Could these dirt-cheap FTSE 250 shares enjoy a December rebound?

The FTSE 250 remains packed with brilliant discounts as we move into the festive season. The stock market volatility we’ve experienced in recent weeks has seen even more top companies move into bargain basement territory.

Take the following FTSE 250 shares: QinetiQ (LSE:QQ.), Softcat (LSE:SCT), and TBC Bank (LSE:TBCG). Each now trades on a rock-bottom earnings multiple following heavy price falls.

Could they rebound in December?

Defence bargain

UK defence shares like QinetiQ have fallen sharply in recent days. The prospect of peace in Ukraine would be welcome after years of bloodshed. But it could have significant impact on defense sector profits if sales slump afterwards.

News of a ceasefire could cause defence contractors to fall further. However, the chances of a peace deal being struck — or holding out after any ceasefire — remain uncertain. The failure of a US-brokered deal could have the opposite effect and prompt shares to rally.

The low valuation on QinetQ shares in particular may help it to rebound in this event. A 16% share price drop over the last month leaves it on a forward price-to-earnings (P/E) ratio of just 13.7 times. This is one of the lowest multiples across the European defence sector.

QinetiQ’s share price also commands a P/E-to-growth (PEG) ratio of 0.8. A reading below 1 implies a share is going mega cheap.

Tech star

Fears of an AI bubble have spread across the broader tech sector in recent weeks. Information technology provider Softcat has sunk 13% as investors have reduced or closed out positions.

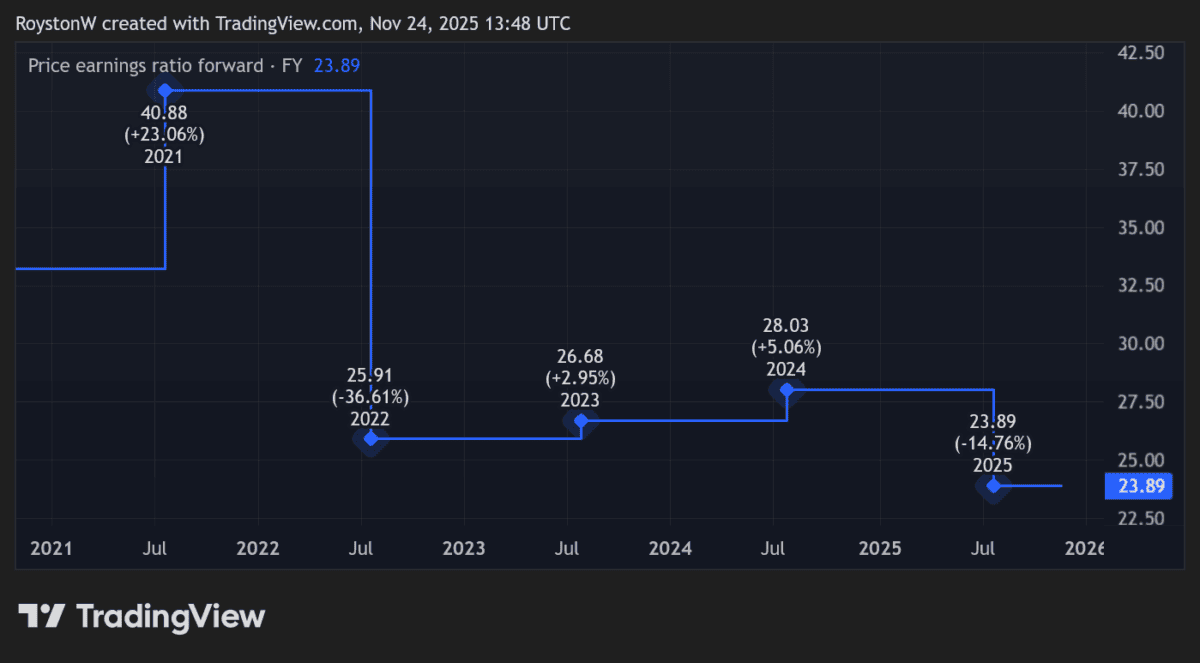

It’s a decline I think merits serious attention from bargain hunters. The business trades on a forward P/E ratio of 19.7 times.

As the chart shows, this is historically a rock-bottom rating for Softcat shares.

My view is that worries over the AI sector have been overblown, as Nvidia‘s blowout results last week showed. I’m backing Softcat to rebound when market sentiment stabilises.

Over the long-term, I’m confident the company could surge in value as increasing digitalisation drives sales. That’s despite the threat of rising costs and competition from US tech shares. Softcat’s share price has rocketed 410% since November 2020.

Bargain bank

TBC Bank has long been one of the most eye-catching FTSE 250 value shares. Having declined 10% over the last month, it’s now a bargain I think merits serious attention from investors.

Its forward P/E ratio is 5.4 times. That makes it the cheapest UK-listed bank share, well behind the likes of Lloyds (11.9 times) and HSBC (9.8 times), for instance.

Furthermore, a 6.6% dividend yield for this year is one of the sector’s highest.

The bank’s shares have dropped after it said full-year profits will undershoot prior forecasts. Current problems include regulatory changes that have introduced a cap on microloans, a key market for the company.

Yet I think the market has overreacted to the news. Trading remains strong, as Georgia’s booming economy drives financial services demand. And the business is accelerating its shift from microloans to areas like SME lending to overcome its recent travails.

I think TBC could spring back as investors wake up to its exceptional all-round value

The post Could these dirt-cheap FTSE 250 shares enjoy a December rebound? appeared first on The Motley Fool UK.

Should you invest £1,000 in QinetiQ Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if QinetiQ Group Plc made the list?

More reading

- Prediction: these FTSE 250 growth stocks are set to explode

- 3 ways the Autumn Budget could impact FTSE stocks

HSBC Holdings is an advertising partner of Motley Fool Money. Royston Wild has positions in HSBC Holdings. The Motley Fool UK has recommended HSBC Holdings, Lloyds Banking Group Plc, Nvidia, QinetiQ Group Plc, and Softcat Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.