How much do you need to invest in a FTSE 100 ETF for £1,000 monthly passive income?

Earning passive income through a FTSE 100 ETF has become a hugely popular strategy. So I decided to dig into the dividend yields of two leading tracker funds to see how much an investor would actually need to reach £1,000 a month in passive income.

Tracker funds

First up, the iShares UK Dividend UCITS ETF offers a 4.9% yield, while the Vanguard FTSE U.K. Equity Income Index Fund yields 4.2%.

The iShares fund is relatively concentrated, holding just 51 stocks. Vanguard spreads its exposure over 104 holdings.

Despite the difference in breadth, both are dominated by FTSE 100 heavyweights such as BP, Rio Tinto, Legal & General, HSBC, and Shell. A handful of FTSE 250 names also appear, but with much smaller weightings.

Calculations

I do hold the Vanguard fund myself, but I donât solely rely on it to build passive income. One reason is that several of its biggest holdings arenât high-yield names, so the income stream is naturally limited.

If the goal is £1,000 a month (£12,000 a year), the 4% rule gives us a simple target: youâd need roughly £300,000 in your pot.

And this is where things get interesting.

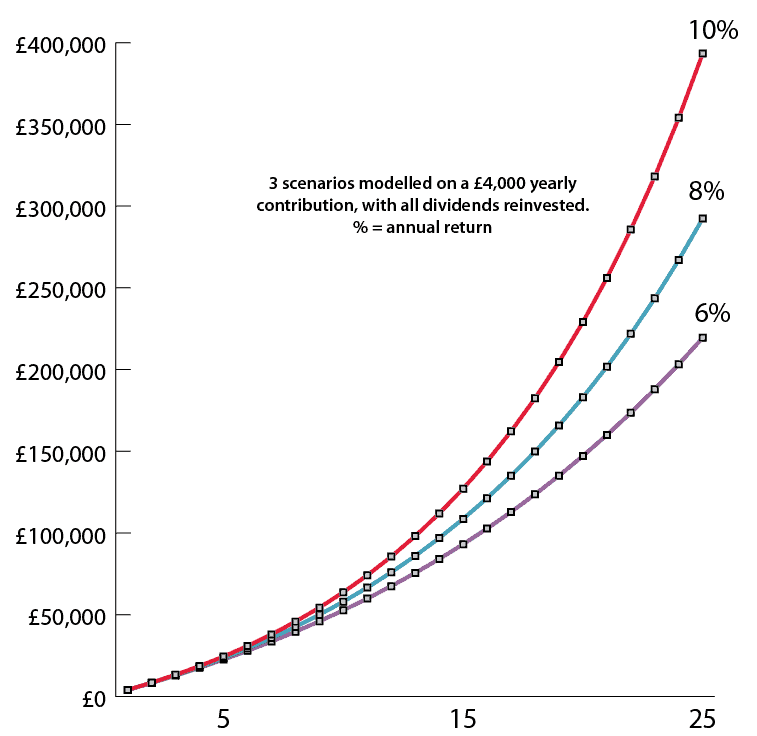

As the chart shows, using fixed yearly contributions of £4,000 and straightforward compounding at todayâs yields, neither ETF gets close to that £300,000 target over 25 years. The income levels just arenât high enough for the pot to grow at the pace required.

Chart generated by author

Thatâs why I prefer pairing a tracker fund with individual dividend shares that offer higher, more meaningful yields.

Income and growth

One big FTSE 100 name missing from both ETFsâ top 10 lists is Aviva (LSE: AV.). Its share price has jumped 32% in a year, which naturally pushed the dividend yield down from 8% to 5.5%.

But hereâs the key difference with owning individual shares: when you reinvest dividends into a strong company, your holding grows much faster than the slow, spread-out growth you get from an ETF.

Refreshed targets

In its latest update, Aviva laid out three bold targets for 2028: grow operating earnings per share at an 11% compound annual rate, deliver an IFRS return on equity above 20%, and generate more than £7bn in cumulative cash remittances.

To hit these ambitious goals, the company is doubling down on its shift to a capital-light model. Within a few years, it expects over 75% of operating profit to come from areas like General Insurance and Wealth, which require far less capital to grow.

If it can smoothly integrate Direct Line, boost flows through Succession Wealth, and continue scaling via major partnerships such as Nationwide, then these targets start to look genuinely achievable.

No investment is risk-free. For Aviva, falling insurance premiums, regulatory changes, or interest-rate swings could pressure profits and dividends. Unexpected claims or slower growth in capital-light divisions could also limit cash generation, which is key for sustaining payouts.

Bottom line

For me, itâs all about building a reliable stream of passive income. Reinvesting dividends from strong, cash-generating shares has quietly built a growing income stream in my ISA over the years. While the FTSE 100 spreads risk broadly, Iâve found that carefully tracking a few high-yield names can turn steady payouts into a powerful compounding engine. And there are plenty of other high-income stocks to choose from.

The post How much do you need to invest in a FTSE 100 ETF for £1,000 monthly passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Aviva plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva plc made the list?

More reading

- Here are the potential dividend earnings from buying 1,000 Aviva shares for the next decade

- My top 3 FTSE 100 dividend shares for a strong second income

- Prediction: in 2026, the Aviva share price could climb to…

- How much do you need in FTSE 100 income stocks to generate £777 a month for retirement?

- How many Aviva shares must I buy for a £1,000 yearly passive income?

Andrew Mackie has positions in Aviva Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.