£5,000 invested in BAE shares 6 years ago is now worth…

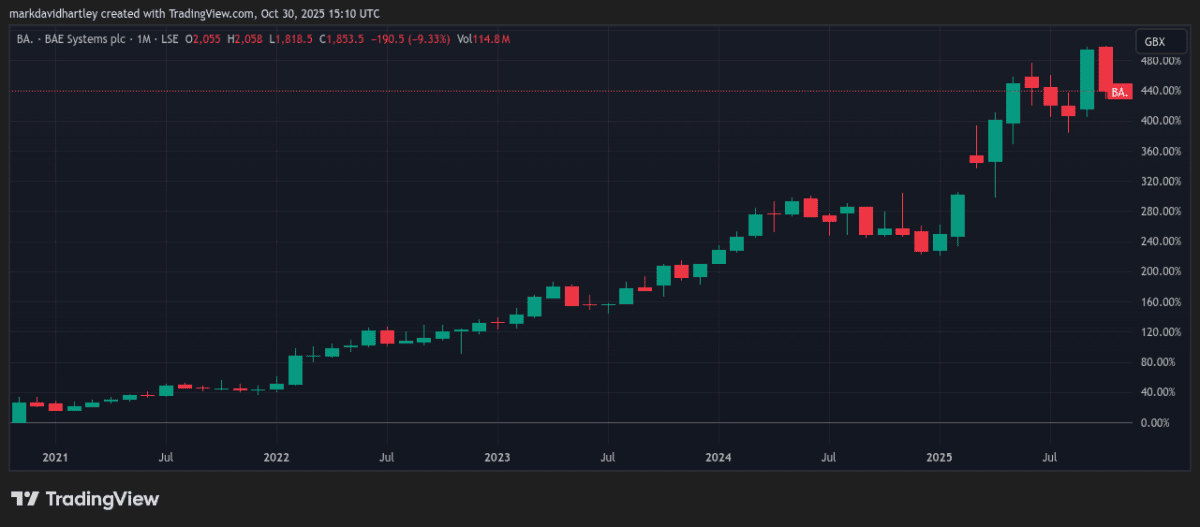

BAE (LSE:BA) shares have rocketed an incredible 440% since November 2020, making the defence giant one of the FTSE 100âs most remarkable recovery stories. After the pandemic struck, the stock sank to just 341p in late October 2020, as global markets panicked and investors fled anything cyclical.

Fast forward six years, and the shares now trade above 1,800p â near all-time highs.

An investor bold enough to put £5,000 into BAE shares at their low point would be sitting on roughly £27,000 today, including dividends. Thatâs the kind of long-term performance many dream of.

But the question now is whether the gains are all gone, or does the stock still deserve a place on an investorâs radar? Letâs take a closer look.

Record-breaking contracts

BAE’s been a clear beneficiary of rising defence budgets across Europe following the war in Ukraine. The company recently confirmed record order books and has raised its full-year guidance twice, citing strong demand for combat systems, submarines and munitions.

Just weeks ago, the group secured a £4.6bn UK-brokered contract to deliver 20 Eurofighter Typhoon jets to Türkiye. Thatâs one of the biggest export deals for British aerospace in years, supporting thousands of domestic jobs and ensuring steady cash inflows for years to come.

Meanwhile, Norway’s chosen BAEâs Type 26 frigate design for its next-generation naval fleet â another significant export and production win. Itâs the same platform adopted by the UK, Australia and Canada, helping BAE establish itself as a cornerstone of allied naval capability.

For investors, these contracts suggest long-term visibility of earnings, and I think thatâs something worth weighing up when assessing the companyâs valuation today.

A reputational risk

However, itâs not all plain sailing. The company recently faced an uncomfortable story in the press after ending support for its Advanced Turbo-Prop (ATP) aircraft, which has grounded planes used to deliver food aid across Africa. Kenyan operator EnComm claims BAE misled it over the aircraftâs future and is now pursuing legal action.

While the dispute may not have material financial consequences, the reputational damage could prove more significant. For a company increasingly judged on its environmental, social and governance (ESG) standards, this kind of controversy adds a risk factor investors should think about carefully.

Solid financial footing

Financially, BAE remains in excellent health. The group generates strong cash flow from long-term government contracts and has continued to raise its dividend, currently yielding around 2.6%. Guidance has been upgraded twice this year thanks to resilient demand for its electronic systems and submarine programmes.

In an unpredictable global economy, I think itâs still a company with a promising future â one with reliable earnings, solid growth prospects and a shareholder-friendly dividend policy.

Final thoughts

Thereâs little doubt that BAE has strong commercial momentum, but reputational and legal risks mean investors should weigh up how sustainable this growth truly is. As scrutiny intensifies over the human consequences of defence contracts, the companyâs toughest battles may not be fought in the skies â but in the court of public opinion.

Still, demand for its expertise is only rising, so in my view, it remains one of the FTSE 100âs top defensive stocks to consider for long-term growth and income.

The post £5,000 invested in BAE shares 6 years ago is now worth… appeared first on The Motley Fool UK.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

More reading

- What on earth’s going on with the BAE share price?

- Check out the Rolls-Royce, Babcock, and BAE Systems share price forecasts â I can see 1 clear winner

- Prediction: here’s when this Fool thinks the BAE Systems share price will reach £30

- Seeking a passive income? 3 low-risk dividend shares to consider

- Rolls-Royce, Babcock and BAE Systems share prices are all falling today! Time to consider buying?

Mark Hartley has positions in BAE Systems. The Motley Fool UK has recommended BAE Systems. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.