Could prioritising FTSE 100 income stocks be costing you big money?

The FTSE 100 has an excellent reputation when it comes to dividends. Loaded with mature, financially robust companies, the index is a natural hunting ground for investors seeking the best dividend stocks to buy.

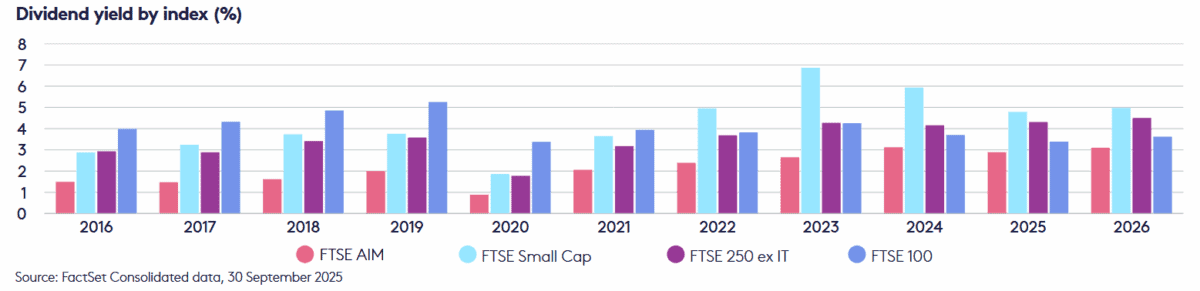

But is the Footsie’s crown beginning to slip? Data shows that smaller companies on the London stock market may be better options for large dividends today and in the future.

Could dividend hunters who focus on blue chips be missing out on potential riches elsewhere?

Leftfield dividend heroes

According to Octopus Investments

both the FTSE SmallCap (excluding investment trusts) and the FTSE 250 continue to offer a higher dividend yield than the FTSE 100, which has declined over recent years as large-cap companies looked to rebuild dividend cover after the Covid pandemic.

Octopus believes this represents an attractive investing opportunity for dividend lovers. According to their fund manager Chris McVey,

we believe itâs an anomaly that these companies are continuing to fly under the radar for traditional income investors. Investors should take advantage of this now as UK smaller-cap stocks can offer them a compelling opportunity in terms of both absolute and relative value, as well as income, benefitting from attractive and growing dividend streams.

Four top income shares

He’s not wrong. I myself have been building a shopping list of non-FTSE 100 shares to consider for a large and sustained passive income. It’s a collection that continues to grow.

Miner Central Asia Metals, green infrastructure stock Gore Street Energy Storage Fund, and bank Lion Finance have all caught my eye recently. Their dividend yields for 2026 are 7.4%, 8.3%, and 6% respectively.

The Schroder European Real Estate Investment Trust (LSE:SERE) sits at the top of my wishlist though. This stock lets out commercial real estate in Continental Europe and distributes the rents it receives in dividends.

Given its geographic footprint, there is foreign exchange risk for profits and dividends when the trust converts euros into pounds. Encouragingly, though, the company has a strong record of delivering juicy cash rewards despite this danger.

This reflects the long-term contracts Schroder has its broad range of tenants locked into. It’s also thanks to the company’s classification as a REIT — under sector rules, at least 90% of annual rental profits must be paid in dividends.

For 2026, the trust’s dividend yield is an enormous 8.2%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Here’s what I’m doing now

I’m not saying that I plan to shun FTSE 100 shares when looking for dividends in future. I own a large selection of large-cap income heroes in my portfolio, and recently added more Aviva and HSBC shares for their passive income prospects.

However, it’s worth looking further afield for top income stocks as well, as you can see. Not doing so could cost investors a fortune in lost dividends.

The post Could prioritising FTSE 100 income stocks be costing you big money? appeared first on The Motley Fool UK.

Should you invest £1,000 in Schroder European Real Estate Investment Trust Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Schroder European Real Estate Investment Trust Plc made the list?

More reading

HSBC Holdings is an advertising partner of Motley Fool Money. Royston Wild has positions in Aviva Plc and HSBC Holdings. The Motley Fool UK has recommended HSBC Holdings. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.