Michael Burry shorting AI stocks with 80% of his portfolio might not be what it seems…

Michael Burryâs latest 13F reveals short positions in Nvidia and Palantir (NASDAQ:PLTR). Together, these seem to make up almost 80% of Scion Asset Managementâs portfolio.

Investors, however, need to be careful with interpreting this. My guess â and it is a guess â is that this isnât the all-in bet against artificial intelligence (AI) stocks it looks like.

Put options

The two largest positions in Scionâs quarterly filing are put options. These give the holder the right to sell a stock at a certain strike price before a specified expiry date.

Puts on Nvidia (66%) and Palantir (13%) make up almost 80% of the firm’s reported portfolio. So it certainly looks like a big bet against some AI names.Â

The associated risk would be huge â if the stocks don’t fall and the options expire worthless, almost 80% of Burryâs portfolio could go up in smoke. But thatâs not necessarily the situation.

Options traders often structure their positions to limit their exposure in ways that donât always show up on 13F filings. And with a sophisticated investor like Burry, this could well be the case.

Bearish structures

One way of betting against a stock using put options involves simultaneously buying contracts at one strike and selling ones at a lower one. The result is a short position, but with a twist.Â

In this case, the trader gets part of their spend back from the options they sell. And if the stock goes down, the puts they own â with the higher strike â go up faster than the ones they sold.

The thing is, if a firm sells options, this doesn’t show up on its 13F. So if Scion sold puts on Nvidia and Palantir alongside its buys, this wouldnât be in the latest filing.

This means that â for all the 13F shows â Burryâs net short exposure to AI stocks might well be much lower than it looks. So investors need to be careful about reading too much into this.Â

Palantir

Burryâs position has got some investors worrying about valuations. And at a price-to-earnings (P/E) ratio of somewhere around 630, Palantir looks like one of the most ambitious right now.

Thatâs been the case for a while, though, and it hasnât stopped the stock from storming higher. And while the firm is still growing rapidly, something in its recent earnings caught my eye.

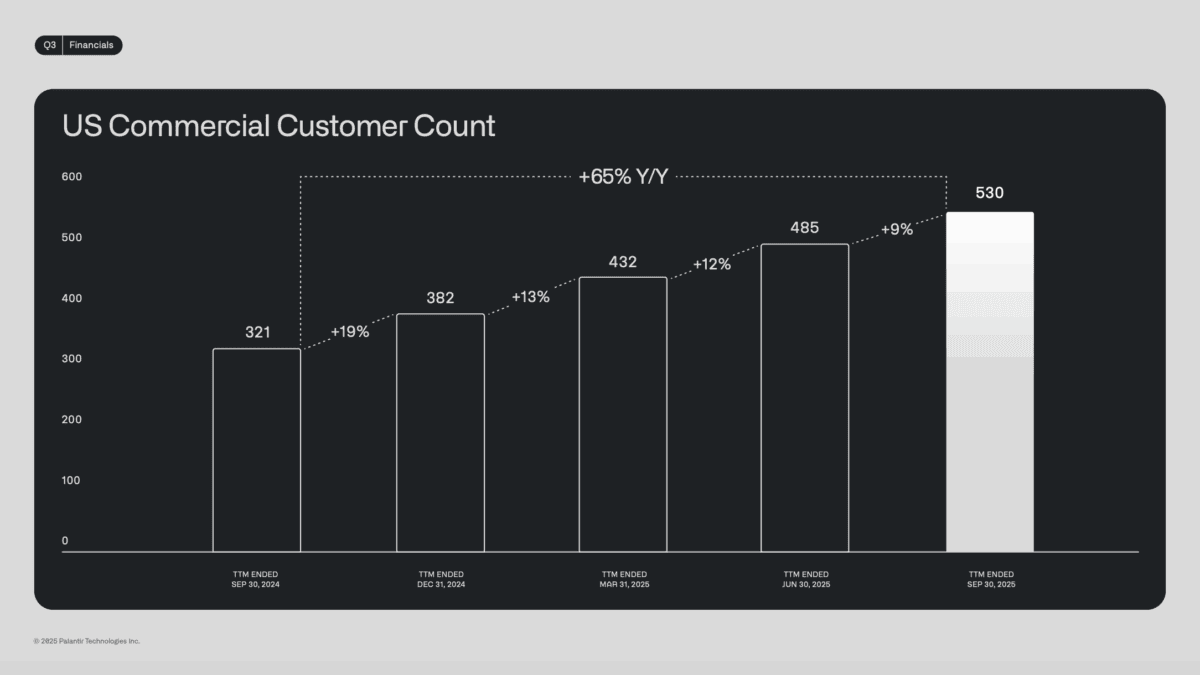

Signing up US commercial customers has driven the companyâs explosive growth. But the rate at which new customers have been coming on board over the last few quarters has slowed.

Source: Palantir Q3 2025 Investor Presentation

At a big multiple, even small disruptions can be significant. And this is something investors who own â or are thinking of owning â Palantir stock need to keep in mind.Â

AI stocks

Michael Burry is almost certainly betting against AI stocks. But given how risky staking 80% of Scion’s assets on two options would be, I think there’s a strong chance the 13F doesn’t tell the full story.

Investors should never just copy what someone else is doing. And itâs exceptionally unwise in this situation, where the public information might be crucially incomplete.

I’m wary of AI disruption in the software industry, though Palantir is one of the few I have a positive view of. But even for me, it’s a bit expensive at today’s prices.

The post Michael Burry shorting AI stocks with 80% of his portfolio might not be what it seems… appeared first on The Motley Fool UK.

Should you invest £1,000 in Palantir Technologies right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Palantir Technologies made the list?

More reading

- Whatâs going on with the Palantir share price?

- Michael Burry just made a big bet against Palantir stock! Time to buy?

- Could the stock market crash in the next 11 days?

- £20,000 invested in Palantir stock 1 year ago is now worthâ¦

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.