I’ve just added this under-the-radar FTSE 100 stock to my SIPP

Iâm always looking for new stocks to put in my Self-Invested Personal Pension (SIPP). Thatâs why, in early December, I decided to add RELX (LSE:REL) to my portfolio.

Since buying my shiny new shares, they’re up in value. OK, not by very much. But as well as this, Deutsche Bank has just lifted its 12-month price target for the stock by approximately 10%. Of course, savvy investors know that shares should be for life, not just for Christmas, but I find it encouraging when my journey as a new shareholder in a company starts on a positive note.

So why did I buy?

Potentially undervalued

The first thing that brought the company to my attention was the near-20% drop in its share price since December 2024. At first glance, this might seem a bit odd. Why buy something that others don’t appear to want? But sometimes a stock falls out of fashion for no obvious reason. In these circumstances, rational investors should eventually see an opportunity to pick up a bit of a bargain. Clearly, I hope this is the case with RELX.

While itâs true that the group could be impacted by others using artificial intelligence (AI) to take away some of its business, either legitimately or by more dubious means, the group appears relaxed. Instead, it sees the technology as an opportunity. Indeed, it says itâs been using AI tools for over a decade to establish itself as one of the worldâs leading providers of information-based analytics and decision tools to professionals and commercial customers.

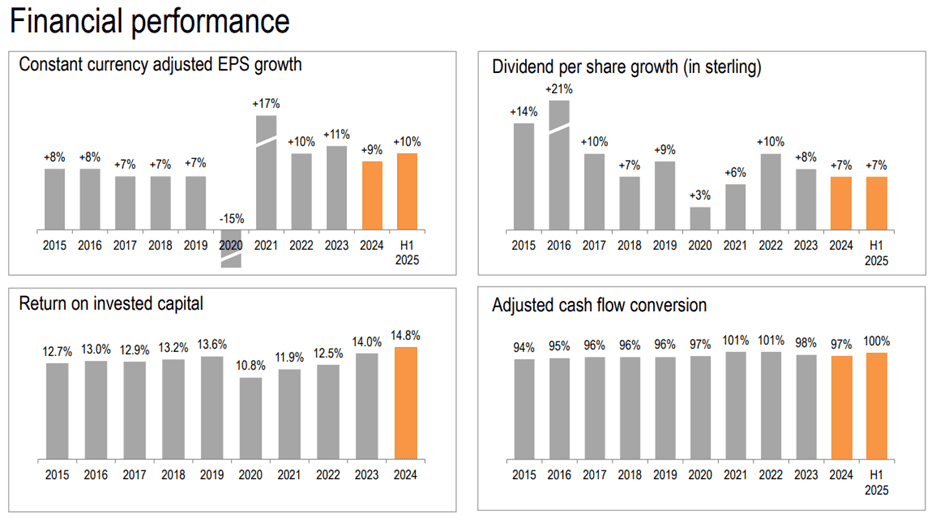

And it appears to be good at what it does. A look at the improvement in some key financial measures over the past 10 years demonstrates this.

Despite being relatively unknown, itâs the UKâs 13th most valuable listed company. Itâs share price has increased by around two-thirds since December 2020.

Things to keep an eye on

Like any business, RELX faces a number of challenges. With a large share in its key markets, the opportunity to gain more customers is limited.

Also, in recent years, itâs moved away from printed material to providing its content online. A breach of IT security is therefore a major threat. The recent cyber attacks at Marks & Spencer and Jaguar Land Rover show how costly â both reputationally and financially â systems weaknesses can be.

However, for the first nine months of 2025, the group reported a 7% increase in underlying revenue compared to the same period a year earlier. It claimed an âimproving long-term growth trajectory” and âpositive momentum across the groupâ.

Iâm not expecting RELX to go gangbusters over the next few years. I reckon itâs more of a slow burner. But thatâs the type of stock that, I think, is ideal for a pension pot. Having said that, analysts have set a 12-month share price target thatâs over 40% higher than its current value.

So thatâs why I decided to put RELX in my SIPP, and why others could consider doing the same. Of course, there are plenty of other UK shares to choose from but, for the time being at least, Iâm happy with my selection.

The post I’ve just added this under-the-radar FTSE 100 stock to my SIPP appeared first on The Motley Fool UK.

Should you invest £1,000 in RELX right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if RELX made the list?

More reading

- Down 17% in 2025! Are these 2 powerhouse growth stocks now screaming buys in 2026?

- Could these 3 holdings in my Stocks and Shares ISA really increase in value by 25% in 2026?

- I just asked ChatGPT a really stupid question about FTSE 100 stocks and it saidâ¦

- Down 18%! Is this beaten down dividend growth hero now the best share to buy in December?

James Beard has positions in RELX. The Motley Fool UK has recommended RELX. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.