1 top-tier ETF to consider on the London Stock Exchange

The London Stock Exchange is home to many world-class companies, including AstraZeneca and HSBC. But it’s also packed with hundreds of exchange-traded funds (ETFs) and investment trusts that give investors exposure to powerful global trends.

For example, there’s the global aerospace and defence sector. This is expected to experience significant growth over the next decade as military spending is ramped up, particularly in Europe in response to Russia’s threat.

Top-notch ETF

Of course, a more dangerous world isn’t what any of us want for our children. But at least UK investors do have a number of options to take part in this expected defence growth. One is through the iShares Global Aerospace & Defence ETF (LSE:DFND).

As of November, this exchange-traded fund (ETF) holds 79 different stocks, including manufacturers of aerospace and defence equipment (so both civil and military), and parts suppliers to the space sector.

This means it’s diversified across different areas, not just defence stocks like BAE Systems, RTX, Northrop Grumman, and Lockheed Martin. So we see names like Rolls-Royce (which makes engines for passenger as well as military jets) and plane-makers Boeing and Airbus.

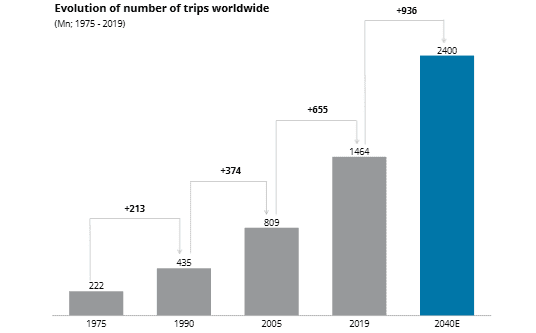

According to Deloitte, the number of outbound trips worldwide will continue to increase, reaching 2.4bn per year by 2040. This will be driven by rising middle classes across Asia Pacific, the Middle East, and Africa.

Investors in this ETF get strong exposure to the rise of global travel through the likes of Rolls-Royce and Airbus.

Interesting growth holdings

Elsewhere in the portfolio, Axon Enterprise is a 2% position. This company provides Tasers, body-worn cameras, and digital evidence platforms to law enforcement, military police, and national security clients. It also has a fast-growing drone software business.

Another exciting stock held by this ETF is Rocket Lab, which makes up around 1% of the portfolio. A fast-growing rocket and space components manufacturer, it could become a challenger to SpaceX if its Neutron rocket passes safety tests in 2026.

Smaller UK holdings include Babcock International and Melrose Industries from the FTSE 100, and the FTSE 250‘s Chemring and QinetiQ.

Flying electric taxi start-up Archer Aviation, which is also making aircraft for the US military, is another interesting holding.

Climate considerations

Naturally, there are risks associated with this ETF. One is that though EU leaders plan to mobilise â¬800bn in defence spending over the next few years, this extra manufacturing could threaten climate targets.

Therefore, some European nations not keen on coughing up extra funds for arms could use this to derail the spending plans. And that could sour investor appetite for European defence stocks, hurting this ETF’s performance.

Solid mix

Despite this risk, I remain bullish on the ETF’s prospects over the longer term. There’s a solid mix of companies in there, from makers of engines and planes to arms contractors and space rocket companies.

The ETF was only launched in early 2024, but performance has been excellent. It’s up around 80% since inception.

The cherry on top is a low total expense cost of 0.35%. For investors searching for a thematic ETF, this one could be worth digging into.

The post 1 top-tier ETF to consider on the London Stock Exchange appeared first on The Motley Fool UK.

Should you invest £1,000 in Ishares V Public – Ishares Global Aerospace & Defence Ucits Etf right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ishares V Public – Ishares Global Aerospace & Defence Ucits Etf made the list?

More reading

- With a 6.3% yield, here’s 1 cheap stock I bought to boost my passive income

- I asked ChatGPT to pick the 2 best stocks to buy now, and it saidâ¦

- This FTSE 100 stock pays a 7.34% dividend yield!

- 30% of my SIPP is invested in 1 magnificent UK stock!

- Can my favourite UK stock soar 47% in my ISA by 2026? This top broker thinks so

Ben McPoland has positions in Axon Enterprise, BAE Systems, and Rolls-Royce Plc. The Motley Fool UK has recommended Axon Enterprise, BAE Systems, Chemring Group Plc, Lockheed Martin, Melrose Industries Plc, QinetiQ Group Plc, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.