The JD Sports share price has tanked after a broker downgrade. But I remain optimistic

By lunchtime today (6 January), the JD Sports Fashion (LSE:JD.) share price was nearly 7% lower after the Bank of America downgraded the stock. In November, Shore Capital was also downbeat about the retailer’s shares. It said the groupâs third quarter (the 13 weeks to 1 November 2025) trading update “underscored the depth of the current trading headwinds“.

Admittedly, the retailer’s latest press release wasnât very positive. The group said pre-tax profits would be at the lower end of the consensus of estimates (£853m-£888m). And, worryingly, compared to a year earlier, like-for-like (LFL) sales were down 1.7%, with Asia-Pacific being the only region to grow.

Shore Capital was concerned that the group was unable to pass on rising labour and operating costs to customers due to a falling top line.

However, despite this apparent doom and gloom, I remain optimistic about the prospects for JD Sports. Hereâs why.

Cheap as chips

At the moment, I reckon the groupâs shares are attractively priced. In fact, they look to be in bargain territory.

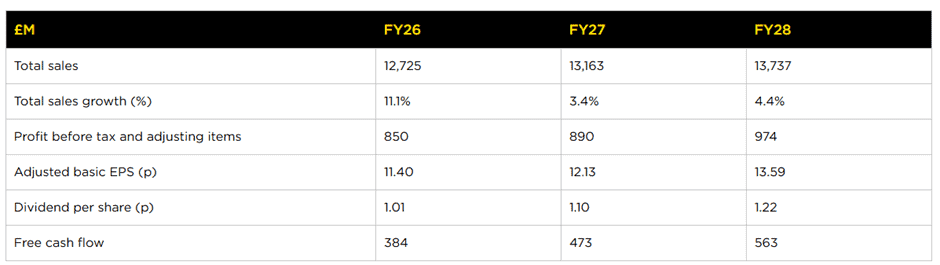

Analysts are expecting adjusted basic earnings per share of 11.4p for its current financial year ending in February 2026 (FY26). This means the stock trades on just 7.3 times expected earnings. Looking ahead to FY28, the multiple drops to 6.1. This is incredibly cheap for any business, especially one thatâs on the FTSE 100.

And with relatively little borrowing on its balance sheet â it reported net debt (excluding leases) of £125m at 2 August 2025 — it remains impressively cash generative. This is important because it gives it the headroom to spend more on either revamping existing stores or buying additional ones. Alternatively, it could return further cash to shareholders.

Overseas focus

Following a major acquisition in 2024, North America’s now the groupâs biggest market. I reckon this is significant because, unlike in Europe, the US economy appears to be growing rapidly at the moment.

Iâm sure this summerâs FIFA World Cup in the region will also help boost sales. But itâs also a reminder of how the groupâs share price has struggled in recent years. Since the last competition in Qatar in December 2022, itâs fallen by around 30%.

Importantly, although Nike, the struggling US sportswear giant, is believed to account for around half of the groupâs sales, JD Sports is brand-agnostic. The British retailer has a reputation for responding rapidly to changing consumer trends. A look at its website shows 108 different brands/manufacturers listed.

Final thoughts

I acknowledge that JD Sports appears to have fallen out of favour at the moment. The groupâs revenue is growing because itâs expanding both organically and through acquisition, and not by boosting LFL sales. To regain investor confidence, I think itâs going to have to address this concern.

But the problems facing the group appear to be sector-wide rather than anything specific to JD Sports. Indeed, the company itself retains a strong brand and a solid balance sheet. I suspect the current downturn in the historically resilient athleisure/sports market is a temporary blip.

Shareholders have probably marked 21 January on their calendars. Thatâs when the companyâs due to give its next trading update, which will include crucial Christmas period sales. Of course, it could announce more bad news. However, for the reasons outlined above, I reckon JD Sports is a stock to consider.

The post The JD Sports share price has tanked after a broker downgrade. But I remain optimistic appeared first on The Motley Fool UK.

Should you invest £1,000 in JD Sports Fashion right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports Fashion made the list?

More reading

- The FTSE 100: can it reach 12,000 points in 2026?

- £5,000 invested in the worst-performing FTSE 100 share a year ago is now worth…

- Iâm taking a risky bet on these 3 bombed-out FTSE 100 growth shares in 2026

- Brokers think this 83p FTSE 100 stock could soar 40% next year!

- I’m backing these 3 value stocks to the hilt – will they rocket in 2026?

Bank of America is an advertising partner of Motley Fool Money. James Beard has positions in JD Sports Fashion. The Motley Fool UK has recommended Nike. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.