Gold vs UK shares: which asset class will make me more money in 2026?

UK shares have done really well in 2025. Year to date, the FTSE 100 index is up about 18%. However, goldâs done even better. Currently, the precious metalâs showing a gain of around 50% for the year to date.

The question is: which asset class will make me more money in 2026?

Could gold hit $5,000?

Goldâs in a strong uptrend right now. This is being fuelled by a range of factors including huge government deficits, economic uncertainty, geopolitical uncertainty, a lack of faith in the US dollar, and concerns that US Federal Reserve independence could be compromised.

Many experts expect the trend to stay in place in 2026. For example, Metals Focus, a UK-based precious metals consultancy, recently predicted that gold will challenge the $5,000 per ounce level in 2026.

Other firms that have mentioned $5,000 as a price target for 2026 include Goldman Sachs and JP Morgan. If it was to hit that level, it would represent a gain of about 25% from here.

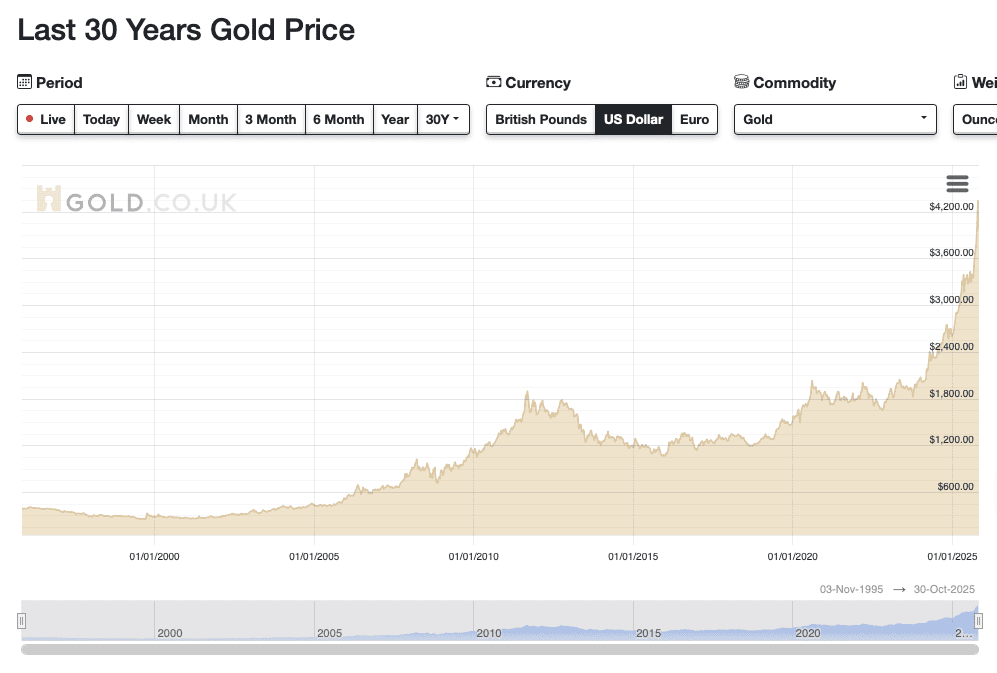

The thing is, while I totally understand why goldâs seeing high demand right now, the commodity has run hard recently. Looking at a 30-year chart, the price has gone a little ‘parabolic’ recently.

History shows that these kinds of price movements are unsustainable. So I actually wouldnât be surprised if gold delivered disappointing returns in 2026.

Of course, with gold, there are no earnings or income, so itâs impossible to value it accurately. So no one really knows how much it’s worth.

UK shares with strong potential

Turning to UK shares, major indexes here have also run pretty hard recently. As I said above, the FTSE 100âs up 18% this year. Thatâs a big gain. The average return for this index over the last 20 calendar years is about 6.3%.

Itâs worth noting that a lot of larger constituents in this index have had a really strong year. For example, HSBCâs gained nearly 40% while Rolls-Royce is up nearly 100%.

I donât expect to see these kinds of gains again next year. So returns from the index could be underwhelming.

That said, there are a lot of individual UK shares that appear to have a ton of potential. An example here is London Stock Exchange Group (LSE: LSEG), which is Now one of the worldâs leading financial data providers.

Itâs underperformed the market this year and currently trades for about £94. However, the average analyst 12-month price target is £124 â roughly 32% higher.

Of course, broker price targets are just forecasts. Often, they donât come to fruition.

However, in this stockâs case, I see a lot of potential share price drivers including:

- The launch of new AI products (developed with Microsoft)

- The realisation by investors that AI isnât killing its business

- A large share buyback

- A refocus on âqualityâ in the stock market

- A valuation re-rating (it currently trades on a low price-to-earnings ratio of 21)

Now, the stock isnât bullet-proof. There are risks around customer spending, competition from rivals, and sentiment towards tech shares.

Iâm backing it to make me more money than gold in 2026 however, and I think itâs worth a look. Currently, itâs my largest UK stock holding.

The post Gold vs UK shares: which asset class will make me more money in 2026? appeared first on The Motley Fool UK.

Should you invest £1,000 in London Stock Exchange Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if London Stock Exchange Group Plc made the list?

More reading

- 1 FTSE 100 share I predict will outperform the S&P 500 over the next 5 years

- 2 FTSE 100 stocks down 19% and 61% to consider in NovemberÂ

- This blue-chip FTSE 100 stockâs soaring and now could be the last chance to snap it up below £100

- My favourite FTSE 100 growth stock has jumped 15% in a week! Should I buy more?

- How much do you need in a SIPP to aim for a £43,900 pension income?

Edward Sheldon has positions in London Stock Exchange Group. The Motley Fool UK has recommended HSBC Holdings, Microsoft, and Rolls-Royce Plc. HSBC Holdings is an advertising partner of Motley Fool Money. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.