How large must my ISA be for a £3,000 monthly passive income?

Have you ever considered loading a Stocks and Shares ISA with high-yield dividend shares for passive income? Millions of Britons do. I own a wide range of global dividend stocks.

At the moment, I revinvest the dividends I receive to grow my portfolio. When I retire, I plan to use my cash rewards to supplement my State Pension income.

But how large will my Stocks and Shares ISA need to be to generate a £3,000 second income every month?

First steps

The good news is I don’t have to factor any cash grabs from the taxman into my calculations. With a tax-efficient ISA, I don’t have to pay a penny in capital gains or dividend tax. And critically for my retirement income, I won’t pay any income tax when I make withdrawals. The dividends I receive are mine and mine alone.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

To get a predictable passive income each month, though, I’ll need to diversify my portfolio across different asset classes. Economic conditions can change quickly and significantly. Not building an ISA to cater for this could make my income highly volatile.

For this reason, it’s important to have a collection of shares spanning different industries and parts of the globe. Companies in defensive sectors like utilities, healthcare and telecoms can provide a reliable income across the economic cycle. More cyclical stocks can deliver tasty dividend growth over time.

A mix of both can be a great way to target a long-term second income. It can also be a good idea to add other fixed income assets like bonds for guaranteed income.

Diversification

I like the idea of buying investment trusts to solve this need. Let’s look at Henderson High Income (LSE:HHI) to understand why.

Today, the trust holds shares in 58 companies, the bulk of which are listed in London. This geographic allocation could harm the share price if investor appetite for UK shares declines. But the large number of multinationals on HHI’s books helps protect dividend income from weakness in specific regions.

What’s more, the stocks it owns operate across both cyclical and non-cyclical sectors for extra passive income stability. Some of its largest holdings are British American Tobacco, Lloyds, Rio Tinto and Unilever.

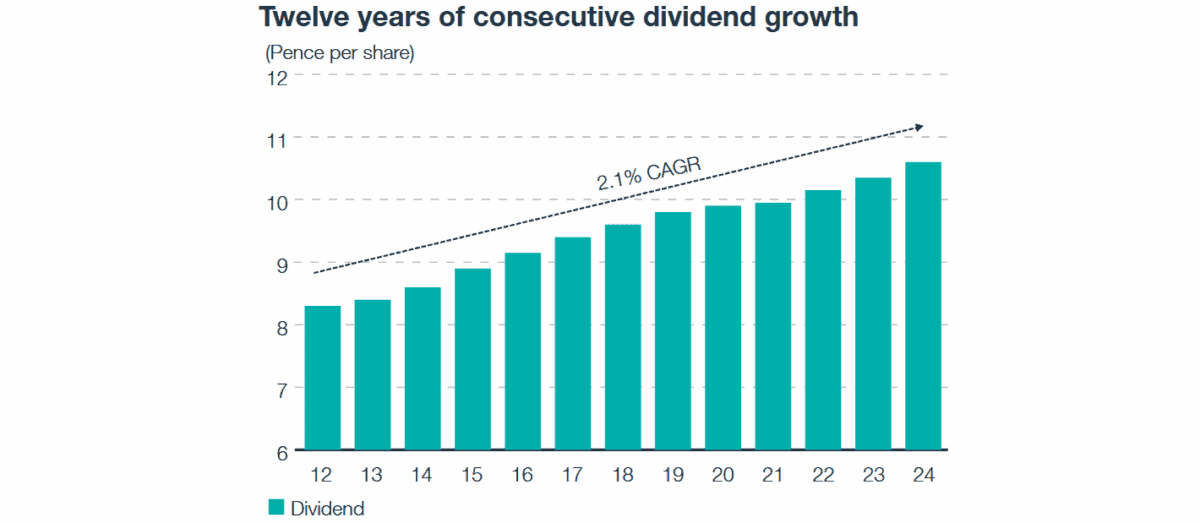

Henderson High Income also holds a wide selection of fixed-income corporate bonds. This blend of shares and bonds has helped the trust grow annual dividends every year for more than a decade.

The final question

The last thing I need to think about when targeting a future passive income is dividend yield.

For our monthly target of £3,000, I’ll need my ISA to be worth £900,000 if packed with shares yielding an average 4%. The amount is £720,000 if the average yield is 5%, and £600,000 based on a 6% yield. You get the idea.

Targeting stocks with higher dividend yields can come with extra risk. Greater dividend yields can indicate an unsustainable dividend, or a company facing significant challenges whose share price has slumped.

However, building a diversified portfolio as I’ve described can spread these risks and generate a predictable long-term passive income. Someone investing £500 a month could achieve that £600k ISA in under 25 years with a 9% average annual return.

The post How large must my ISA be for a £3,000 monthly passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Henderson High Income Trust plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Henderson High Income Trust plc made the list?

More reading

- I asked ChatGPT for the best investment trusts for passive income, and it said…

- State Pension worries? 7 income stocks to consider for retirement

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended British American Tobacco P.l.c., Lloyds Banking Group Plc, and Unilever. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.