Why the Amazon share price is surging after Q3 earnings

Amazon (NASDAQ:AMZN) reported Q3 earnings last night (30 October) and the share price soared 13% in extended trading. Iâm surprised, but there is a very clear reason why.Â

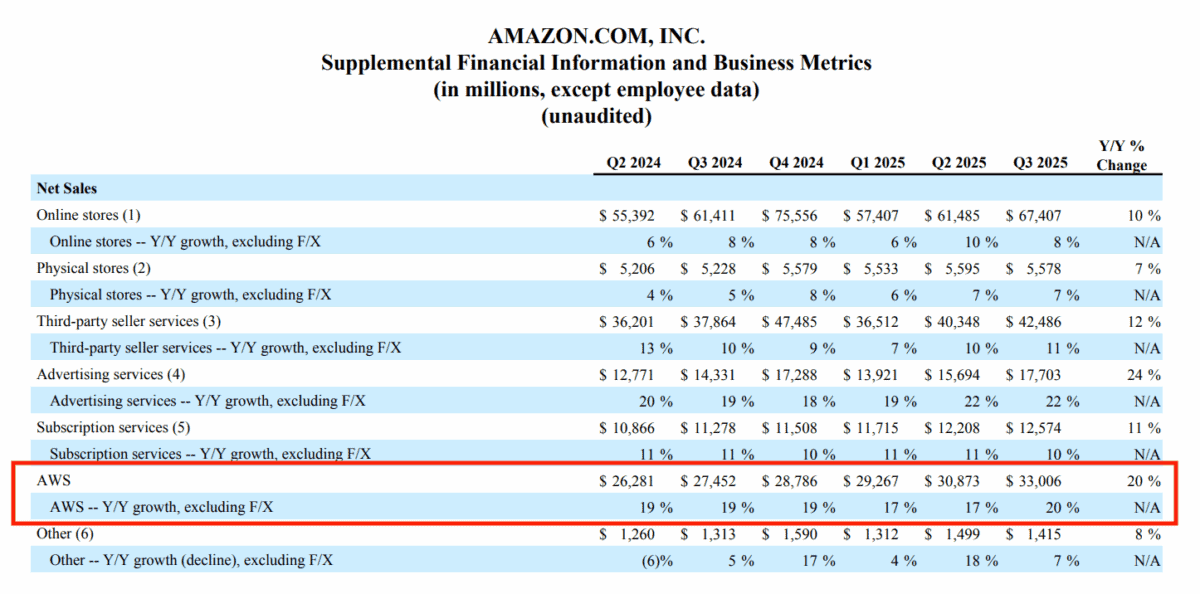

AWS â the firmâs cloud computing arm â is seeing an acceleration in revenue growth. And thereâs more for investors to be interested in on the artificial intelligence (AI) front.

AWS growth

Before the report, I thought AWS revenue growth would be around 17%. And I expected the market to take this badly with Microsoft (40%) and Alphabet (36%) posting higher numbers.

Itâs worth noting that AWS is around the size of the other two competitors combined. But its growth has clearly been slower than its rivals and the stock has struggled as a result.

Source: Amazon Q3 2025 Earnings Release

In fact, growth in the cloud business came in at 20% â its best result since 2022. Thatâs a sign of strong demand and Amazon boosted its capital expenditure forecast to $125bn from $118bn.

Thereâs a lot to like about AWS and its future growth prospects. But I think one of the most important developments might just be starting to take shape.

Trainium2

Amazonâs report included news of strong adoption of Trainium2, which is the companyâs custom AI chip. And this is something Iâm focusing on at the moment.

Over the medium term, I expect this to be a major source of growth. Trainium2 has better power efficiency than Nvidiaâs Blackwell GPUs, but this comes at the cost of flexibility.

Blackwellâs versatility is valuable in the short term, but I think this will change as applications develop. Once AI roles become more settled, I expect efficiency to become more important.

Importantly, Trainium2 is purpose-built for applications within AWS. So it also creates a significant switching cost for customers who use it in their AI developments.Â

Risks

Strong results in AWS donât mean the other challenges facing the business have gone away. And consumer weakness in the US and ongoing tariff concerns are both issues.

Amazon canât do much directly about either of these issues. But investors looking to assess the importance of the risks should note a couple of things.Â

The first is that the firmâs scale means itâs better-placed than its rivals to weather a downturn. So weak consumer spending might actually strengthen the companyâs long-term position.

The second is that Amazon has been looking to reduce the size of its workforce recently. And this should go some way towards offsetting the rising costs associated with tariffs.

Outlook

Amazon is one of the largest investments in my Stocks and Shares ISA. And I think the latest results are very positive for the company.

Seeing growth accelerating in the cloud computing business is an encouraging sign. And Iâm really interested in the adoption of Trainium2 chips as a source of long-term growth.

While AWS is â rightly â the current focus, Iâm also impressed at the 24% revenue growth generated by the advertising division. Thatâs something I think is also worth attention.

I had hoped the share price might fall after earnings, giving me a buying opportunity. But even though that hasnât happened, I still think the stock is worth considering.

The post Why the Amazon share price is surging after Q3 earnings appeared first on The Motley Fool UK.

Should you invest £1,000 in Amazon right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Amazon made the list?

More reading

- Is the Amazon share price a good indicator of what AI could mean for other stocks?

- After 5 years of underperforming the S&P 500, this stock could be about to surgeÂ

- 2 world-class stocks to consider buying for an ISA todayÂ

- 3 alternative AI watchlist ideas for a Stocks and Shares ISA

Stephen Wright has positions in Amazon. The Motley Fool UK has recommended Alphabet, Amazon, Microsoft, and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.