These FTSE 100 stocks have just tanked. Are they now too cheap to ignore?

The past seven days (at 13 November) have seen some large swings in the share prices of a number of FTSE 100 stocks.

For example, the continuing surge in the gold price has helped push Endeavour Mining and Fresnillo higher. And investors were seemingly impressed with SSEâs plans to spend £33bn on additional renewable energy infrastructure, even though shareholders are being asked to contribute £2bn towards the final bill.

But itâs movements in the opposite direction that interest me the most. Thatâs because a sharp fall could present an opportunity to take a position in a quality stock at a knockdown price.

| Stock | Share price change (%) |

|---|---|

| SSE | +18.0 |

| Endeavour Mining | +11.2 |

| Fresnillo | +10.0 |

| Auto Trader Group | -16.0 |

| Rightmove | -16.3 |

| 3i Group | -23.0 |

A confused picture

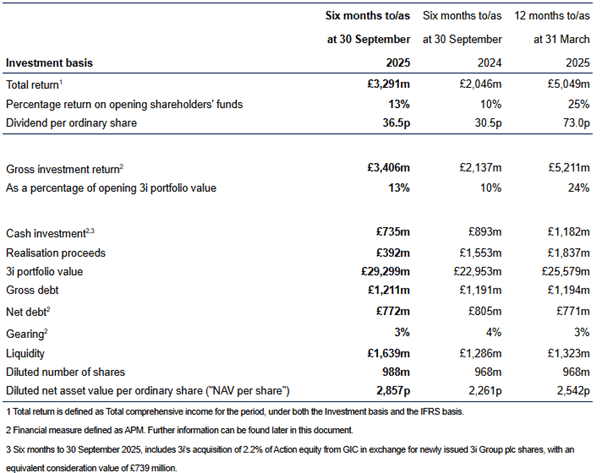

Yesterday (13 November), the share price of 3i Group (LSE:III) fell 18% after the investment company published its results for the six months ended 30 September.

At first glance, the reaction of investors was a bit of a puzzle. The group reported an impressive 13% return on opening shareholder funds, increased its interim dividend by approximately 20%, and reduced its net debt.

So what caused such a large fall in the groupâs market cap? I suspect investors took fright at comments made by 3i’s chief executive. He said: âWe remain cautious in the deployment of capital into new investment, but will continue to allocate selectively, including to lower-risk reinvestments in businesses we know and trust.â

This implies that less will be invested, which could reduce future earnings growth. And, in theory, less risky investments are likely to generate a lower rate of return.

Indeed, even after yesterday’s market reaction, I have my concerns about the valuation of the group. At 30 September, it had a net asset value of £28.57 a share. Now, the groupâs share price is around £33. Many of 3i’s investments are in unquoted investments, which can be difficult to accurately value, so itâs impossible to know for sure what the groupâs worth.

And its dividend isnât generous enough to tempt me to take a position. Even after the share price fall, the stockâs yield (2.1%) is below the FTSE 100’s average of 3.3%.

Same again

Rightmoveâs shareholders have also had a bad week.

On 7 November, the property websiteâs share price tanked 12.5% after the group announced plans to spend £300m on artificial intelligence (AI). The investment is intended to drive âefficiency, speed and valueâ.

The group already has an 80% share of time spent on the UK’s property portals, which makes me question how it’s going to grow significantly, even with the investment in AI. Having said that, wiping £1bn off its market cap seems like an over-reaction to me.

But to make matters worse, the companyâs confirmed that itâs now received a legal claim. Newspaper reports suggest that estate agents are seeking £1bn in damages for alleged excessive fees. Rightmove hasn’t given any figures but says: âWe’re confident in the value we provide to our partners.â

Although the stock’s now trading on a reasonable 19 times expected 2025 earnings, taking a position would be too risky for me right now.

Even though I remain skeptical about both 3i Group and Rightmove, I still believe there are plenty of other FTSE 100 stocks worth considering. And I shall continue looking at the largest fallers each day in the hope of picking up a bargain.

The post These FTSE 100 stocks have just tanked. Are they now too cheap to ignore? appeared first on The Motley Fool UK.

Should you invest £1,000 in 3i Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if 3i Group plc made the list?

More reading

- 3i Group shares plunge 15% on todayâs results â is this the ultimate FTSE 100 buying opportunity?

- ChatGPT and Gemini warn AI is a 7/10 threat to this FTSE 100 stock

- No savings at 43? Buying FTSE shares could be the key to building life-changing retirement wealth!

- Should investors consider buying last weekâs FTSE 100 losers IAG, Rightmove, and Smith & Nephew?

- Down 12.5% in a day! Is this FTSE 100 stock a brilliant bargain or an accident waiting to happen?

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Auto Trader Group Plc, Fresnillo Plc, and Rightmove Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.