3 no-brainer UK shares to buy now for 2026, according to experts

2025 has been a spectacular year for hundreds of UK shares. The FTSE 100‘s up a stunning 17% in the year to date, driven by surging demand for value shares.

The party’s not over yet either, if City brokers are to believed.

Take the following bangers: Rolls-Royce (LSE:RR), Lloyds (LSE:LLOY), and Prudential (LSE:PRU). Many analysts rank each of these FTSE 100 shares as brilliant Buys heading into 2026.

Are they right?

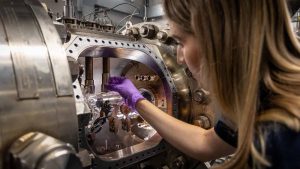

Rolls-Royce

Of the 17 who analyse Rolls-Royce shares, 11 rate the engineer as a Strong Buy. Given the firm’s impressive momentum since the end of the pandemic, I’m not wholly surprised.

The company’s firing on all cylinders thanks to strength across its operations. A robust airline industry is driving demand for its plane engines and aftermarket services. Defence sales are recovering as Western countries rebuild their militaries. Rapid data centre growth is boosting activity at Power Systems.

To cap things off, restructuring work continues to outperform expectatations, boosting margins and cash flows.

But is the good news now baked into Rolls-Royce’s share price? I think it may be.

With a forward price-to-earnings (P/E) ratio of 37 times, I think the stock may struggle to keep rising. I’m not convinced it’s the Strong Buy most analysts think.

Lloyds

Brokers are similarly impressed by the investment potential of Lloyds shares. Of the 19 analysts who cover the bank, 11 rank it as a Strong Buy.

There’s more of an opinion split than with Rolls-Royce shares, though. One rates the company a Sell. Six have slapped a Hold rating on it. But overall, the City clearly likes its investment prospects.

Robustness in the housing market and a pivot towards fee-based services as interest rates fall should support the bank’s profits. Ongoing work to improve its digital banking proposition should also help drive growth.

But there are also significant risks here. Intense competition and interest rate cuts threaten margins. Loan growth is also uncertain as the UK economy struggles. Finally, the bank also faces huge misconduct costs for mis-selling car loans that are yet to be determined.

Lloyds’ share price currently attracts a forward P/E ratio of 13 times. This is high from an historical perspective and fails to reflect those risks, in my opinion.

Prudential

I’m far more convinced by Prudential’s Buy credentials at the moment. Out of a total 18 brokers, 11 consider the financial services giant a Strong Buy.

Of the remainder, four class it as a bog-standard Buy. One has placed a Hold on the FTSE firm.

I’m not surprised by the City’s love-in given Prudential’s continued outperformance. Economic bumpiness remains a problem in keymarkets like China. But the company continues to shrug off these troubles and punch terrific profits growth.

New business profit rose 13% during Q3, beating The Pru’s short-term target of 10% once again. It has market-leading positions in the insurance and asset management segments, underpinning its momentum. And it has significant growth potential as wealth levels in Asia boom.

Prudential’s forward P/E ratio of 13.6 times is historically on the high side. But I think this quality business still offers good value on balance.

The post 3 no-brainer UK shares to buy now for 2026, according to experts appeared first on The Motley Fool UK.

Should you invest £1,000 in Lloyds Banking Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group plc made the list?

More reading

- Here’s how you can invest £5,000 in UK stocks to start earning a second income in 2026

- Is the unloved Aston Martin share price about to do a Rolls-Royce?

- Prediction: here’s where the red-hot Lloyds share price and dividend yield could be next Christmas

- Rolls-Royce shares are down 12% from their highs. Should those who donât own them consider buying now?

- Will the Lloyds share price double in 2026?

Royston Wild has positions in Prudential Plc. The Motley Fool UK has recommended Lloyds Banking Group Plc, Prudential Plc, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.