Late to investing? Don’t worry… here’s how we aim to build a retirement-boosting ISA

For many of us who invest through a Stocks and Shares ISA, the long-term goal is to reach a stage where we can take a passive income. This could allow us to retire earlier or maybe have a more comfortable retirement.

Even if investing started later in life, itâs still possible to build meaningful wealth with a clear, disciplined approach.

After opening an investment account, preferably an ISA, the next step is to contribute regularly to build a capital base: set an affordable monthly amount, treat contributions like a bill, and increase them when possible.

With a growing capital base, focus shifts to investing wisely. For me, this means using data to inform investment decisions. Nothing should be left to luck.

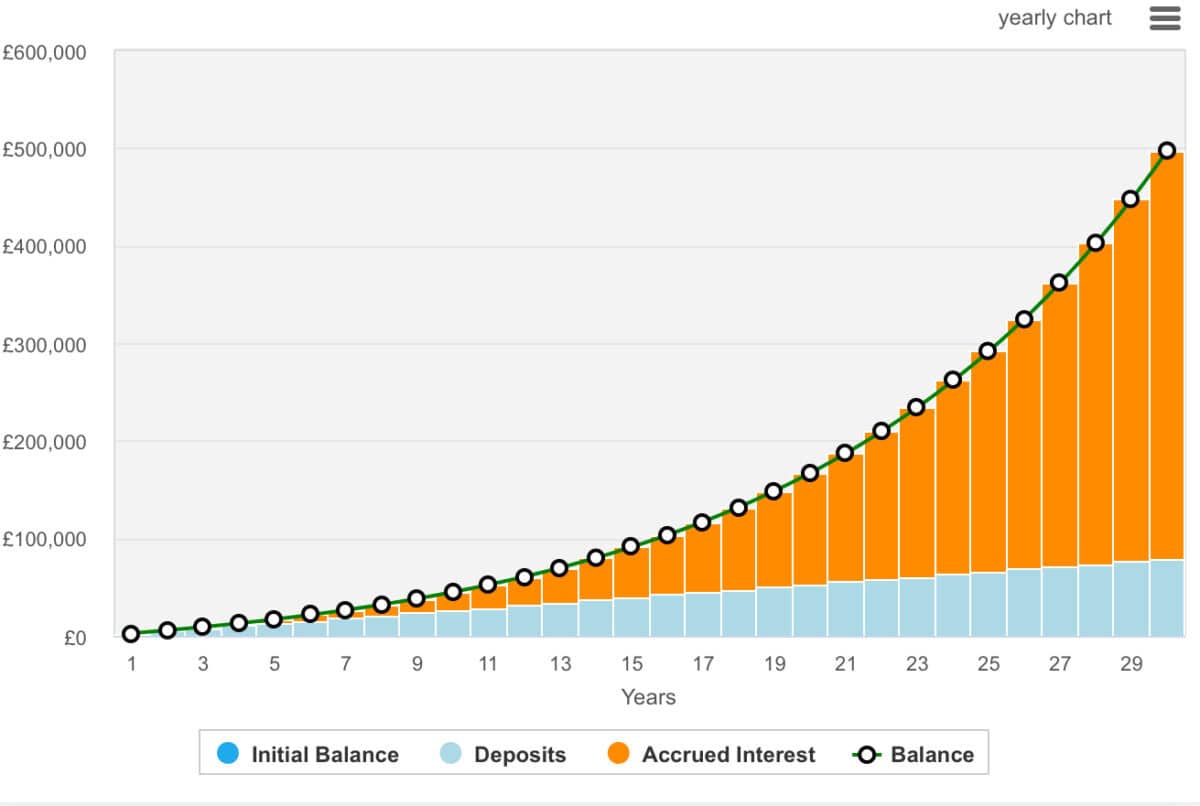

And then itâs about letting compounding do the work. Small returns reinvested over years create material gains.

In short, a disciplined savings plan, combined with prudent stock selection and compounding, can transform a late start into a retirement-boosting ISA. It is never too late to begin.

Running some maths

The main variables when it comes to invest are time, returns, and contributions. With that in mind, Iâve created a table highlighting how much an investor would need to contribute depending on the annualised return to reach £500,000.

As we can see, the fewer the years until retirement, the more money an investor would need to contribute to hit this £500,000 figure. This monthly contribution falls depending on the annualised return and the time afforded for it to compound.

| Years to retire | Annualised return (%) | Monthly contribution (£) |

|---|---|---|

| 10 | 5 | 3,200 |

| 10 | 7 | 2,900 |

| 10 | 10 | 2,450 |

| 20 | 5 | 1,225 |

| 20 | 7 | 950 |

| 20 | 10 | 660 |

| 30 | 5 | 600 |

| 30 | 7 | 410 |

| 30 | 10 | 220 |

The final number shows us something very telling. Good investors with time only need a fraction of the money to reach their desired endpoint. In fact, we can see from this graph below that compound interest is doing all of the heavy lifting.

Where to invest?

Well, as I said before, I like a data-driven approach. And with that in mind, Hikma Pharmaceuticals (LSE:HIK) appears undervalued relative to its growth prospects. I certainly think itâs worth considering.

The stock trades on a forward price-to-earnings (P/E) of around 12 times for 2025, falling to just 9.3 times by 2027. Thatâs well below the FTSE 100 average.

Meanwhile, earnings per share are forecast to rise by roughly 31% between 2025 and 2027, supported by steady revenue expansion from $3.32bn to $3.71bn and margin gains as new capacity in the US comes online.

The companyâs free cash flow yield is projected to rise from 5.6% to over 8%, offering scope for further dividend growth; payouts are expected to climb from $0.82 to $0.98 per share, implying a forward yield above 4%.

With net debt forecast to fall from $969m to $542m over the same period, Hikma is strengthening its balance sheet while maintaining a disciplined capital return policy.

In addition to the strong data, the companyâs prospects are buoyed by upcoming opportunities in GLP-1s (weight loss drugs) as patents expire.

However, itâs worth remembering that tariffs and currency fluctuations havenât been working in the businessâs favour recently.

The post Late to investing? Donât worry⦠hereâs how we aim to build a retirement-boosting ISA appeared first on The Motley Fool UK.

Should you invest £1,000 in Hikma Pharmaceuticals PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hikma Pharmaceuticals PLC made the list?

More reading

- How much do you need in an ISA to target £1,799 in monthly passive income?

- Late to investing? Here are Dr James Foxâs favourite FTSE 100 stocks right now

- 2 overlooked UK shares to consider for dividend income

- These undervalued FTSE 100 shares could rise more than 50% over the next year, according to brokers

James Fox has no position in any of the shares mentioned. The Motley Fool UK has recommended Hikma Pharmaceuticals Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.