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.