16% annual return! Why I chose this fund over other Euro ETFs

The shares, trusts, and exchange-traded funds (ETFs) in my porfolio cover all four corners of the globe. But my exposure to Europe was looking a little light, so I decided to remedy this by investing some tax relief in my Self-Invested Personal Pension (SIPP).

Interest in European shares has rocketed in 2025 as investors look for better value than US shares currently offer. The FTSE 100 is up 14% in the year to date, slightly outpacing the S&P 500‘s 13.8% gains.

Germany’s DAX has risen an even-more impressive 21%, though performance has been mixed in places. France’s CAC40 is up 10%, though a volatile political landscape hasn’t helped.

To plug the gap in my portfolio, I decided last week to open a position in the iShares Core MSCI Europe UCITS ETF (LSE:SMEA), which has provided an average annual return of 16% since October 2022.

Here’s why.

Strong gains expected

Evidence is growing othat both retail and professional investors are losing confidence in the long-term outlook for US shares. This in turn is sparking interest in other regions, and especially companies that are closer to home.

According to BNP Paribas,

the change in economic and geopolitical policies from the US administration, combined with a significant increase in European defence and infrastructure spending, have led many investors to reassess Europeâs investment potential

Can European stock markets continue to climb, though? There’s no guarantee, but a broad selection of analysts strike a confident tone.

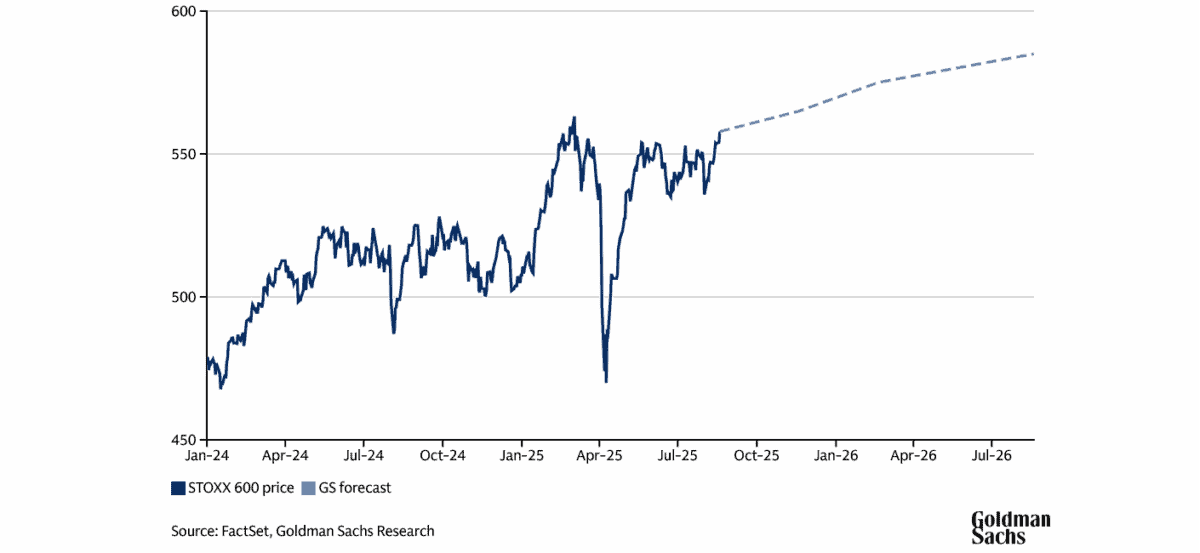

Goldman Sachs expects the STOXX Europe 600 index to provide a total return of 8% over the next 12 months.

Other City forecasters are predicting even greater gains. UBS is tipping an 11% total return by the end of 2026. Deutsche Bank reckons the STOXX Europe 600 will rise 15% by the end of next year.

A top ETF

I plumped for the iShares Core MSCI Europe fund to capitalise on this opportunity.

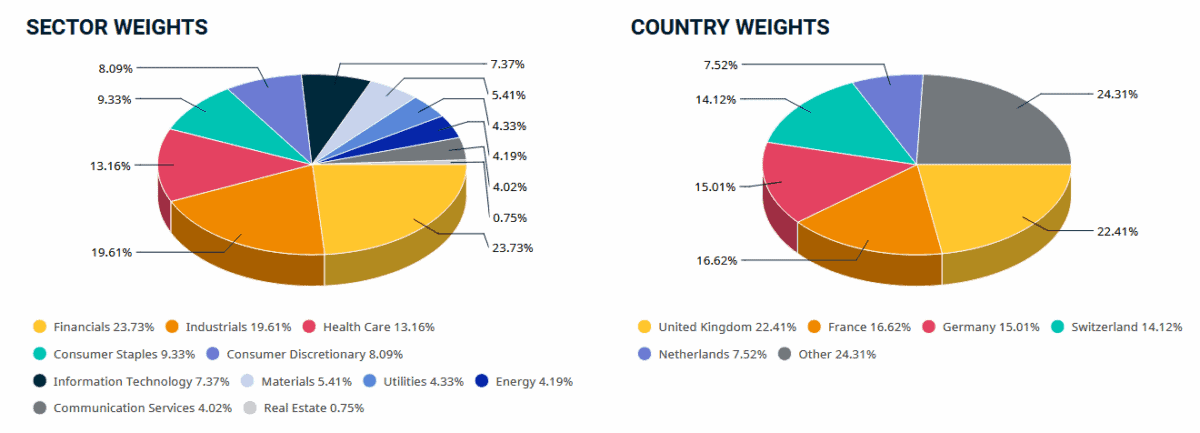

One reason is its focus on the MSCI Europe index. Unlike the STOXX Europe 600, it only contains large and mid-cap companies, meaning it may perform more robustly in what remain uncertain economic times.

There’s plenty of ETFs geared towards MSCI Europe. But this iShares product is the largest and most liquid out there, with total assets under management of â¬12.6trn. It also has one of the lowest ongoing management charges, at 0.12%.

What’s more, this iShares product is the only European fund to beat the broader MSCI Europe index every year since 2015.

It may not have as many holdings as a STOXX Europe 600-based ETF. But at 402, it still owns a diversified enough pool of stocks to help holders effectively manage risk and capture a huge selection of growth and income opportunities.

Holdings are as varied as software developer SAP and drugmaker Novartis, to consumer goods giant Nestlé and banking star HSBC.

It’s possible my ETF could disappoint if trade wars intensify or inflationary pressures grow, pulling share prices lower. But given the strong regional outlook, I think the possibility of further significant returns outweighs the risk.

The post 16% annual return! Why I chose this fund over other Euro ETFs appeared first on The Motley Fool UK.

Should you invest £1,000 in iShares III Public Limited Company – iShares MSCI Europe UCITS ETF EUR (Acc) right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if iShares III Public Limited Company – iShares MSCI Europe UCITS ETF EUR (Acc) made the list?

More reading

- While there are bubbles in the stock market, this sector looks dirt cheap

- How big does your ISA need to be to target an £888 monthly passive income?

- Is this my last chance to buy Taylor Wimpey before the share price rockets?

- Is the Barclays share price a steal after its recent fall?

- Worried about dividend cuts? 3 of the FTSE 100’s best dividend growers

HSBC Holdings is an advertising partner of Motley Fool Money. Royston Wild has positions in HSBC Holdings and iShares III Public – iShares Msci Europe Ucits ETF Eur (Acc). The Motley Fool UK has recommended HSBC Holdings. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.