This FTSE 100 dividend stock yields 5.6% – could it be the safest passive income play in December?

The FTSE 100 is packed with dividend stocks yielding over 5%, but only two have delivered both big income and strong share price gains in 2025: British American Tobacco and Aviva (LSE: AV.). I wonât touch tobacco stocks, but Aviva is a different story entirely â and Iâm becoming increasingly bullish on the insurance giantâs prospects.

Growing dividends

A lot has changed since the company cut its dividend during Covid. A major strategic overhaul â including the sale of eight underperforming international businesses and a shift towards a capital-light model â has reshaped the group into a far stronger, more focused operation.

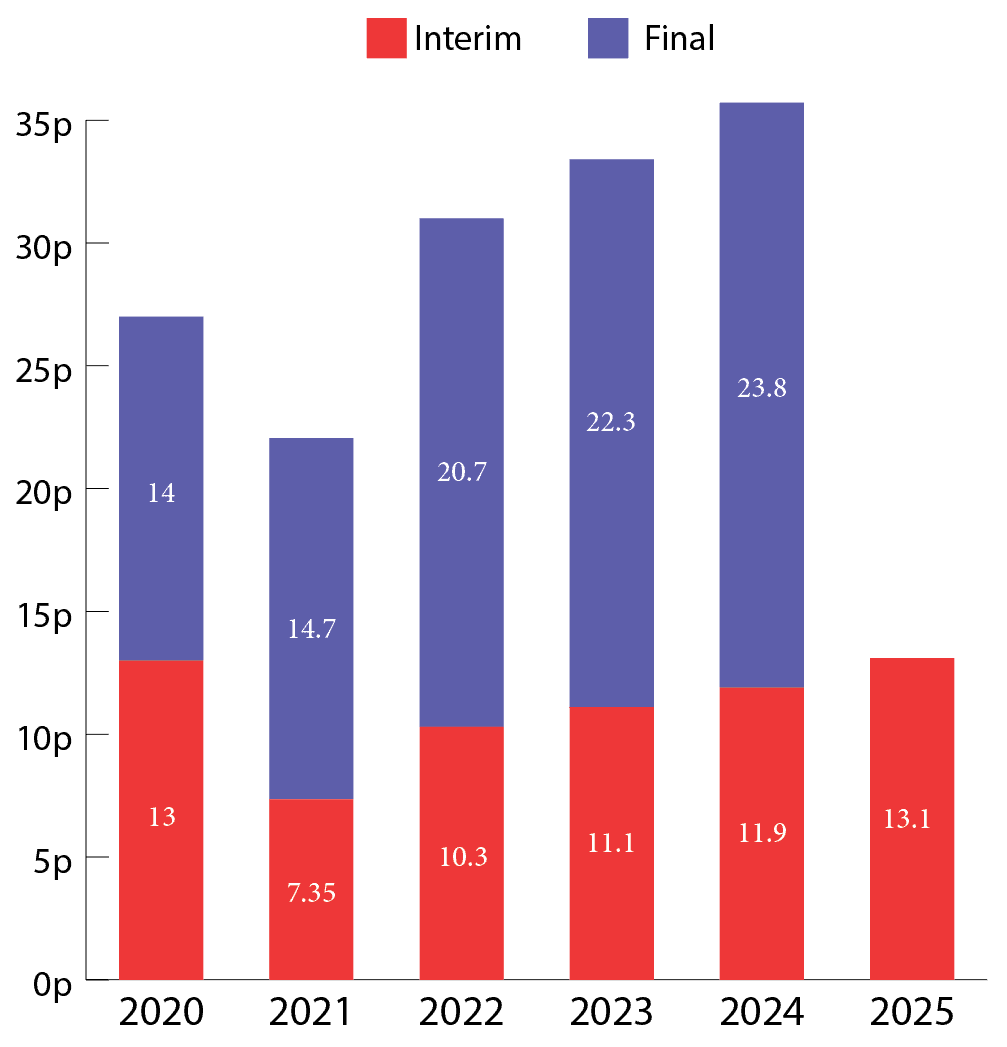

The results speak for themselves. The share price has more than doubled over the past five years, and the dividend has powered higher too, as the chart below shows.

Chart generated by author

At H1 in August, the company raised its interim dividend by 10%, partly to offset equity dilution from its Direct Line acquisition. Management also expects the total cash cost of the dividend to grow at a mid-single-digit rate going forward. And from 2026, share buybacks are set to resume â adding another layer of potential returns for investors.

Customer focused

The company serves nearly 22m customers. This makes it one of the largest franchises in UK financial services and bigger than many well-known banks.

But what really stands out is the depth of those relationships. More than 7m customers hold multiple policies, and 43% of all new policies are sold to existing customers. These multi-policy holders tend to stay longer, engage more, and create a compounding stream of repeat business.

The sheer scale of this customer base represents a huge growth opportunity. Its product suite already spans every stage of life. The acquisition of Direct Line will add even more breadth, particularly in pet insurance and vehicle rescue.

Behind the scenes, the company has spent the past five years rebuilding its digital backbone. Customer data is now unified in a single view, enabling far more personalised interactions, and artificial intelligence is increasingly used to enhance engagement.

All of this points to a business with deep customer loyalty, expanding capabilities, and a long runway of opportunities still to come.

Risks

A key risk is how Aviva might hold up in a recession. An economic slowdown could reduce demand for new policies, while cash-strapped customers may cut or downgrade existing cover.

Claims costs can also become less predictable during tougher times, putting pressure on underwriting profitability. Investment returns may weaken if markets turn volatile.

And with any rise in unemployment, policy lapses could increase. The business may be financially stronger than it was a few years ago, but itâs not immune to a downturn.

Bottom line

Aviva has come a long way since its Covid-era challenges. A sharper, capital-light model, a large and highly engaged customer base, and years of digital investment suggest a business on much firmer footing.

Dividends continue to grow, and buybacks return in 2026, offering the blend of income and stability I look for. The yield may be lower than a year ago, but the combination of steady payouts and clear strategic progress makes it one of the safer passive-income candidates on my radar this December â which is why I recently topped up my own holdings.

The post This FTSE 100 dividend stock yields 5.6% â could it be the safest passive income play in December? appeared first on The Motley Fool UK.

Should you invest £1,000 in Aviva plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva plc made the list?

More reading

- Yields above 5%! Here are my 2 favourite FTSE 100 dividend stocksÂ

- If the FTSE crashes 20%, these are the 2 stocks I want to buy first

- These FTSE 100 shares are on sale after the stock market slump

- Hereâs what compounding the dividends from 1,000 Aviva shares for a decade could earn

- How many Aviva shares do we need to target £3,000 of passive income a year?

Andrew Mackie has positions in Aviva Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes <a href=”https://www.fool.co.uk/help/disclaimer/what-does-it-mean-to-be-motley/”>us better investors.