Why it’s time to ignore the gold price rally (or is it now a slump?)

The price of gold has been soaring lately. Well, it was until two days ago. At the time of writing on 22 October, itâs down 2% to $4,038 an ounce. The day before, it experienced its biggest one-day fall (6%) for 12 years. Itâs been a strange week. On Monday (20 October), it reached an all-time high of $4,381.

But experienced investors know not to panic about short-term price movements. However — almost inevitably — this price correction has resulted in commentators speculating whether the recent rally is over and asking if the metal has lost its shine.

Personally, I think we need to keep a sense of perspective. Even after the events of the past couple of days, the gold price is still 53% higher than it was at the start of 2025!

A false alarm?

This bull run has been widely interpreted as a sign that investors are concerned about the state of the worldâs economy and that equities — particularly in the US — are dangerously overpriced. Historically, the metalâs been viewed as a âsafe havenâ and a hedge against inflation.

However, Iâve come across an academic study that challenges this assertion. Published in the Global Finance Journal in September, âThe diminishing lustre: Goldâs market volatility and the fading safe haven effectâ by Hussain Faraj, David McMillan and Mariam Al-Sabah, looked at prices over the past 37 years.

The paper concludes: âOur findings undermine the conventional view of gold as a safe haven in the post-2005 periodâ. Almost as if they were predicting this weekâs events, the authors warned that during periods of market stress, âadding gold to a portfolio may raise volatility without providing expected protectionâ.

In other words, the recent rally shouldnât be interpreted as a sign of impending doom on the worldâs stock markets. If this analysis is right, itâs good news for those of us who have the majority of their assets tied up in equities. It means that unless we own shares in mining companies, we probably shouldnât pay too much attention to the gold price.

Something to consider

With this in mind, now could be a good time to consider buying shares in RELX (LSE:REL), the FTSE 100 provider of information-based analytics and decision tools for professionals and businesses. It employs artificial intelligence (AI) solutions to help improve its offering to customers. This means it could be in the right sector at the right time.

The groupâs shares are currently changing hands for 6% above their 52-week low. But its share price is still around 20% cheaper than it was in February.

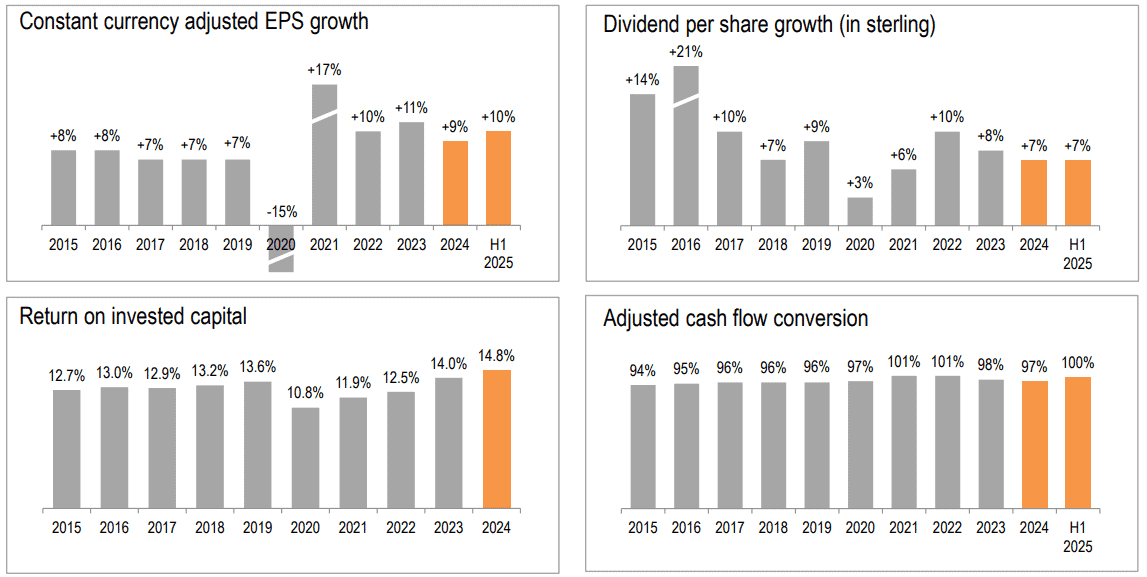

Yet this doesnât reflect its impressive track record of improving its financial performance.

However, RELX faces some challenges.

With 84% of its revenue derived from online products, it could be vulnerable to a cyber attack. And ironically, the company reckons thereâs a risk that its intellectual property could be circumvented by AI technologies.

But I think it’s in good shape. It retains a blue-chip customer list and has a presence in over 180 countries. Also, as an IT-based supplier, thereâs very little extra cost incurred in providing its services to another customer, which means it generates a healthy margin.

As a business, RELX is probably as far removed from a gold miner as you can get. I think its stock is worth considering.

The post Why it’s time to ignore the gold price rally (or is it now a slump?) appeared first on The Motley Fool UK.

Should you invest £1,000 in RELX right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if RELX made the list?

More reading

- 2 FTSE 100 shares near 52-week lows that warrant attention today

- Just released: our 3 top income-focused stocks to consider buying in September [PREMIUM PICKS]

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended RELX. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.