After falling 30% this year, should I consider putting beaten-down Diageo shares in my ISA?

I have a bit of spare cash in my Stocks and Shares ISA at the moment. But inflation’s constantly eroding its value so Iâd rather it be deployed in the stock market.

To identify potential candidates, one option I like to pursue is to look at well-known names that have seen their share prices fall significantly over a relatively short period of time.

Of course, this could be a sign of a fundamental problem. But sometimes, itâs an indication of a short-term issue thatâs likely to be overcome, although often not immediately.

If all goes to plan, in a few yearsâ time, it might be possible to look back and pat myself on the back for picking up a bit of a bargain. However, I think itâs important to be patient. A recovery can take time and is rarely smooth.

A fallen giant

The Diageo (LSE:DGE) share price has fallen 31% since the start of 2025. The stockâs now (31 October) changing hands for around 56% less than when it reached its post-pandemic high in December 2021.

However, the group remains a titan of the drinks industry. It owns over 200 brands â the most famous probably being Guinness — covering all tastes and price points in the market. It was one of the few companies that did well during the pandemic.

But over the past four years, the groupâs seen a decline in its sales volumes. It says this reflects a trend towards drinking better not more. In other words, people are trading up and buying more expensive brands. For example, from 2014-2024, the share of the spirits market accounted for by premium labels increased from 26% to 35%.

Yet I would have expected this to be reflected in an improvement in the groupâs gross profit margin. Instead, this appears to be relatively flat and has been in a narrow range of 43.4%-43.7% during its past four financial years.

| Financial year | Reported volume (million equivalent units) | Gross profit margin (%) |

|---|---|---|

| 2022 | 263.0 | 43.7 |

| 2023 | 243.4 | 43.4 |

| 2024 | 230.5 | 43.7 |

| 2025 | 230.1 | 43.5 |

Not all bad

Despite the groupâs woes, Guinness continues to be a success story. Thanks to some high-profile âGuinnfluencersâ creating plenty of social media interest, itâs been estimated that the brandâs now worth nearly 20% of the groupâs total market-cap. And as evidence of changing tastes, the alcohol-free version is doing particularly well. Ocado now sells more 0.0 than it does of the original.

One benefit from the falling share price is that those who invest now could achieve a 4.5% yield compared to the average for the FTSE 100 of 3.3%. This is based on amounts paid over the past 12 months. Of course, there can never be any guarantees when it comes to dividends.

My verdict

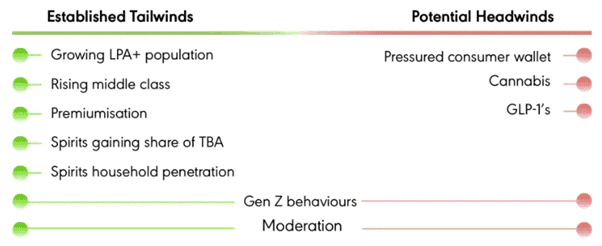

On balance, the stockâs not for me. Although Diageo has some impressive brand names in its stable, due to changing tastes and attitudes, I think thereâs some uncertainty over the long-term prospects for the drinks industry.

For health and financial reasons, GenZ-ers are drinking less than their parents. And increasingly cash-strapped governments around the world are likely to consider the sector an easy target for additional duties and taxes.

Although I think the group has lots going for it, until I see evidence of a turnaround, Iâm not going to invest.

The post After falling 30% this year, should I consider putting beaten-down Diageo shares in my ISA? appeared first on The Motley Fool UK.

Should you invest £1,000 in Diageo plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo plc made the list?

More reading

- Down 29%, are Diageo shares â and their 4.4% dividend yield â worth the risk?

- Can anything save the Diageo share price?

- Down 50% to a 10-year low, the Diageo share price is driving me to drink!

- Thank goodness I didn’t buy £5,000 of Diageo shares 4 years ago!

- How much could 1,216 Diageo shares earn me in annual dividends?

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Diageo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.