Now with a 7% dividend yield, how many ITV shares are needed to target a £1k passive income?

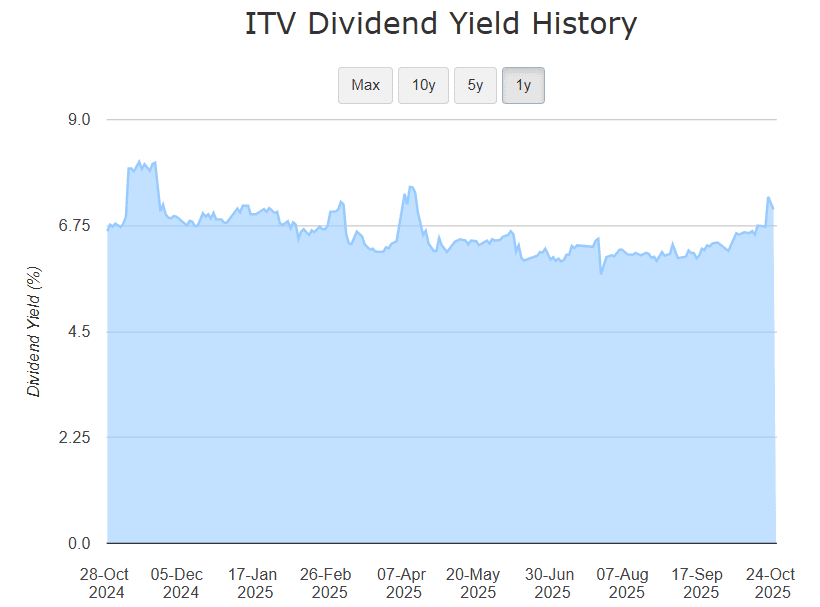

ITV (LSE: ITV) lost a bit of its shine earlier this year when its dividend yield fell below 6%. But as the share price has slipped almost 13% in the past six months, the yield has slowly climbed back above 7%.

That could present an opportunity for investors to scoop up some shares while cheap and aim to boost their dividend income.

But how many shares would be needed? Well, for the past three years, ITV’s paid out a full-year dividend of 5p per share. It hasnât yet declared its final dividend for 2025 but it looks likely to remain the same.

That means 100,000 shares would bring in £5,000 worth of dividends a year.Â

With the shares now changing hands at around 70p each, that would require a hefty £70,000 investment. No small amount — but achievable with regular contributions compounded over several years.

How would that look? Letâs see.

Calculating returns

Say, for instance, an investor buys 500 shares a month for £350. In just over 10 years, by reinvesting the dividends, the pot would have grown to £70,000 (assuming the 7% yield held).

In the investment world, that’s not a long time to dedicate towards building a decent passive income stream.

But is ITV the best dividend stock to choose today? Let’s consider the pros and cons of investing in this famous British broadcasting company.

Changing tides

ITV’s working on a new strategy dubbed ‘More Than TV’ to diversify and grow beyond traditional broadcasting. While there are some encouraging signs, the business remains exposed to advertising cyclicality, regulatory shifts and margin pressures.

In its first-half results to 30 June, it showed total revenue of £1,848m. Advertising revenue dipped 7% to £824m while digital revenue rose 9% to £271m. This is indicative of the ongoing shift in media consumption trends.

It also announced additional cost-cutting measures to the tune of about £15m on top of existing savings, and trimmed its content spend to £1.23bn to better reflect shifting viewer patterns.

What does this mean for potential investors? From a financial standpoint, ITV still has some strengths. Its production arm, ITV Studios, saw UK revenue growth of 7% to £420m in H1, for example.

With streaming hours up and digital ad revenue growing, the strategy to move away from broadcasting and shift to digital is promising. However, profit before tax for the period fell markedly, revealing the challenges of this new business model.

With the lack of a major football tournament, advertising revenue took a hit this year. This was compounded by new UK regulations restricting the advertising of less-healthy foods. These are just two examples of the ongoing regulatory and cyclicality risks the broadcaster faces.

Final thoughts

As traditional broadcasting continues to slip, future profits rely quite heavily on the success of ITV Studios and its digital offerings.

With limited growth potential, the 7% dividend yield is the key attraction here. But I wouldn’t rely on it alone. ITV could make a great addition to an income portfolio, but should only be considered as part of a highly diversified selection of stocks.

Fortunately, the FTSE 100 and FTSE 250 are chock-a-block with reliable, high-yielding dividend stocks to choose from.

The post Now with a 7% dividend yield, how many ITV shares are needed to target a £1k passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in ITV right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITV made the list?

More reading

- Meet the 71p UK stock with a 7.1% dividend yield

- How on earth has the ITV share price fallen by 75%?

- With a yield of 7.3%, is it time to consider ITV shares?

- A 6.7% yield but down 15%, is it time for investors to consider this FTSE 250 media star?

- These 3 UK stocks are rumoured to be takeover targets

Mark Hartley has positions in ITV. The Motley Fool UK has recommended ITV. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.