How much do you need in an ISA for a £3,000 monthly second income?

Fancy an extra £3,000 a month second income? Who doesn’t? While it’s not without risk, I think the best way to target a return like this is by buying dividend-paying shares in a Stocks and Shares ISA.

With an ISA, individuals don’t pay a penny in income tax. This can make them a more profitable way to target a second income than other investment accounts, not to mention the many side hustles people can pursue.

On top of this, this strategy also allows investors to harness the wealth-building power of the stock market. With an average annual return of 8%-10%, share investing has delivered both enormous capital gains and dividends to investors down the years.

But how much would you need in a tax-efficient ISA for a regular £3k income? Read on…

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Targeting a passive income

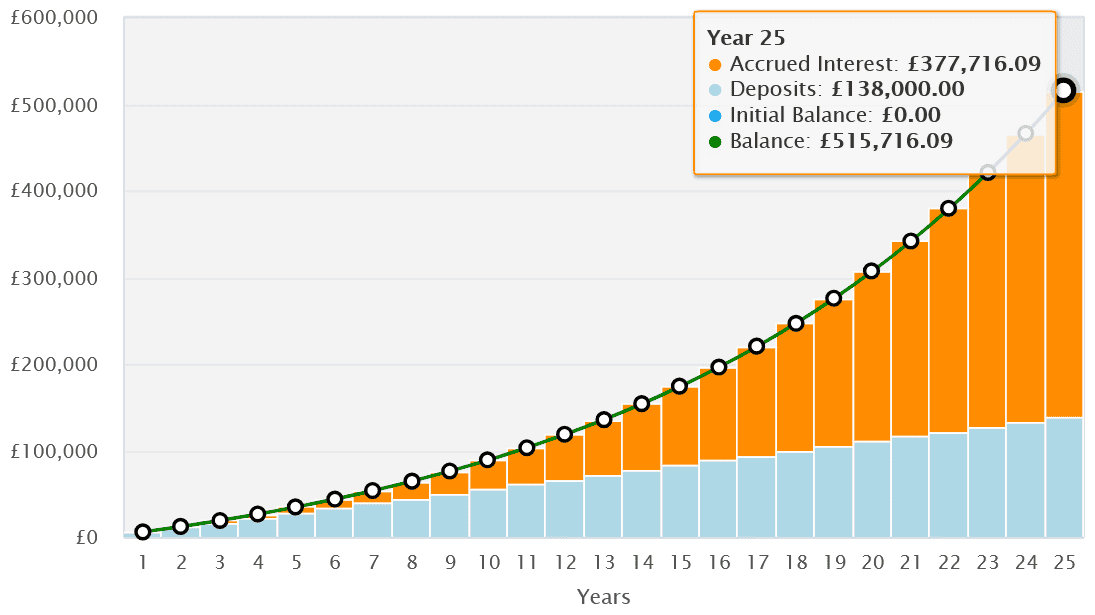

The amount anyone would need for a £36,000 yearly dividend income would depend on the average yield of their portfolio. For someone holding 7%-yielding income stocks, they’d need a Stocks and Shares ISA of roughly £515,000.

I know, that’s a large chunk of money and you’re unlikely to find that in the back of a drawer. But for those with time on their side, it’s a very realistic target.

With an ISA also providing protection from capital gains and dividend taxes, a £460 monthly investment in the stock market could deliver that £515k pot after 25 years, assuming a total average annual return of 9%.

Investors have a range of tools and tricks they can use to hit this target too, such as:

- Reinvesting dividends to boost compounding and accelerate ISA growth.

- Choosing a low-fee broker to stop costs from eroding returns.

- Aiming to hold shares for at least five years to avoid knee-jerk (and often costly) trading decisions.

- Building a diversified portfolio of shates to capture many investing opportunities and spread risk.

FTSE 100 dividend hero

Legal & General‘s (LSE:LGEN) a top dividend share I really like for an ISA. In fact, it’s a core plank of my own portfolio. And at 8.5% forward dividend yield, it could potentially deliver more cash than our theoretical 7%-yielding portfolio.

In my view, Legal & General’s one of the FTSE 100’s greatest dividend stocks to consider. And it’s not just due to that enormous yield. The company’s proven to be one of the most durable income stocks out there, raising dividends every year (bar one) since the early 2010s.

This proud record is testament to the firm’s formidable cash generation. Tough economic conditions can hamper Legal & General’s profits growth and its share price. Yet a healthy balance sheet has so far enabled it to keep raising shareholder payouts.

With a Solvency II capital ratio of 217%, according to latest financials, it looks in great shape to keep its progressive dividend policy going in 2026. Over the longer term, I’m expecting dividends to climb as demographic changes and growing interest in financial planning drive profits.

So there we are. With patience, a tax-efficient ISA, and quality stocks like Legal & General, building a large second income with dividend shares really is possible.

The post How much do you need in an ISA for a £3,000 monthly second income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- Is 2026 a brilliant year to build a second income?

- £10,000 invested in Legal & General shares at the start of 2025 is now worthâ¦

- This crackerjack FTSE dividend stock now has a forecast yield of 8.9%!

- How much passive income could 1,909 Legal & General shares generate in 2026?

- With an 8.7% forecast dividend yield, is this top FTSE 100 passive income stock an unmissable bargain?

Royston Wild has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.