How much do you need in a Stocks and Shares ISA to target £1,500 a month in passive income?

A Stocks and Shares ISA is my go-to for building tax-free passive income. With Cash ISAs now capped at £12,000 a year and interest rates falling, relying on cash alone makes hitting £1,500 a month (roughly half the average full-time salary) unrealistic. Investing instead lets me target higher returns and put compounding to work to reach this goal faster.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Size of the pot

Data from HMRC shows that ISA contributions largely depend on income, but surprisingly, 17% of earners in the £0-£4,999 band contributed the maximum!

Using this insight, Iâve modelled a tiered yearly contribution strategy, where the amount invested rises as earnings grow:

| Tiered years | Yearly ISA contribution |

| 1-5 | £2,000 |

| 6-10 | £5,000 |

| 11-15 | £10,000 |

| 16-25 | £20,000 |

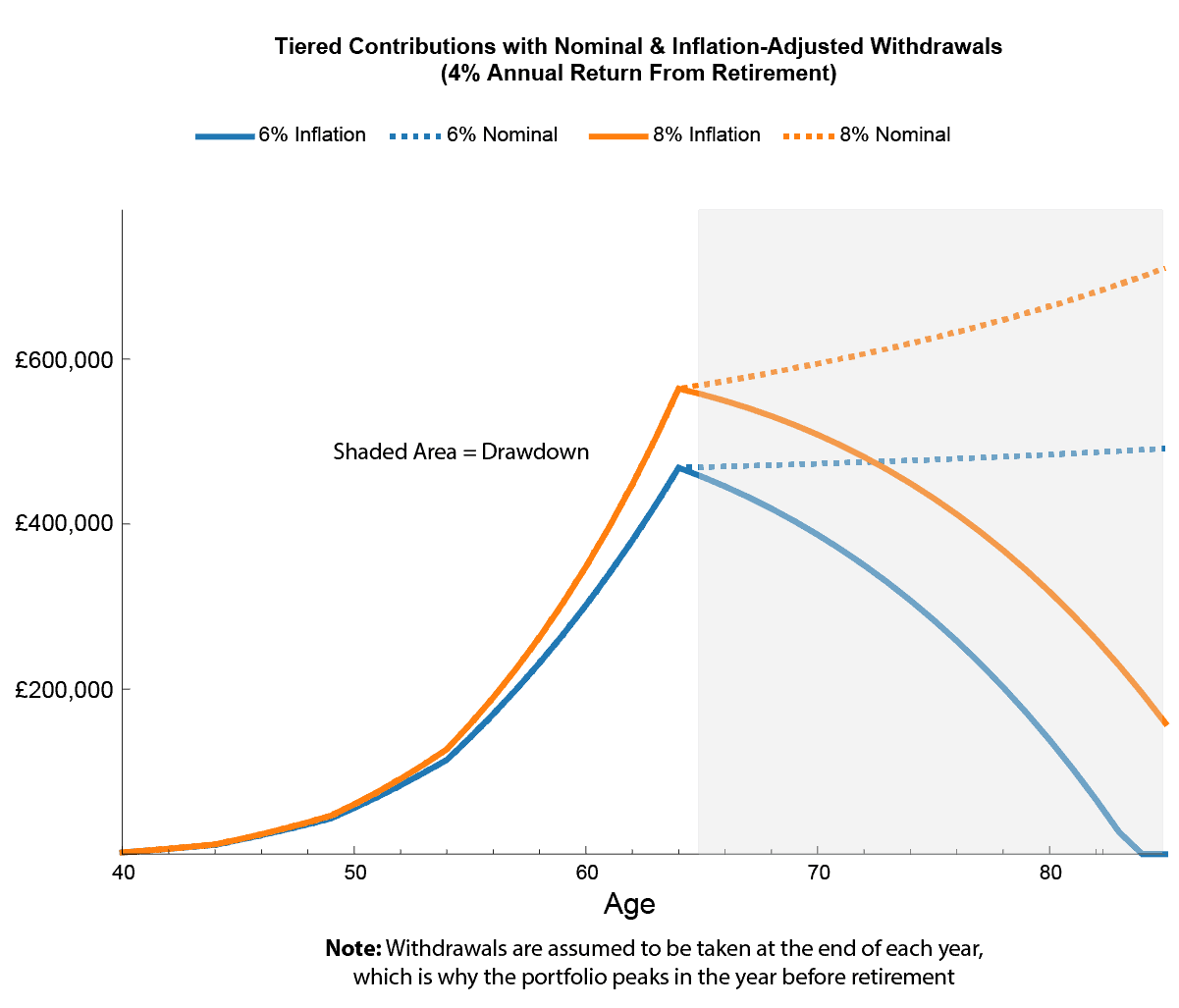

The chart below shows lifetime ISA contributions from age 40 to 65 and drawdown to 85, assuming 6% or 8% annual returns. Contributions grow nicely while working, but retirement changes everything.

Most people forget two things: inflation and the need to dial down risk once you start drawing money. Iâve dropped the return to 4% in drawdown and inflationâadjusted the £1,500 monthly withdrawal at 2%.

Look closely â many focus on the wrong lines, thinking nominal growth tells the full story. At 6%, the pot runs dry; at 8%, youâre left with just £150,000. The chart clearly shows why planning for inflation and lower returns in retirement is crucial if you want your ISA to deliver a steady passive income.

Chart generated by author

Bold stock

Investors often shy away from the FTSE 250, wary of mid-cap volatility. But there are many great businesses offering strong dividends with growth potential. One of my favourites is asset manager Aberdeen (LSE: ABDN).

Its direct-to-consumer arm, interactive investor (ii), has taken the market by storm. Customer numbers rose 14% year on year to 492,000, including a 29% jump in SIPP accounts to 98,000.

Daily trades increased 43%, while assets under administration climbed 20% to £93bn. Momentum here is strong, making ii a serious challenger to Hargreaves Lansdown.

A tale of two divisions

The Adviser division, by contrast, remains under pressure, weighed down by years of net outflows and the long-term shift from active to passive funds. Outflows have eased over the past year, helped by fee reductions across funds. Revenues may have taken a hit in the short term, but stabilising this core business is key for long-term growth.

Market-beating dividend

One of the main attractions for me is getting that 7.5% dividend yield while waiting for a potential recovery. No dividend increase is expected before at least 2027, but reinvesting payouts into more shares can create a compounding effect, potentially magnifying long-term returns.

Bottom line

Aiming for £1,500 a month in passive income at retirement, measured in todayâs money, wonât happen overnight. Itâs also unlikely to happen if Iâm too conservative during the crucial contribution phase.

Once I reach retirement, my chance to grow my portfolio aggressively will be much smaller. Thatâs why I focus now on finding stocks that offer both market-beating yields and long-term growth potential, while I still have time on my side. Thatâs why Aberdeen is in my ISA portfolio. But itâs far from the only one Iâm watching at the moment.

The post How much do you need in a Stocks and Shares ISA to target £1,500 a month in passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in aberdeen group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if aberdeen group made the list?

More reading

- Up 45% in a year with a 7.2% yield and a P/E of 13! Is it too late to buy this fabulous FTSE 250 stock?

- Can these 2 incredible FTSE 250 dividend stocks fly even higher in 2026?

- Hereâs how another £5,000 invested in this high-yield FTSE 250 star could make me £2,969 a year in dividend income over time!

Andrew Mackie owns shares in Aberdeen. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.