What can investors expect from the BT dividend yield ahead of this week’s results?

With BT Group (LSE: BT.) set to announce its half-year results tomorrow (5 November), investors will be keen to hear about any dividend guidance.

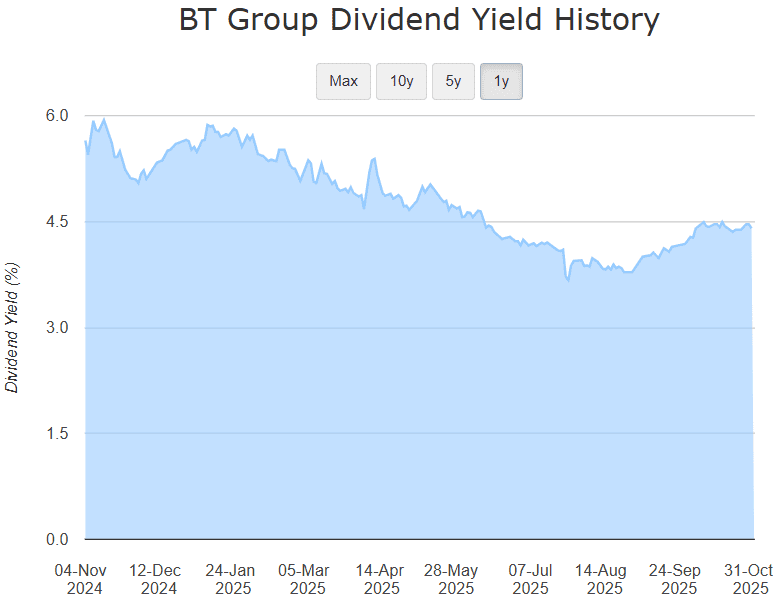

It currently has a dividend yield of around 4.4% â down significantly from roughly 6% in November last year. The reduction comes as the group raised its dividend by 3.9% in 2024, and by only 2% in the latest year. Meanwhile, a roughly 30% share-price increase over the past 12 months has worked to drag the yield lower.

So the big question is: will the yield continue falling, or could this weekâs results signal larger dividend rises in 2026?

Letâs see what the analysts are saying.

Moderate growth potential

Forecasts point to moderate dividend increases rather than anything spectacular. For example, dividend-per-share expectations rise from about 8.16p to 8.33p in 2026, and the view is that the yield might climb to around 4.8% over the coming years.

That implies a modest increase â perhaps enough to attract income-oriented investors, but unlikely to generate much excitement.

Of course, history has taught us that such forecasts rely on many assumptions and are seldom spot-on. If the share price fell sharply, the yield could jump higher (as it did in 2022). Conversely, if the share price continues climbing, the yield could slip back below 4%.

That said, BT has a credible track record of raising dividends. After the 2008 financial crisis the company delivered annual increases of 6% to 14% for several years. The pandemic interrupted this momentum, but the dividend now seems steered towards returning to pre-2019 highs (around 15.4p per share).

If the group opts for aggressive hikes once the heavy investment phase ends, the dividend could potentially double by 2030 and bring the yield nearer to 8%.

Mitigating factors

However, investors should weigh up important mitigating factors. The economic environment is very different today: lingering effects of the pandemic have given way to concerns such as geopolitical conflict and trade tariffs.

BT is also in the middle of a major network upgrade, which is draining profits and putting pressure on debt (net debt remains around £20bn). These burdens limit the pace at which the dividend might rise, at least in the near term.

On the bright side, two metrics give cause for mild optimism. First, the companyâs cash-dividend coverage looks strong and the current valuation still seems modest in certain respects. Its price-to-earnings growth (PEG) ratio is cited at 0.68 and price-to-sales (P/S) about 0.91.

If investor confidence and equity levels improve, debt pressures could ease and support more meaningful dividend rises.

Final thoughts

BTâs financials and valuation appear to support the case for further dividend increases. Even if large rises donât materialise imminently, the current dividend yield makes the stock worth considering as part of an income-oriented portfolio.

That said, the proof of the pudding is in the eating: if this weekâs results fail to impress, the share price could take a hit. The yield may rise briefly as a result but that’s not ideal for existing shareholders.

I suspect that until BT sees the fruits of its digital network upgrade, dividend increases will remain moderate. In short, the dividend yield is solid and the outlook is steady, but thereâs little indication yet of a dramatic leap ahead.

The post What can investors expect from the BT dividend yield ahead of this weekâs results? appeared first on The Motley Fool UK.

Should you invest £1,000 in BT Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT Group made the list?

More reading

- If I invest £10,000 in BT shares, how much passive income can I earn?

- The BT share price would have turned £5,000 into this much in 5 yearsâ¦

- Down 16% since July! Should I buy BT for my Stocks and Shares ISA?

- The BT share price slides 5% on broker downgrades! Is the 4.5% yield still worth it?

- The BT share price tanked 15% but analysts say it can rebound to £â¦

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.