This FTSE 100 stock isn’t the highest-yielding on the index, but it’s been one of the most reliable dividend payers

Based on amounts paid over the past 12 months, the FTSE 100âs currently (28 November) yielding 3.15%. But it has been higher. For example, in 2020, it was over 4%. And the current return is at its lowest level since 2007.

Some of this reduction can be explained by a recent trend towards more share buybacks. According to AJ Bell, companies on the index have announced plans to use £50.9bn of surplus funds to repurchase their own shares. When combined with dividends, analysts are expecting a cash return to shareholders of 5.5% in 2025.

Over four decades of increases

But thereâs one stock on the index — Scottish Mortgage Investment Trust (LSE:SMT) — that, according to the Association of Investment Companies, has raised its payout for a remarkable 43 years in a row. In cash terms, its dividend for the year ended 31 March (FY25) was 28% higher than for FY20.

Having said that, itâs also been following the crowd. From March 2024 to 30 September, the trustâs bought £2.6bn of its own stock. However, despite this impressive run of dividend hikes, the stockâs only yielding 0.4%. If I was a shareholder, I wouldn’t be getting too excited about this.

A different objective

But income isnât what the trustâs all about. Its stated mission is to invest in the worldâs âmost exceptionalâ growth companies. At 30 September, its five biggest holdings were Space Exploration Technologies (7.6% of assets), Mercadolibre (5.4%), TSMC (5.3%), Amazon (4.6%) and Bytedance (3.8%).

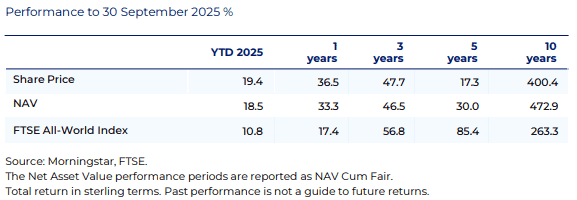

However, since October 2021, the trustâs share price has lagged the performance of the FTSE All-World index. Prior to this, it consistently did better. In November 2021, its shares were changing hands for over £15.

Pros and cons

At the moment, the trust’s shares trade at a 13% discount to its net asset value. This is a strong indication that the stockâs undervalued. However, it also highlights a potential issue that might be concerning investors.

Namely, a significant proportion of its investments, including its position in SpaceX, are in unlisted companies (26.6% of assets at 30 September). These can be difficult to value as thereâs no active market for their shares.

Another possible risk is that the trustâs earnings can be erratic. As its manager says, its investing style âcomes with a tolerance for volatility as progress is rarely in a straight lineâ.

But a look at the trustâs holdings is like a whoâs who in the world of tech and other high-growth sectors. Many are companies at the forefront of their industries demonstrating strong earnings growth and healthy cash flows.

My verdict

Scottish Mortgage Investment Trust has one of the longest unbroken sequences of dividend increases of any FTSE 100 stock. But I donât believe itâs worth looking at as an income share. However, for its long-term growth potential, I think it could be one to consider.

Taking a position in an investment trust is a great way of spreading risk. In this case, itâs possible to have exposure to 99 different companies through a single shareholding. Itâs a way of owning quality stocks without the hassle of having multiple positions.

The post This FTSE 100 stock isn’t the highest-yielding on the index, but it’s been one of the most reliable dividend payers appeared first on The Motley Fool UK.

Should you invest £1,000 in Scottish Mortgage Investment Trust PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage Investment Trust PLC made the list?

More reading

- Could these FTSE 100 bargain shares bounce back in December?

- 3 exceptional investment trusts that could boost the returns of a Stocks and Shares ISA

- 3 FTSE 100 shares to target a 19% annual return

- Up 53% in 2 years, has this FTSE 100 stock finally got its mojo back?

- This FTSE 100 fund holds half of the world’s 10 most valuable ‘unicorns’

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended Aj Bell Plc, Amazon and MercadoLibre. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.