I asked ChatGPT how to build £1,000 a month in passive income using an ISA – here’s what it suggested

Building a £1,000-a-month passive income (£12,000 a year) from an Individual Savings Account (ISA) isnât straightforward. When I asked ChatGPT for a plan, it flagged the reality: achieving this requires either very high capital or high-return investments, because Cash ISAs alone wonât get you there.

That left me wondering: could a Stocks and Shares ISA bridge the gap and help reach this goal?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Size of the pot

ChatGPT quickly calculated the pot Iâd need to hit my passive income target â and thatâs where it went a bit off the rails!

It suggested that with a Cash ISA at 4% growth, Iâd need a £300,000 pot. A Stocks and Shares ISA generating 6% yearly returns could reduce that to £200,000.

The confusion came with the difference between total contributions needed and the pot required to safely sustain £1,000 a month. Thatâs a subtle but crucial distinction for anyone planning income from an ISA.

Crunching the numbers

First, donât forget inflation. Over time, it quietly erodes purchasing power. Assuming 2% inflation over a 20-year investing horizon, that £1,000 monthly target effectively rises to £1,486.

Using the classic 4% withdrawal rule, the final pot would need to be £445,800.

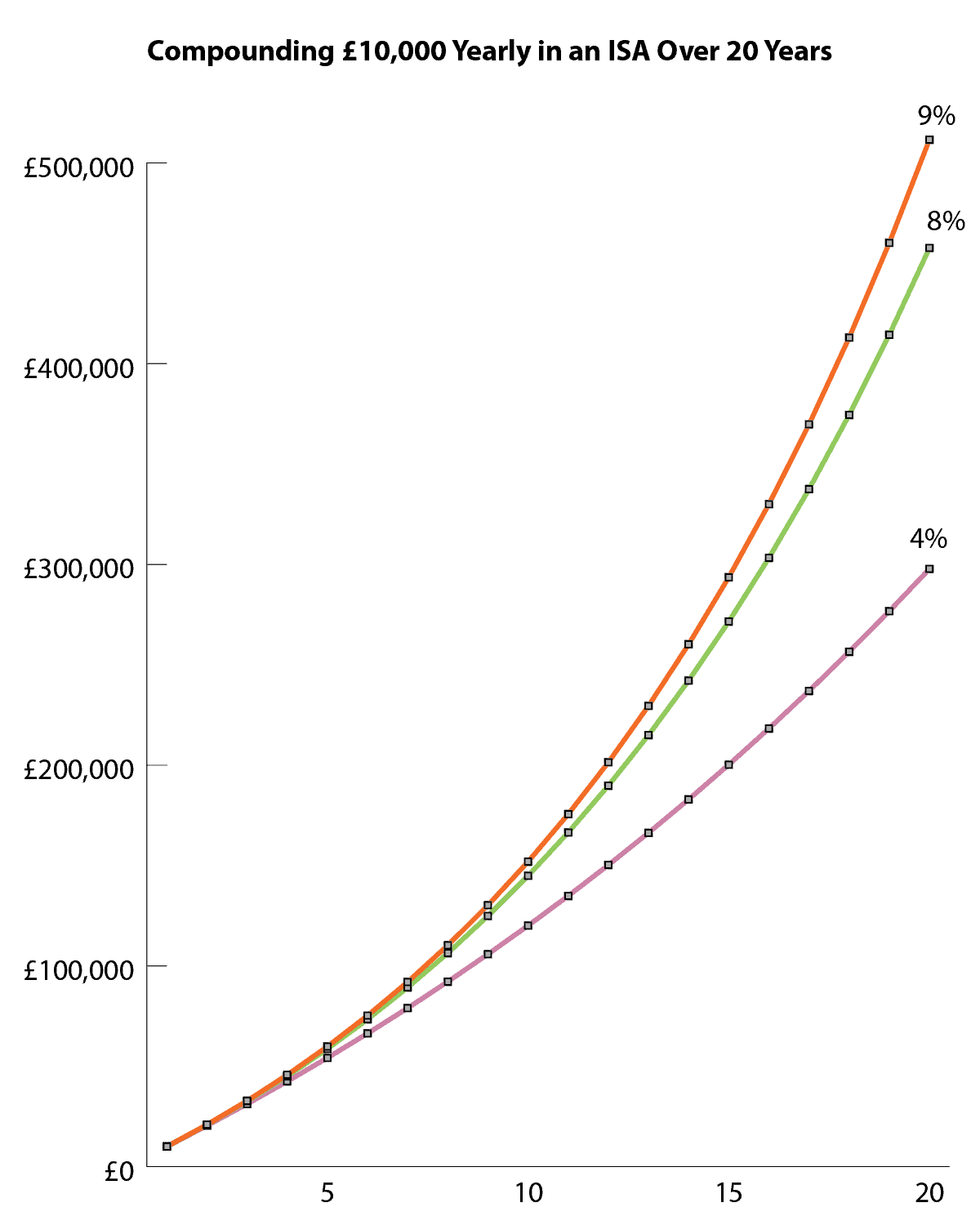

The chart below models £10,000 a year contributions into an ISA over 20 years. It shows that even with a 4% Cash ISA return, the target remains out of reach. But with annual investment returns of 8%-9%, achieving the goal becomes realistic.

Chart generated by author

Constructing a portfolio

Investing isnât about hitting the target every year â itâs about hitting it on average. Markets deliver good years and bad ones, and thatâs unavoidable.

A set-and-forget ETF, like the iShares UK Dividend UCITS ETF, can do a lot of the heavy lifting. Itâs had a strong year, combining low double-digit capital growth with a 4.9% dividend yield.

But over the long term, a major bear market can seriously delay recovery â sometimes beyond your investing timeframe. Thatâs why I donât rely on one approach. I blend passive investing with active stock picking, targeting high-yield shares for income and a small number of high-conviction growth stocks for long-term outperformance.

A high-yield income stock

Phoenix Group (LSE: PHNX) yields 7.6%, one of the highest dividends in the FTSE 100. Many investors worry about its sustainability because headline IFRS earnings can look weak. For example, last year it generated negative earnings per share.

For insurers, I pay far less attention to those accounting numbers. Profits are distorted by long-term assets backing pensions and life policies.

Instead, I focus on operating capital generation, which strips out the noise. On that measure, the insurerâs cash generation has been strong and, in my view, comfortably supports the dividend.

However, the company relies on stable market conditions and tight cost control to keep funding the dividend. A prolonged market downturn or regulatory change could put pressure on both. Remember, no dividend is ever guaranteed.

Bottom line

For me, building passive income inside an ISA is about patience and balance. I focus on owning high-quality businesses, spreading risk across sectors, and reinvesting income to let compounding do the heavy lifting. Over time, combining reliable dividends with selective growth gives my ISA the best chance to work harder for me.

The post I asked ChatGPT how to build £1,000 a month in passive income using an ISA â hereâs what it suggested appeared first on The Motley Fool UK.

Should you invest £1,000 in Phoenix Group Holdings plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Phoenix Group Holdings plc made the list?

More reading

- How much do you need in a Stocks & Shares ISA for a £3,333 monthly passive income?

- 7.7% yield! These 3 dazzling dividend shares could generate a £1,573 passive income in an ISA

- Yields up to 8.5%! Should I buy even more Legal & General, M&G and Phoenix shares?

- Can you turn your Stocks and Shares ISA into a lean, mean passive income machine?

- £5,000 in Phoenix shares at the start of 2025 is now worth…

Andrew Mackie has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.