Forget Rolls-Royce shares! This top growth stock looks more attractive in 2026

At the start of 2026, I thought Rolls-Royce shares were set for a more low-key year. After all, they had returned 222%, 90%, and 104% respectively in 2023, 2024, and 2025.

This FTSE 100 stock was due a breather!

But Rolls-Royce has flown out of the traps, with a 9.5% gain, making it the sixth-best performing Footsie share so far this year.

However, the stock’s now trading at 39 times 2026’s forecast earnings. At this lofty valuation, everything will have to go right this year for it to keep powering on. And that’s obviously not guaranteed, with geopolitical tensions high and ongoing supply chain challenges.

As such, I see more interesting opportunities elsewhere in the market right now. Here’s one of them.

Taking market share

On Holding (NYSE:ONON) is the Swiss firm behind the sportswear brand that has taken the world by storm over the past three years.

In 2025, the company expects sales to have risen 34% at constant currency to around 3bn Swiss francs ($3.74bn, at the current exchange rate).

Considering the industry downturn that has seen Nike and other sportswear brands struggle, this is a remarkable performance. It tells us that the brand is taking share in a tough market because customers love the products.

Premium positioning

Wall Street expects another 20%+ jump in sales in 2026 and 2027, with an even stronger growth in profits. And this growing profitability is really attractive, with On positioning itself as the world’s most premium sportswear brand.

Unlike most other brands, On doesn’t discount, which is translating into industry-leading margins. Its Cloudmonster Hyper trainer line can cost as much as £260 a pair, while its Cloudboom Strike LS (LightSpray) racing shoes go for even more.

In future, management sees further margin expansion as it aggressively moves into apparel and opens more retail stores. Apparel typically carries higher gross margins than footwear, and the firm’s in the very early innings of capturing this global opportunity.

What [premium] really does, it really sets ourselves apart from the mass market where…there’s a lot of competition. And this allows us to actually charter our own path and not just fish in the same pond like everyone else.

CEO Martin Hoffman

Innovation-driven

When I think of my best-ever investments (particularly Nvidia, Intuitive Surgical, and Axon Enterprise), they’re extremely innovative companies. I see something similar here.

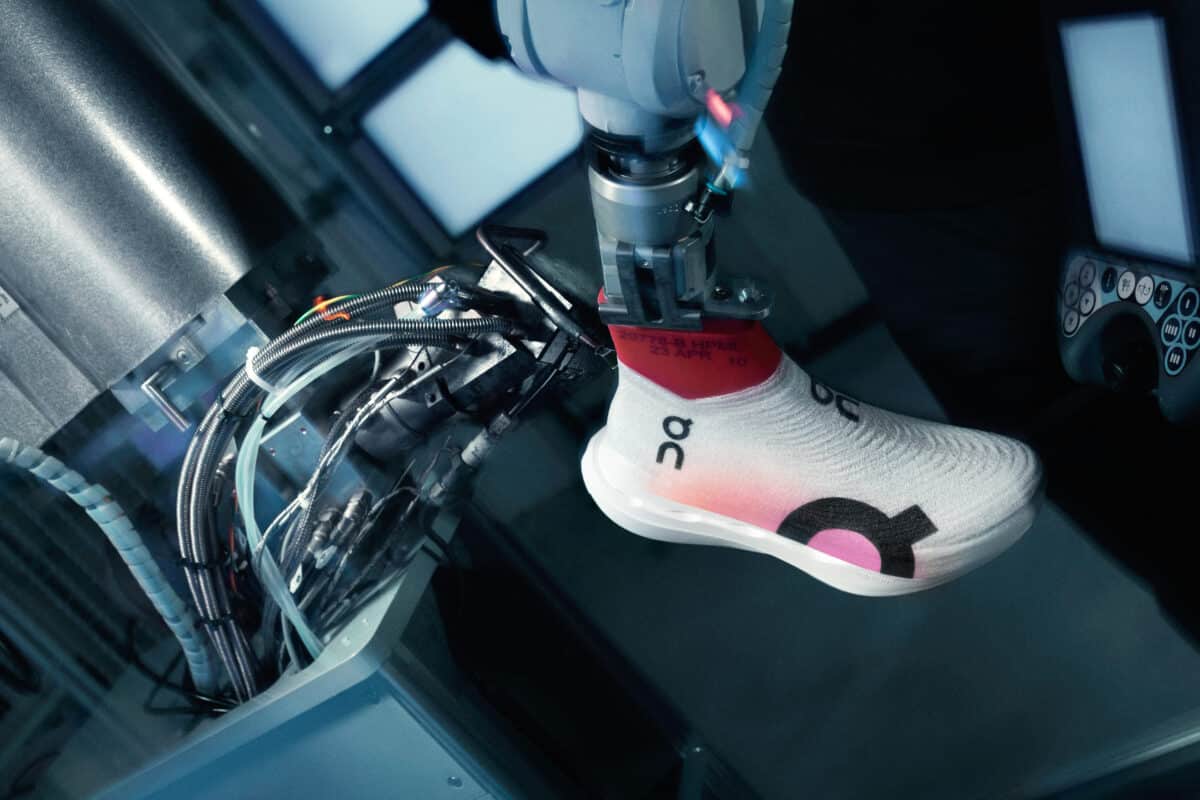

For example, the companyâs LightSpray technology involves a robotic arm spraying a continuous filament onto a mould. The entire upper of the shoe is created in just three minutes rather than hours of manual labour!

On plans to open robot-led factories close to major retail markets rather than permanently relying on Asian manufacturing. If successful, this would result in quicker production, faster shipping, less carbon footprint, and perhaps even higher margins in future.

Valuation

One future risk I see is a drop-off in manufacturing quality. After all, folk aren’t paying top dollar for cool products to be disappointed, so excellence is expected but not necessarily guaranteed.

Meanwhile, Hoka provides competition in high-end running shoes.

Still, at 25 times 2027’s forecast earnings, I think the stock’s well worth considering. If On can grow its current 1% share of the global sportswear market to 3% or even 5%, there could be significant returns for investors today.

The post Forget Rolls-Royce shares! This top growth stock looks more attractive in 2026 appeared first on The Motley Fool UK.

Should you invest £1,000 in On Holding right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if On Holding made the list?

More reading

- Want to earn £1k each month in dividends from an ISA? Hereâs how

- I think this is a rare chance to buy this beaten up FTSE 250 stock

- Should these updated analyst forecasts for Tesla stock change my view?

- Warren Buffett’s number 1 rule for investing in the stock market

- Will Rolls-Royce’s share price surge or sink? 4 key things to consider

Ben McPoland has positions in Axon Enterprise, Intuitive Surgical, Nvidia, On Holding, and Rolls-Royce Plc. The Motley Fool UK has recommended Axon Enterprise, Intuitive Surgical, Nike, Nvidia, On Holding, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.