£5,000 buys 2,439 shares in this FTSE 250 passive income gem

Generating a passive income from buying UK shares is my favourite way of building wealth over time. But that does not mean I just slavishly look for stocks with the highest yields. This is particularly the case when looking in the lower-tier FTSE 250 index, which tends to exhibit more volatility than the FTSE 100.

Trading update

One company that has caught my attention recently is asset management giant Aberdeen (LSE: ABDN). The woes affecting the business have been well documented. However, I am becoming increasingly optimistic about its prospects after years in the doldrums.

Improving underlying fundamentals have seen the stock rise 70% since hitting an all-time low back in April.

Its Q3 update highlighted that outflows from its key Adviser business have continued to come down. Net outflows for the quarter halved to £500m. Total year-to-date outflows now stand at £1.4bn.

I put this improvement down to two factors. First, a comprehensive repricing across its fund portfolio. Second, significant investment in client experience, particularly improving service levels.

These are exactly the kind of initiatives that could entice more independent financial advisers (IFAs) to sign up to its platform. Today, it already serves around half of all IFAs in the UK, representing over 400,000 end customers.

Compounding gains

The stock may have bounced back strongly, but it still offers an inflation-busting dividend yield of 7.1%.

As the business continues to rebuild, its dividend per share is unlikely to rise before 2027. However, I can offset that by reinvesting my yearly dividends to buy more shares.

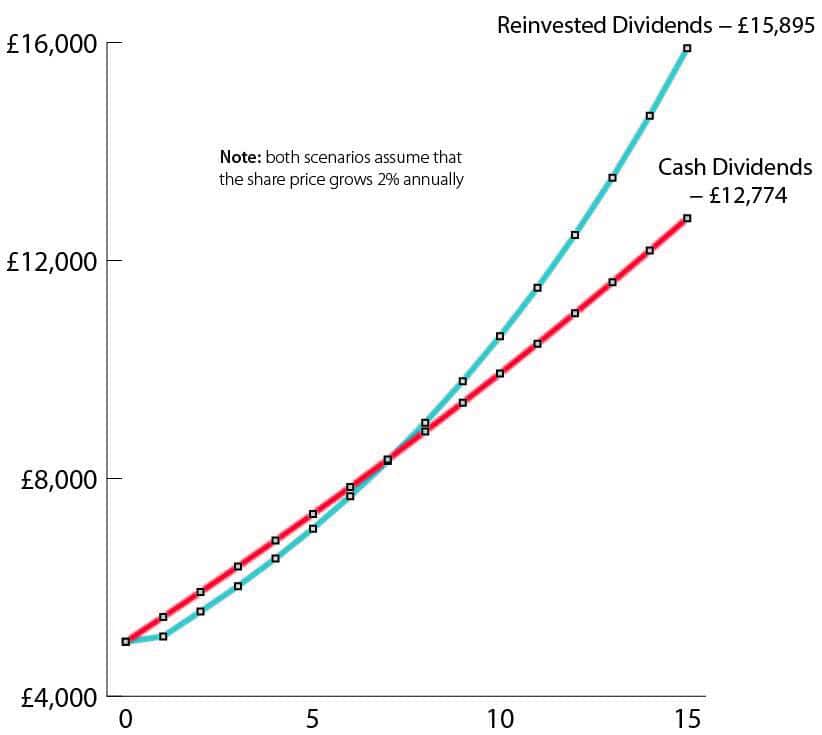

The following chart highlights the power of compounding in action. Each year, as I reinvest those dividends, I am effectively creating a self-fuelling income machine. Every new share I buy adds its own dividends to the mix â and those dividends, in turn, buy even more shares.

After around seven years, the results become dramatic. The curve steepens, and my portfolio growth really takes off. It is easy to see why Albert Einstein reportedly called compounding the âeighth wonder of the worldâ.

Risks

The asset management industry is evolving rapidly, driven by the rising popularity of low-cost tracker funds.

It is estimated that more than half of all global capital is now invested in instruments such as exchange-traded funds (ETFs). Their low fees and instant diversification have rewritten the rules of investing, while at the same time eroding the profit margins of traditional asset managers. This shift has been a key factor behind the long-term decline in active management strategies.

Aberdeen was slow to respond to this threat and has been playing catch-up ever since. While recent progress shows promise, the company remains exposed to continued fee compression and intense competition from passive products.

Bottom line

The runaway success of Aberdeenâs direct-to-consumer platform, interactive investor, highlights the untapped potential within the business.

I am not expecting an instant turnaround in its fortunes, but the chance to lock in a very attractive 7.1% dividend yield while waiting for longer-term share price recovery is a major plus in my view.

That is why Iâve recently added the shares to my portfolio â for the combination of high income today and the potential for future growth.

The post £5,000 buys 2,439 shares in this FTSE 250 passive income gem appeared first on The Motley Fool UK.

Should you invest £1,000 in aberdeen group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if aberdeen group made the list?

More reading

- £5,000 in this FTSE 250 stock could more than triple â hereâs how

- 2 dividend stocks on the FTSE 250 with twice the yield of the index average!

- 1 key reason why the Aberdeen share price could rally in the coming year

Andrew Mackie has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.