Can the Rolls-Royce share price hit £16 in 2026? Here’s what the experts think

The Rolls-Royce (LSE:RR) share price has clocked up another impressive year. As a result, anyone who invested £1,000 in the stock five years’ ago now has an investment worth £9,868.

Analyst price targets for 2026 suggest another strong year for the FTSE 100âs version of Nvidia could be on the cards. So despite the stock being up 889%, is there still a buying opportunity?

Analyst forecasts

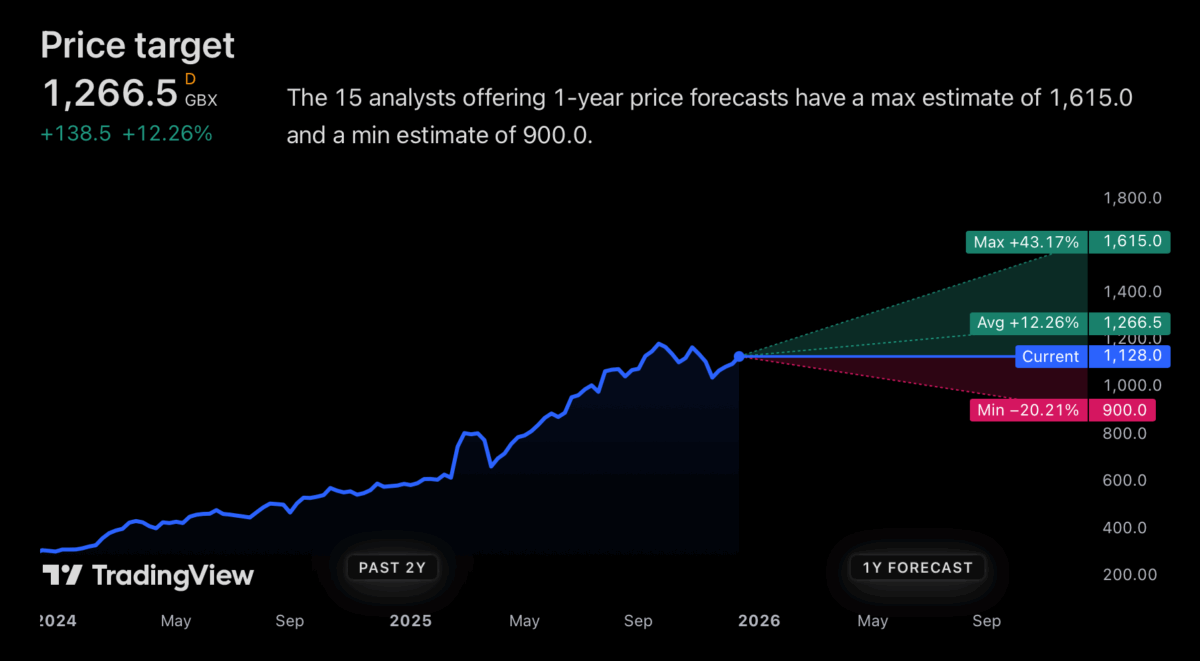

Right now, the average analyst price target for the stock is around 12% higher than the current level. Thatâs more than the FTSE 100 manages in an average year.

Source: TradingView

If things go well, thereâs a case for thinking the Rolls-Royce share price could do even better. The highest estimate is just over £16 â 43% above where the stock’s trading right now.

It’s trading at a price-to-earnings (P/E) ratio of 16, but that includes some one-off boosts to profits that wonât be repeated. Adjusting for these, the multiple is more like 35. That means some things will need to go right for the firm and these canât be guaranteed. And that means the high multiple is a risk with the stock going into 2026.

Air travel

In recent years, the biggest force propelling Rolls-Royce forward has been its civil aviation business. Air travel demand has been strong and this looks set to continue in 2026. There is, of course, always a risk with this industry. Downturns can come suddenly and out of nowhere when businesses are least expecting them and they can have a big impact.Â

Economic growth has been relatively weak recently and that means a cyclical downturn is a real possibility. And high fixed costs mean margins can contract quickly.

Importantly though, Rolls-Royce has been at the centre of a couple of important long-term trends recently. So even if air travel demand falters, there might still be room for positivity.

Defence and power

Two of the biggest themes in 2025 have been defence and artificial intelligence (AI). These are both areas that Rolls-Royce has exposure to, either directly or indirectly.

NATO commitments to increase defence spending should boost demand for aircraft, submarines and ships. And thatâs like to bring increased demand for the firmâs engines.

In terms of AI, the data centres that big tech companies have been building need reliable backup power. And Rolls-Royce provides both generators and battery solutions.

Importantly, both of these divisions should provide growing earnings well beyond 2026. So theyâre also key reasons to be positive about the stock over the long term.

Long-term investing

Iâm a little hesitant when it comes to Rolls-Royce shares next year. Anything can happen with the firmâs civil aerospace division and the stock can move sharply in either direction.

From a long-term perspective things look a bit more positive, with the company exposed to some key growth industries. And that means investors might want to take a look.

My sense though, is that itâs hard to see this as the best FTSE 100 stock to buy right now. While it has a lot of momentum, I think there could be better opportunities to explore.

The post Can the Rolls-Royce share price hit £16 in 2026? Here’s what the experts think appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Where will Rolls-Royce shares go in 2026? Here’s what the experts say!

- I’m thrilled I bought Rolls-Royce shares in 2023. Will I buy more in 2026?

- Will Rolls-Royce shares be the gift that keeps on giving in 2026?

- Is the stock market going to crash in 2026? Here’s what I plan to do

- £10,000 invested in Rolls-Royce shares 5 Christmases ago is now worth…

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.