£5,000 invested in Glencore shares in January 2025 is now worth…

A year ago, I could buy Glencore (LSE: GLEN) shares for 354p. Today, theyâre trading around 12% higher, turning a £5,000 investment into roughly £5,600. Thereâs been a small dividend along the way too, but thatâs not the point.

The point is volatility.

In April, during the tariff-driven sell-off, the shares slumped to a three-year low. Since then, theyâve surged 95%. That kind of price action isnât unusual for a miner â but it does leave investors wondering what comes next.

So can shareholders expect another bumpy ride in 2026? To answer that, I focus on one metric that cuts through the noise.

Alternative performance measure

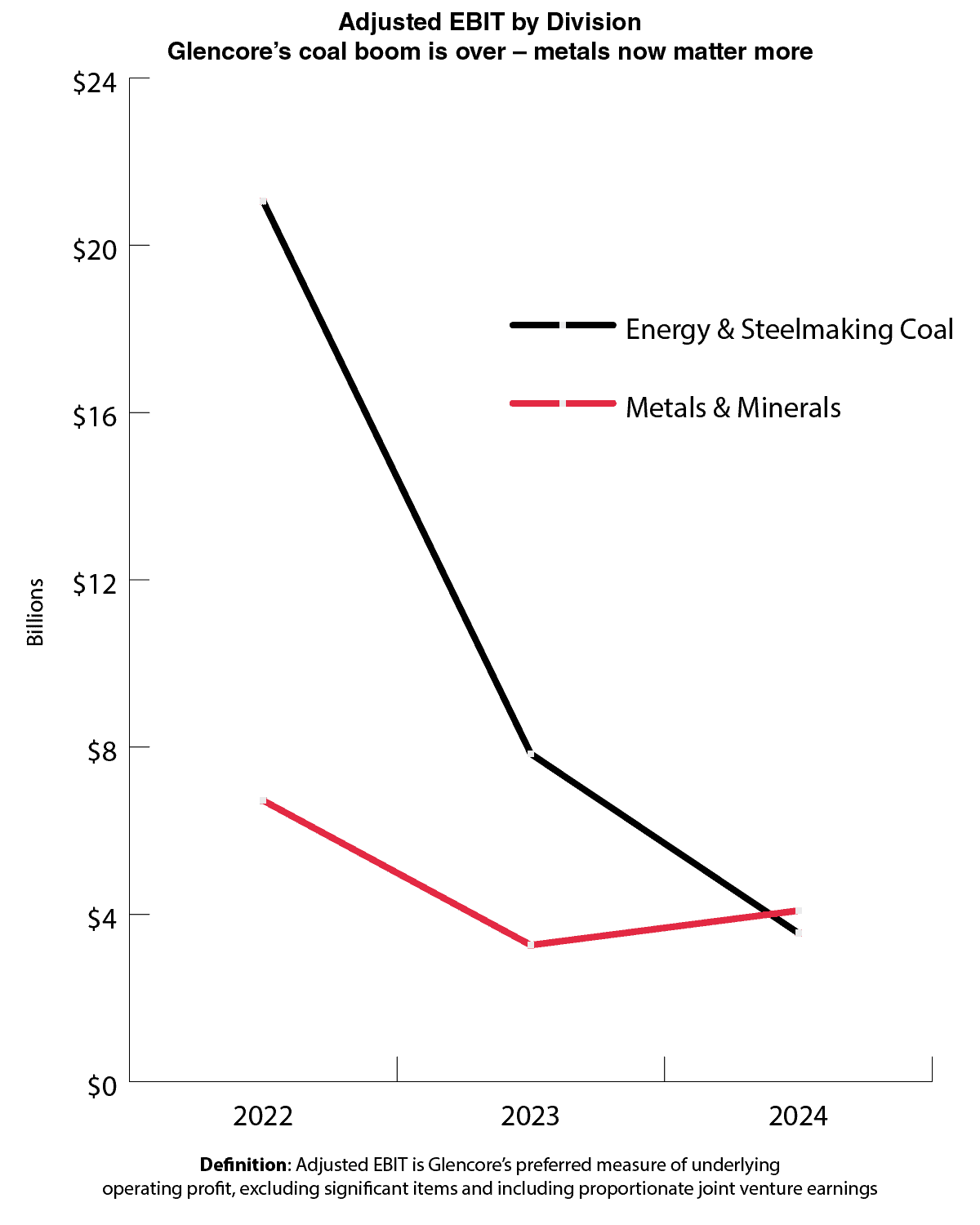

Adjusted EBIT (earnings before interest and tax) is the minerâs measure of underlying operating profit. It strips out significant items, such as one-off asset sales or impairment charges, giving a clear view of which parts of the business are actually generating profit.

The chart below shows Glencoreâs adjusted EBIT over the past three years.

Chart generated by author

In 2022, energy and steelmaking coal generated an extraordinary profit windfall, dwarfing metals and minerals. That year now looks increasingly like a one-off.

Since then, coal earnings have collapsed. At its H1 results, the miner reported that Newcastle thermal coal prices had fallen by 20%, while hard coking coal prices were down by a third year on year. This comes on top of already steep declines in 2023.

That narrowing gap matters. It suggests the miner is no longer leaning on coal to prop up the income statement in the way it did during the post-Covid commodity spike.

Copper is the future

Whatâs most instructive about the EBIT chart is that, despite weak copper prices in 2023 and 2024, the metals divisionâs underlying profitability held up far better than many might expect. That resilience bodes well for full-year 2025 results.

Copper has had an excellent year so far, up 32%, with pressure building on both the supply and demand side. Demand from electrification, renewable energy, and AI infrastructure continues to rise, and there are few signs of that slowing.

On the supply side, fears that the US administration could impose new tariffs next year have prompted traders to accelerate shipments into the US, stockpiling metal there while tightening availability elsewhere.

At the same time, disruptions at major copper-producing mines in Chile and Indonesia have deepened concerns about global supply. With new discoveries thin on the ground, bringing meaningful new tonnage online wonât happen overnight.

Major risks

Copper prices remain volatile and could fall sharply in a global recession. Coal is still Glencoreâs largest revenue generator, so prolonged weakness would weigh on cash flows. Geopolitical and regulatory risks are ever-present across its operating footprint, while weather disruptions and operational setbacks could also derail production targets.

Bottom line

The key takeaway from the EBIT chart is simple: metals are shaping Glencoreâs future.

Only this month, the miner cut around 1,000 jobs as part of a restructuring that bets heavily on rising copper demand. The plan is to lift copper production to around 1.6m tonnes a year by 2035, positioning Glencore among the worldâs largest producers. This year, output is expected to reach 850,000 tonnes.

The journey wonât be easy, but the trajectory is clear. Thatâs why Iâve been adding to my exposure to the miner throughout the year.

The post £5,000 invested in Glencore shares in January 2025 is now worth⦠appeared first on The Motley Fool UK.

Should you invest £1,000 in Glencore plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore plc made the list?

More reading

- These 2 UK shares were stinking out my SIPP â now theyâre flying! What next?

- 2 FTSE shares experts think will smash the market in 2026!

- Up 25% in 3 months! Now check out the Glencore share price and dividend forecast for the next year

Andrew Mackie has positions in Glencore Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.