Up 53% in 2 years, has this FTSE 100 stock finally got its mojo back?

It has been a weird few years for FTSE 100 stock Scottish Mortgage Investment Trust (LSE:SMT). After surging for years, it crashed by 59% in just 18 months between late 2021 and mid-2023. And the share price today still remains 30% beneath its Covid-era peak.

Yet there are signs things are back on track, with a 53% jump in Scottish Mortgage stock in the past two years. And looking at the interim results released on 7 November, I think shareholders like myself can feel optimistic that the next few years will be better than the last five.

A very strong period of performance

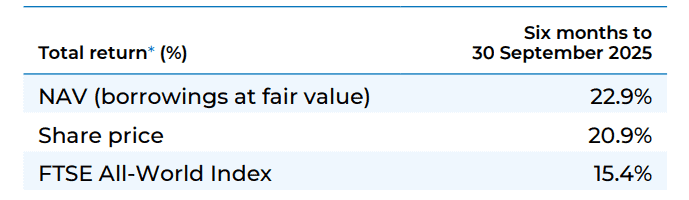

In the six months to 30 September, the growth-focused investment trust outperformed the FTSE All-World Index. Its net asset value (NAV) per share increased 22.9%, beating the indexâs 15.4% gain.

Meanwhile, the trust bought back 75.2m of its own shares in this period, at a total cost of £765.4m. That was part of a whopping £2.6bn repurchasing programme in place since March 2024, which has helped narrow the gap between the share price and the NAV per share.

The growth-oriented portfolio doesn’t generate much income. But having increased its annual dividend for 43 straight years, Scottish Mortgage is classed as a ‘Dividend Hero’. It left the interim dividend unchanged at 1.6p per share. Â

Gearing reduced from 13% in March to 11%.

Gainers and detractors

The key holdings that drove performance were Roblox (+128.1%), Taiwan Semiconductor, or TSMC (+50.9%), Nvidia (+65.1%), MercadoLibre (+14.9%), and Cloudflare (+82.9%). Happily, these five shares have been driving my portfolio higher too this year.

Top detractors included Chinese stocks like food delivery giant Meituan (-35.7%), EV maker BYD (-18.6%), and unlisted financial services firm Ant International (-23.7%). Meituan stock has collapsed due to China’s escalating delivery price wars.

Scottish Mortgage is more bullish on food delivery apps than I am. By my count, it’s invested in five today.

A mistimed sale

The report mentions AI quite a bit, so it’s worth mentioning that the trust sold out of Palantir a few years back. I cannot find any explanation for this disposal, but in hindsight, it was a poor decision. Palantir stock is up around 2,200% since ChatGPT’s launch!

For a trust that prides itself on finding big winners, to sell very early what’s turning into an era-defining AI software company is disappointing for shareholders.

Perhaps I’m unfairly nit-picking here, though. As Wall Street legend Peter Lynch once said, to be right six times out of 10 when picking stocks is doing well.

Scottish Mortgage’s NAV return was nearly 500% in the 10 years to 30 September. Clearly it’s doing something right.

Getting stronger

As always, a big sell-off in US tech stocks is a risk to performance moving forward. As I write, the Nasdaq Composite is on the slide, so this is worth monitoring.

Taking a long-term view though (five-to-10 years), I expect Scottish Mortgage to outperform. With the shares trading at an 11% discount, I think they’re worth checking out as a diversified way to play the AI/tech revolution.

Large holdings like SpaceX (the largest position), Amazon, TSMC, BYD, Nvidia, Shopify, and Stripe are only getting stronger. Interestingly, Elon Musk has recently been talking up a possible SpaceX IPO, which could unlock big gains for long-term backer Scottish Mortgage.

The post Up 53% in 2 years, has this FTSE 100 stock finally got its mojo back? appeared first on The Motley Fool UK.

Should you invest £1,000 in Scottish Mortgage Investment Trust PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage Investment Trust PLC made the list?

More reading

- This FTSE 100 fund holds half of the world’s 10 most valuable ‘unicorns’

- How much do you need in a SIPP to aim for a £37,430 pension income?

- Retirement savings: 3 investments that have helped double the value of my SIPP in 2 years

- Amazon stockâs huge 12% jump is excellent news for these FTSE 100 shares

- Compared: £3 a day vs £30 a day passive income plan!

Ben McPoland has positions in Cloudflare, MercadoLibre, Nvidia, Roblox, Scottish Mortgage Investment Trust Plc, Shopify, and Taiwan Semiconductor Manufacturing. The Motley Fool UK has recommended Amazon, Cloudflare, MercadoLibre, Nvidia, Roblox, Shopify, and Taiwan Semiconductor Manufacturing. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.