£5,000 invested in Lloyds shares at the beginning of 2025 is now worth…

Lloyds (LSE:LLOY) was one of the world’s best-performing bank shares in 2025. Over the course of the year, the FTSE 100 company rose a spectacular 76% in value.

That was more than triple the broader Footsie‘s 21% gain. And it would have turned a £5,000 lump sum investment on 1 January into £8,800.

However, last year’s brilliant gains have fuelled talk of a bubble and a potential correction for Lloyds share price. So what can we expect from the banking giant in 2026?

Hitting the wall

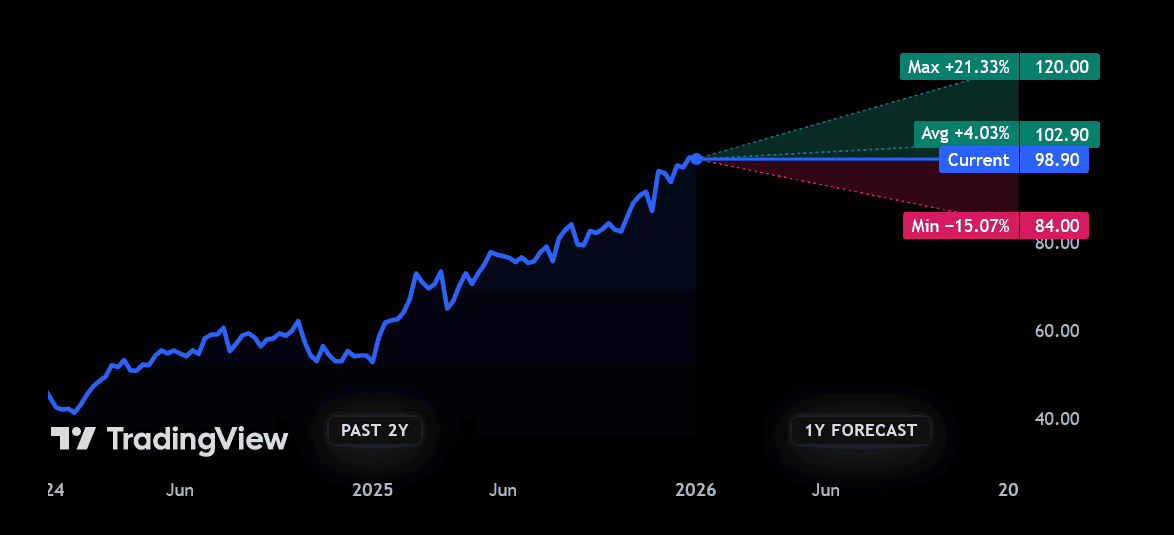

It’s useful to consider what professional, experienced commentators think about the Black Horse bank. So I’ve looked at the share price forecasts of the 17 City analysts who cover it today.

The average 12-month price target among this group is 102.9p per share. That represents a rise of just 4% from current levels.

Look, that’s not terrible. Combined with expected dividends, it suggests Lloyds shares will deliver a total return north of 8% in 2026. But it’s clear that brokers expect price gains to slow sharply from recent levels.

An 11% rise…

But as that chart shows, some opinions differ significantly among that group of analysts. RBC Capital expects Lloyds’ share price to hit 110p over the next year, up 11% from today’s levels.

RBC says that “Lloyds should trade at a premium to peers for a number of factors“, adding that “it’s hard to see [the bank] underperforming into the medium term, given rate expectations and a softening regulatory backdrop“.

The broker has also praised the bank’s strong base of customer deposits, its structural hedge (which protects margins when interest rates drop), and its total return yield, which factors in dividends alongside share price movements.

… or a 15% drop?

At the other end of the scale, Shore Capital thinks Lloyds shares will crumble 15% in value over the next year, to 84p.

One reason is they believe further Bank of England rate cuts will smack margins despite the structural hedge. Net interest margins (NIMs) — a key measure of profitability — can crumble when interest rates fall.

Another factor is that the FTSE 100 bank now looks expensive from an historical perspective. Today its price-to-book (P/B) ratio is 1.5 times, miles above the 10-year average of 0.9. It now trades at a tasty premium to the value of its assets.

At this level, even the slightest whiff of bad news could send Lloyds’ share price tumbling.

Here’s my take on Lloyds

And the bank faces a multitude of dangers that could make this reality. A downturn in the UK’s already weak economy could hammer revenues growth and drive up impairments. Further charges related to the motor finance mis-selling scandal might also spook investors, as could competitive pressures that ramp up margin pressures.

Given these dangers and Lloyds’ huge valuation, I’m not tempted to buy its shares for my own portfolio. But the banking giant might be a possible stock addition for more adventurous investors to consider.

The post £5,000 invested in Lloyds shares at the beginning of 2025 is now worth⦠appeared first on The Motley Fool UK.

Should you invest £1,000 in Lloyds Banking Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group plc made the list?

More reading

- Iâm getting a stunning 8.9% yield on my fabulous Lloyds sharesÂ

- Lloyds shares have risen 80% in a year. How many more do you now need to target £100 of monthly passive income?

- So the Lloyds share price made it past £1. Big deal. What next?

- What can we learn from Elvis Presley and Albert Einstein about investing in the stock market?

- £10,000 invested in Lloyds shares 3 months ago is now worth…

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.