£250K ISA: how much second income could you get monthly?

If youâre looking to use an ISA to generate a second income, understanding how your savings grow over time is key.

Tiered contributions

To reach a £250,000 ISA, the first step is knowing how much you need to contribute each year. Contributions typically increase gradually over time, reflecting realistic savings behaviour. The table below illustrates how you could reach your target under different return assumptions over a 20-year period.

| Annual Return | Total Contributions | Average Annual Contributions |

| 6% | £143,750 | £7,188 |

| 7% | £130,000 | £6,500 |

| 8% | £117,500 | £5,875 |

What that £250,000 could mean for your income

Hitting a £250,000 ISA total is an important milestone, but itâs only the starting point. What really matters is how much dependable second income that pot can generate in retirement.

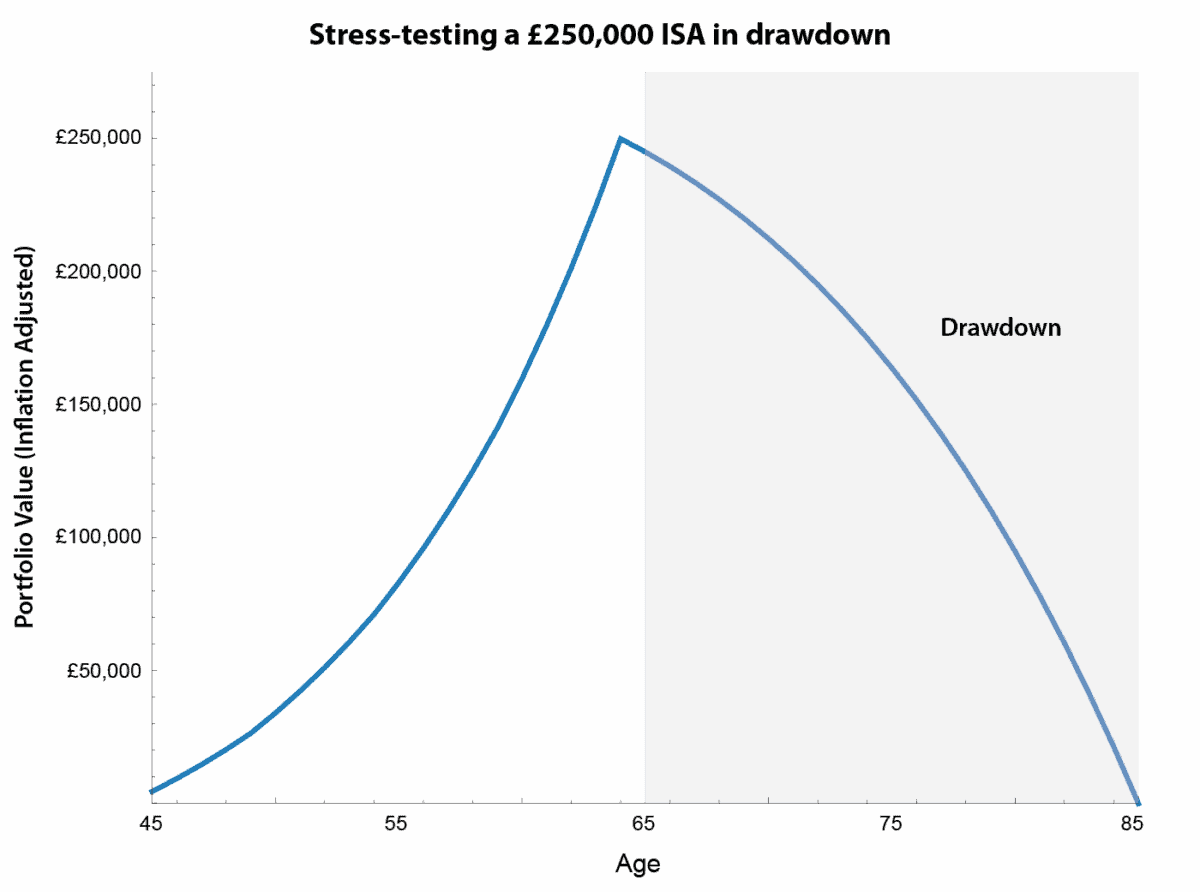

Assuming the ISA moves into drawdown and is invested more cautiously, Iâve modelled long-term returns at 4% a year. The chart below shows what happens when the portfolio is deliberately run down to zero at age 85.

Chart generated by author

Under these assumptions, the ISA can deliver an annual income of just over £10,000 â or around £833 a month. All figures are inflation-adjusted, so that income keeps its real spending power throughout retirement.

Most investors, however, wonât want to spend their final pound. Building in a sensible safety margin of 10% to protect against market shocks, longer life expectancy or to leave an inheritance still supports a £750 monthly income â with around £57,000 left in the ISA pot at age 85.

Growth catalyst

To achieve the higher return assumptions used in the contribution phase, long-term investors need exposure to businesses with recovery and re-rating potential. One FTSE 250 stock I think fits that bill is asset management giant Aberdeen (LSE: ABDN).

Despite a strong rebound over the past year, the shares remain around two-thirds below their 2015 highs. That reflects well-documented challenges facing traditional active asset managers, particularly sustained outflows from the groupâs Adviser division.

However, the market may be overlooking how much has already changed beneath the surface â and why the risk-reward balance now looks more attractive for patient investors.

Diversified business

The groupâs interactive investor — or ii — platform has become a genuine growth engine. Customer numbers, trading activity and assets under administration continue to rise, driven by demand for self-directed investing and SIPPs.

With its flat-fee pricing model and growing brand recognition, ii is steadily emerging as a credible challenger in the direct-to-consumer market. Crucially, this business benefits from operating leverage â incremental growth should increasingly feed through to profits.

The long-running drag from the Adviser division is also easing. Net outflows have fallen sharply year on year, helped by more competitive pricing and sustained investment in service quality. While this business may not return to strong growth in the short term, stabilisation alone could materially improve group cash generation.

Even so, risks remain. A renewed market sell-off could prompt independent financial advisers to move clients out of Aberdeenâs funds, and further outflows could delay any re-rating. Shares are best held as part of a diversified ISA during the growth phase, rather than relied on for income alone.

Bottom line

From an accumulation perspective, Aberdeen illustrates how a recovery story with built-in yield can work in practice. The shares currently yield around 7%, which could be reinvested to enhance long-term growth â showing how considering an ISA holding like this could contribute to a steady second income over time.

The post £250K ISA: how much second income could you get monthly? appeared first on The Motley Fool UK.

Should you invest £1,000 in aberdeen group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if aberdeen group made the list?

More reading

- How much do you need in a Stocks and Shares ISA to target £1,500 a month in passive income?

- Up 45% in a year with a 7.2% yield and a P/E of 13! Is it too late to buy this fabulous FTSE 250 stock?

- Can these 2 incredible FTSE 250 dividend stocks fly even higher in 2026?

Andrew Mackie owns shares in Aberdeen. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.