Should I buy Fundsmith Equity for my Stocks and Shares ISA in 2026?

Last year, I considered adding Fundsmith Equity to my Stocks and Shares ISA. However, I came to the conclusion that I needed more evidence that manager Terry Smith could return to market-beating form after four consecutive years of underperformance.

Last week, Fundsmith published its 2025 annual results. Based on these, is now the time for me to invest?

Performance

For those unfamiliar, Fundsmith invests in high-quality businesses with strong brands or competitive moats, high returns on capital, predictable cash flows, and the ability to grow profits without needing much debt.

Smith strips this down to a simple three-step mantra: “Buy good companies. Don’t overpay. Do nothing.”

Putting this into practice, Smith trounced the fund’s benchmark (the MSCI World Index) between 2010 and 2020. Since then, though, Fundsmith has now underperformed for five straight years.

In 2025, it returned just 0.8% compared with a rise of 12.8% for the MSCI World Index. In a strong year when most indexes soared, that’s very disappointing.

What’s gone wrong?

Smith said three things help explain this underperformance:

- Extreme S&P 500 index concentration

- Passive index investing

- Dollar weakness

The last one doesn’t really concern me. But Smith points out the 10 largest stocks accounted for 39% of the S&P 500 at the end of 2025, delivering 50% of the total return.

Without owning Magnificent Seven stocks as large positions, the fund manager argues it’s been very hard to outperform in recent years.

While true it’s harder, it’s not impossible. For example, Bill Ackman (Pershing Square) and Chris Hohn (TCI Fund Management) have successfully outperformed the S&P 500 over the past five years without owning Tesla, Meta, Apple, or Nvidia.

Additionally, he argues that passive index funds are distorting markets by buying stocks without regard for quality or valuation, essentially creating a momentum-driven bubble.

[E]ven if we are right in diagnosing this move to index funds as one of the causes of our recent underperformance and it is laying the foundations of a major investment disaster, I have no clue how or when it will end except to say badly.

Terry Smith

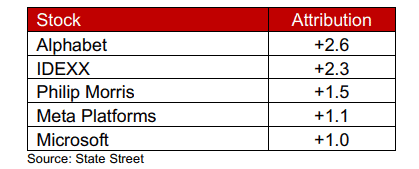

It’s worth noting that Fundsmith owns three Magnificent Seven stocks (Microsoft, Meta, and Alphabet), and all were among the top five contributors to 2025’s performance.

Indeed, Meta ranked among Fundsmithâs top contributors for the fifth time, with Microsoft making its tenth appearance. So, while Big Tech has helped drive the fund’s longer-term performance (which is still strong), Smith just hasn’t had enough exposure to it.

Wegovy maker

Novo Nordisk (NYSE:NVO) crashed about 40% last year, easily Fundsmith’s worst performer. The Wegovy maker fell behind rival Eli Lilly in the GLP-1 drug race, leading to the ousting of its CEO.

However, I note that the stock has bounced back 17% so far this year, driven higher by news that its Wegovy treatment has been approved in a daily pill form by US regulators.

As well as improving its competitive standing, this could also get sales growth moving back in the right direction. The main risk with this business is Eli Lilly beating it again with an improved GLP-1 drug.

However, trading at 16.7 times forward earnings, I think Novo Nordisk stock is worth considering.

As for Fundsmith, though, I’m going to give it a miss. The ongoing underperformance still worries me.

The post Should I buy Fundsmith Equity for my Stocks and Shares ISA in 2026? appeared first on The Motley Fool UK.

Should you invest £1,000 in Novo Nordisk right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Novo Nordisk made the list?

More reading

Ben McPoland has positions in Nvidia and Pershing Square. The Motley Fool UK has recommended Alphabet, Apple, Meta Platforms, Microsoft, Novo Nordisk, Nvidia, and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.