By 2026, these FTSE 100 stocks could yield above 6.3%

The FTSE 100 rose above 9,500 for the first time earlier this month. Yet despite reaching this milestone, many dividend stocks continue to sport bumper dividend yields.

One such Footsie stock is Aviva (LSE:AV.). Based on current fiscal 2026 forecasts, the insurer is tipped to pay out 41.5p per share. At today’s share price of 659p, that equates to a forward yield of 6.32%.

Considering the Aviva share price is up 40% year to date, that’s still a hearty offering. And 41.5p would represent year-on-year dividend growth of 7.2%, thereby outpacing UK inflation by a decent margin.

Of course, these forecasts might not turn out to be accurate (sometimes they end up wide of the mark). But Avivaâs enjoying strong business momentum right now, with operating profit jumping 22% to £1.07bn in the first half of the year.

Also, the integration of Direct Line is well underway. This combined business will have over 21m customers, or four in 10 adults in the UK. Avivaâs confident this deal will âcontribute significantlyâ to future growth.Â

Over the past five years weâve transformed the performance and prospects of Avivaâ¦We are very well positioned to accelerate growth in the capital-light areas of wealth, health and general insurance, and deliver more and more for our shareholders.

Aviva CEO Amanda Blanc.

Admiral

Another FTSE 100 insurance stock forecast to offer decent income in 2026 is Admiral (LSE:ADM). The companyâs expected to dish out £2.13p per share, equating to a forward-looking yield of 6.55%.

This would only be 1.1% growth, but Admiral has a solid track record of increasing its annual payout (nearly 8% over the past few years). And dividends have risen significantly since 2023.

The UK motor insurance giant is well-run outfit with excellent underwriting margins and a keen focus on improving its data capabilities to maintain its competitive positioning. In the first half, UK customers rose 13% to 9.3m.

As a major UK motor insurer, Admiralâs exposed to claims inflation (repair costs, labour, parts, etc). Aviva faces similar risks with its beefed-up car insurance business, while both would face challenges from an economic downturn. Â

Nevertheless, I think theyâre top insurance stocks to consider for their long-term income potential.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

REIT

Finally, there’s Londonmetric Property (LSE:LMP). This is a real estate investment trust (REIT) that owns a lot of logistics and warehousing property â the sort of assets that underpin the online shopping economy.

This year, Londonmetric’s dividend is forecast to jump more than 20%. Then it’s tipped to rise another 3.6% next year to 12.9p. At today’s share price of 189p, that would result in a yield of 6.82%.

Of course, property values remain sensitive to higher interest rates, and a UK recession could lead to more tenant defaults. However, Londonmetricâs occupancy rate is high at 98%, and I like that it has been taking advantage of market uncertainty to acquire assets and increase its exposure to logistics.

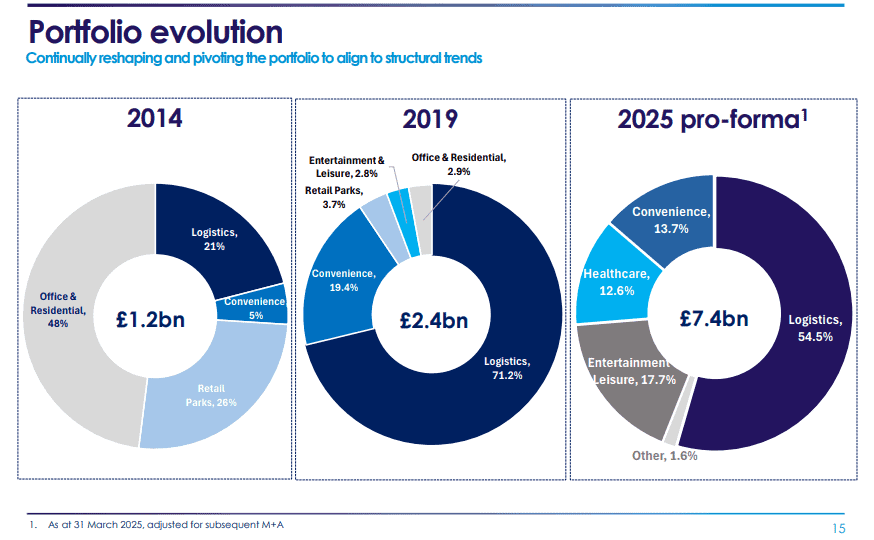

As shown above, the company has more than doubled its exposure to logistics as e-commerce has boomed over the past decade. Itâs also reduced exposure to offices and retail parks, while leaning into areas with more resilience and/or structural growth.

With interest rates expected to fall in 2026, I think Londonmetric, at 189p, is also worth considering for income.

The post By 2026, these FTSE 100 stocks could yield above 6.3% appeared first on The Motley Fool UK.

Should you invest £1,000 in Aviva plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva plc made the list?

More reading

- £20,000 of Aviva shares could make me £10,390 a year in dividend income, given its 6.7% forecast yield!

- How big does your ISA need to be to target an £888 monthly passive income?

- With £5,000, here’s how to create a second income from UK property without buy-to-let

- Can you unlock a £5,513 annual second income by investing £100 a month?

- Got £20k? Watch an Aviva shares portfolio grow with compounding

Ben McPoland has positions in Aviva Plc. The Motley Fool UK has recommended Admiral Group Plc and LondonMetric Property Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.