How much do you need in an ISA to target a £3,000 monthly passive income?

Every time I cover ISAs, The Beatlesâ hit song Taxman pops into my mind. After all, tax grabs are as popular now as in 1966 when that popular anthem was released.

With a Stocks and Shares ISA, investors don’t have to worry about paying capital gains tax or dividend tax. They’re also protected from income tax when drawing money down. I’m sure song writer George Harrison would have loved this tax-saving product!

These savings can be a gamechanger for building wealth, giving investors more money to grow their portfolio through compounding. They can also make it easier to generate a large second income to supplement the State Pension.

But as an ISA investor, how much would you need for a regular £3,000 monthly income?

Building wealth

I think a £3k passive income target is a sensible one to aim for. That’s £36,000 a year, which — when combined with the State Pension — would give individuals a good chance of retiring comfortably.

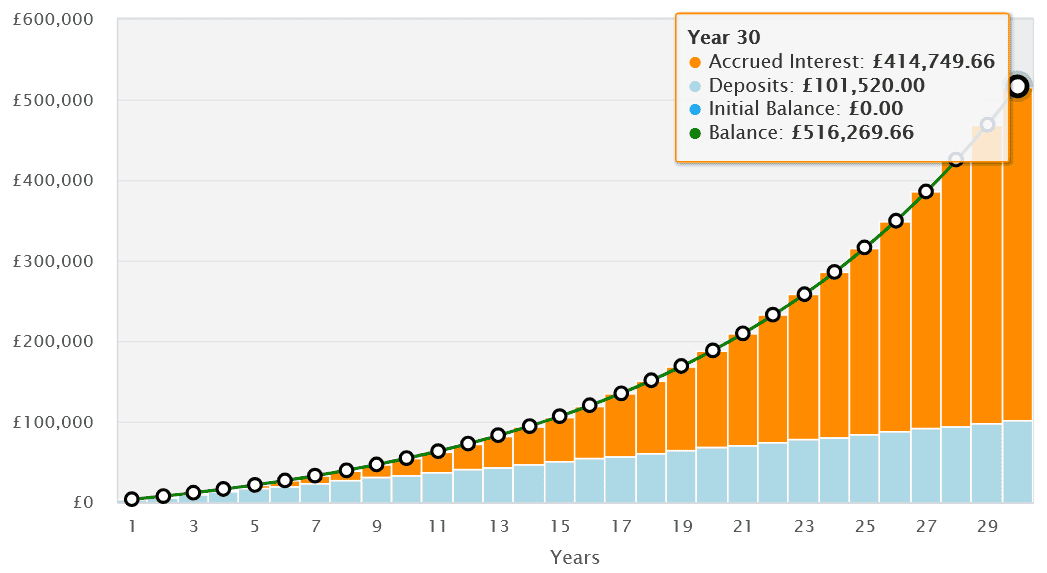

To reach this figure, someone would need a portfolio worth £515,000. This figure assumes our pensioner invests in 7%-yielding dividend shares and lives off the cash payments.

I personally like this approach because it allows scope for portfolio growth as well as a regular passive income.

At face value, that £515k looks like a lot of cash. To be fair, it’s not small potatoes. But with patience and regular small investments, it’s a very achievable target.

Someone who invests just £282 a month for 30 years could reach that £515,000. That’s assuming they achieve an average stock market return of 9% a year.

Without an ISA, they’d need to invest even more, given the tax grabs I’ve described above.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Dividend hero

Thankfully, UK share investors have many great dividend shares to choose from for income. This reflects the London stock market’s strong dividend culture and vast collection of financially-robust companies with leading positions in mature sectors.

M&G (LSE:MNG) is one such share for income investors to consider. It’s raised annual dividends every year since it launched in 2019 on the FTSE 100.

As a consequence, its dividend yield has consistently ranged between 6% and 9%. For 2025, the yield is a FTSE-topping 7.6%.

M&G has limited growth opportunities, so it prioritises dividends when deciding what to do with excess cash. Acquisitions and organic investment are further down the list.

Like any financial services provider, earnings can come under pressure when consumers feel the pinch. But the company’s loaded with cash — its Solvency II ratio is 230% — giving it flexibility to keep growing dividends even if profits disappoint.

The bottom line

I think M&G would look great in a diversified ISA of 15 stocks or more. A broad portfolio can deliver a stable long-term income and protect investors from one or two dividend shocks.

The post How much do you need in an ISA to target a £3,000 monthly passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in M&g Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if M&g Plc made the list?

More reading

- My 2 favourite dividend shares could earn investors £1,558 income in an ISA â with growth on top!

- How much would you need to invest to earn over £1,000 per month in passive income?

- I asked ChatGPT for a bargain stock to put in my ISA. Here’s what it said…

- 5.9%+ yields! 3 high-yield shares to consider for a SIPP this December

- 3 FTSE 100 and FTSE 250 shares to consider after the Autumn Budget!

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended M&g Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.